#105 On-chain Insights by IT Tech - Week 48 Highlights & Analysis

Crypto Market Dynamics: Altseason Hints, Liquidity Inflows, Profit takings.

Hello,

I'm thrilled to announce the release of the 105th issue of On-chain Insights by IT Tech.

Thank you for being part of this journey - your support means a lot to me! 💙 With over 4,000 subscribers, we’re growing stronger together. If you haven’t joined yet, now’s the perfect time! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Crypto Weekly Highlights: Top 10 News You Can't Miss

Current market situation

Bitcoin dominance and altcoin season

Profit taking by Long Term Investors

Correlation between USDT and USDC market caps and Bitcoin price

Join Zoomex – The Best Non-KYC Exchange with an Exclusive Bonus

Paid newsletter subscription - support content development

Newsletter issue summary and forecast

1. Partnership with WymienBitcoina.pl

I'm thrilled to announce my collaboration with WymienBitcoina.pl, founded by Patryk Kempiński of the Krypto Raport YouTube channel.

WymienBitcoina.pl is a trusted crypto exchange where you can securely buy or sell cryptocurrencies like Bitcoin, Ethereum, $USDT, $USDC, and over 190 other assets. Their branches provide technical support and offer crypto-related products like hardware wallets, books, and apparel. The knowledgeable staff ensures smooth and hassle-free transactions, helping customers receive their crypto or cash on-site.

To enhance your experience, I’ve waived my commission, resulting in lower transaction fees. Use the code IT TECH for even more savings. Details are provided in the graphic below.

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Unfortunately, X/Twitter has blocked the embedding of tweets on Substack, so I include screenshots of the tweets along with links to them in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Crypto Weekly Highlights: Top 10 News You Can't Miss.

Trump's Crypto Policy Proposal: The Trump administration reportedly plans to eliminate capital gains taxes on cryptocurrencies issued by U.S.-registered companies, aiming to boost adoption in the U.S.

HyperLiquid Token Airdrop: HyperLiquid, a popular crypto exchange, is preparing to distribute 310 million tokens to early adopters, which could increase platform liquidity and user engagement.

Ethereum Inflows Surge: Ethereum has seen significant institutional inflows, accounting for 90% of Bitcoin's inflows over the same period, highlighting strong institutional interest in ETH.

Coinbase Ends USDC Rewards in Europe: Coinbase will terminate its USDC rewards program in Europe due to upcoming EU regulations (MiCA), a move that may impact stablecoin adoption in the region.

U.S. Dollar Defense Strategy: Former President Trump has voiced opposition to the BRICS nations moving away from the U.S. Dollar, signaling ongoing global currency competition and potential shifts towards cryptocurrencies like Bitcoin.

XRP Profit Realization: XRP holders have realized over $1.5 billion in profits in a single week, partly influenced by Ripple’s $25 million investment in the next U.S. election cycle, suggesting bullish trends for XRP.

Tornado Cash Legal Victory: Tornado Cash, a decentralized mixer, recently won a significant legal victory, which could reshape the privacy and regulatory landscape for DeFi.

Morocco Legalizes Crypto: Morocco has officially legalized cryptocurrency activities, marking a significant milestone in the country's approach to digital assets and potentially influencing North African adoption.

Elon Musk and Dogecoin: Elon Musk’s launch of a DOGE account on X and developments regarding Dogecoin on Bitcoin Layer-2 networks continue to stir speculation and interest in meme coins.

Crypto Exchanges’ Legal and Financial Moves:

Coinbase has listed $PEPE, expanding its meme coin offerings.

FTX is set to repay $16.5 billion to creditors, signaling recovery in the crypto exchange sector.

3. Current market situation.

Bitcoin has hit a new all-time high of $99,000, continuing its remarkable upward trend. Altcoins are experiencing significant increases, whereas meme coins are witnessing a slight decline in enthusiasm. Even previously overlooked projects are seeing a resurgence. A substantial amount of optimism has re-emerged in the market

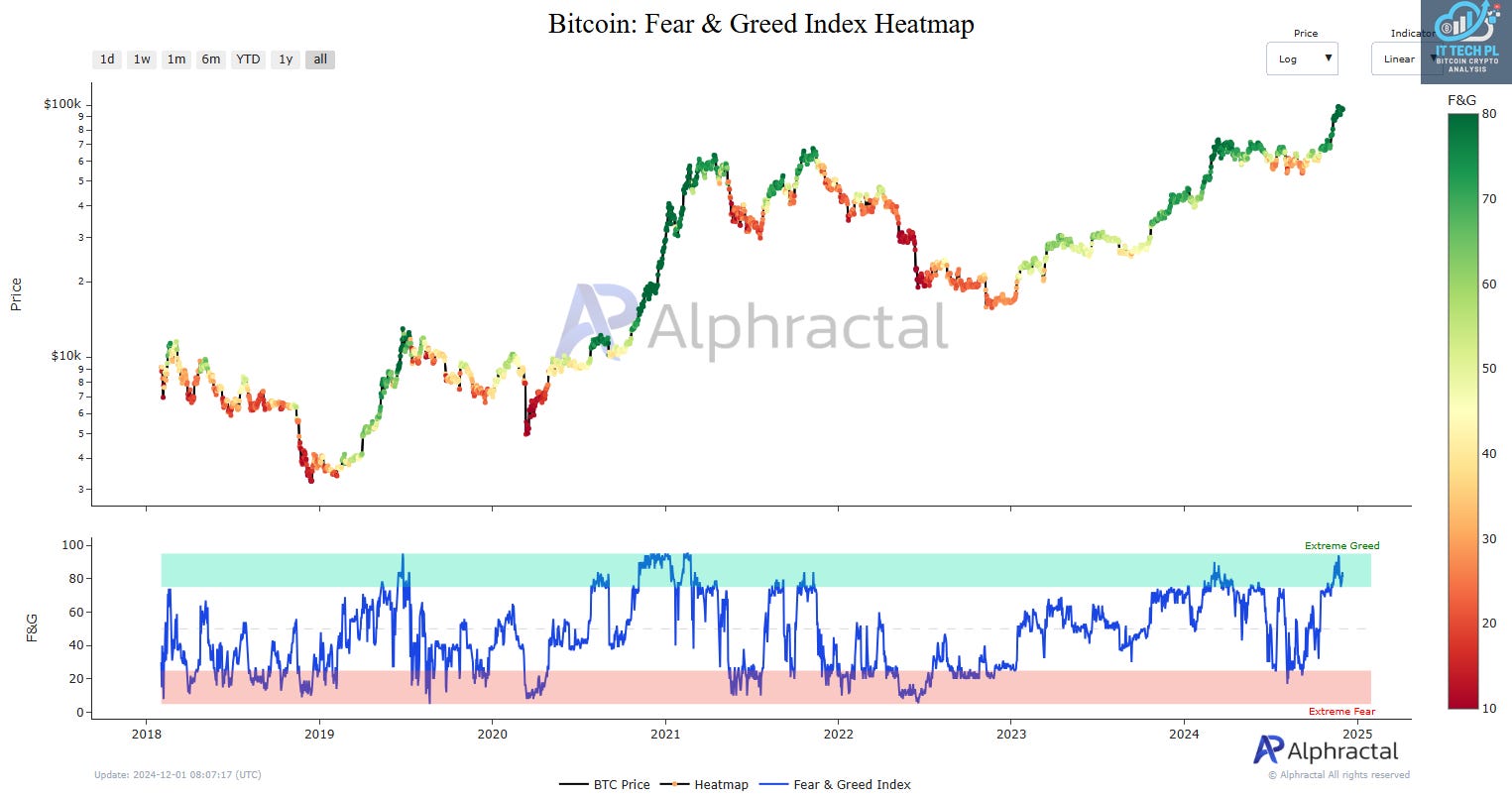

While Extreme Greed aligns with past peaks, the current level is still below the absolute highs seen during previous market cycles. This indicates that the market has room to grow further before reaching historical sentiment extremes.

The correlation between Bitcoin’s price and the Fear & Greed Index is evident. As sentiment grows more optimistic, prices have shown steady increases. This aligns with the rally toward the psychological $100,000 level.

Bitcoin remains in a consolidation phase below $100,000, with buyers defending the $95,000 support. This pause in the rally may act as a healthy correction, setting the stage for a potential breakout if buying momentum increases. However, failure to breach $100,000 in the coming week could result in further consolidation or minor corrections toward lower support zones around $92,000.

4. Bitcoin dominance and altcoin season.

Insights:

Bitcoin Dominance (BTC.D):

BTC dominance has seen a decline of approximately 1.15% (from 58.5% to 57.37%) since November 25, 2024.

This drop signifies a shift in market focus from Bitcoin to altcoins, potentially signaling a short-term rotation of capital as investors explore higher-risk, higher-reward opportunities.

Altcoin Market Cap (TOTAL3):

The altcoin market cap increased by $95.29 billion during the same period, showing significant inflows into the altcoin sector.

This suggests renewed interest and confidence in alternative cryptocurrencies, likely driven by specific catalysts or market narratives.

Implications:

Altcoin Momentum: The decrease in BTC dominance combined with rising altcoin capitalization indicates a potential "altseason" phase, where altcoins outperform Bitcoin.

Strategic Positioning: Investors may consider diversifying into selected altcoins that exhibit strong fundamentals or technical setups.

Risks: While this trend may provide opportunities, altcoins often carry higher volatility. Caution is advised, especially if Bitcoin experiences a major price correction.

This shift in capital allocation highlights the evolving dynamics in the crypto market, with altcoins attracting attention while Bitcoin consolidates near key resistance levels.

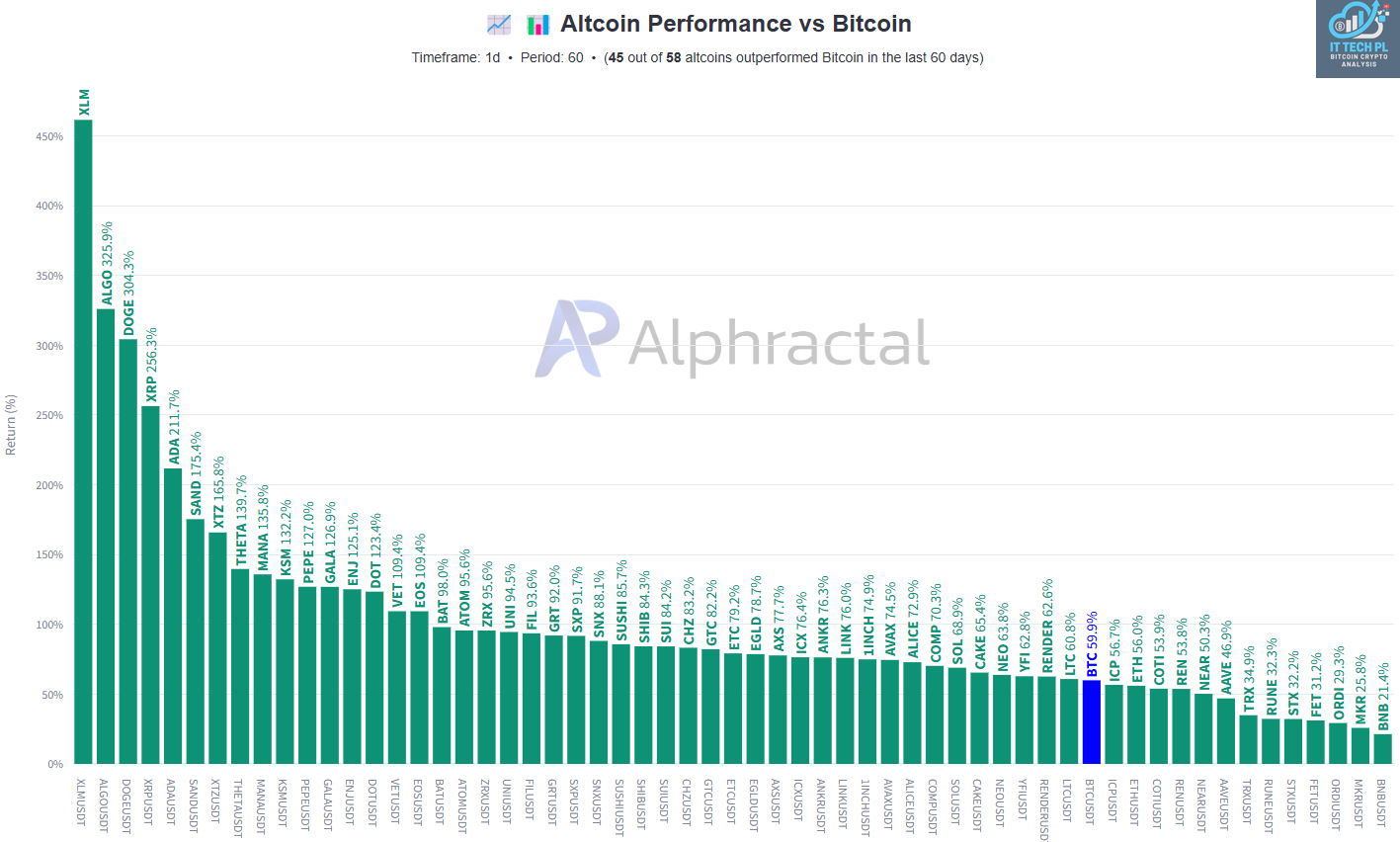

Altcoin Performance vs. Bitcoin:

A significant number of altcoins (45 out of 58 tracked) have outperformed Bitcoin in the past 60 days.

Stellar (XLM), Algorand (ALGO), and Dogecoin (DOGE) lead the chart with impressive returns of 450%, 325%, and 305%, respectively.

Bitcoin’s relative return over this period lags at 59.9%, highlighting the growing momentum in the altcoin market.

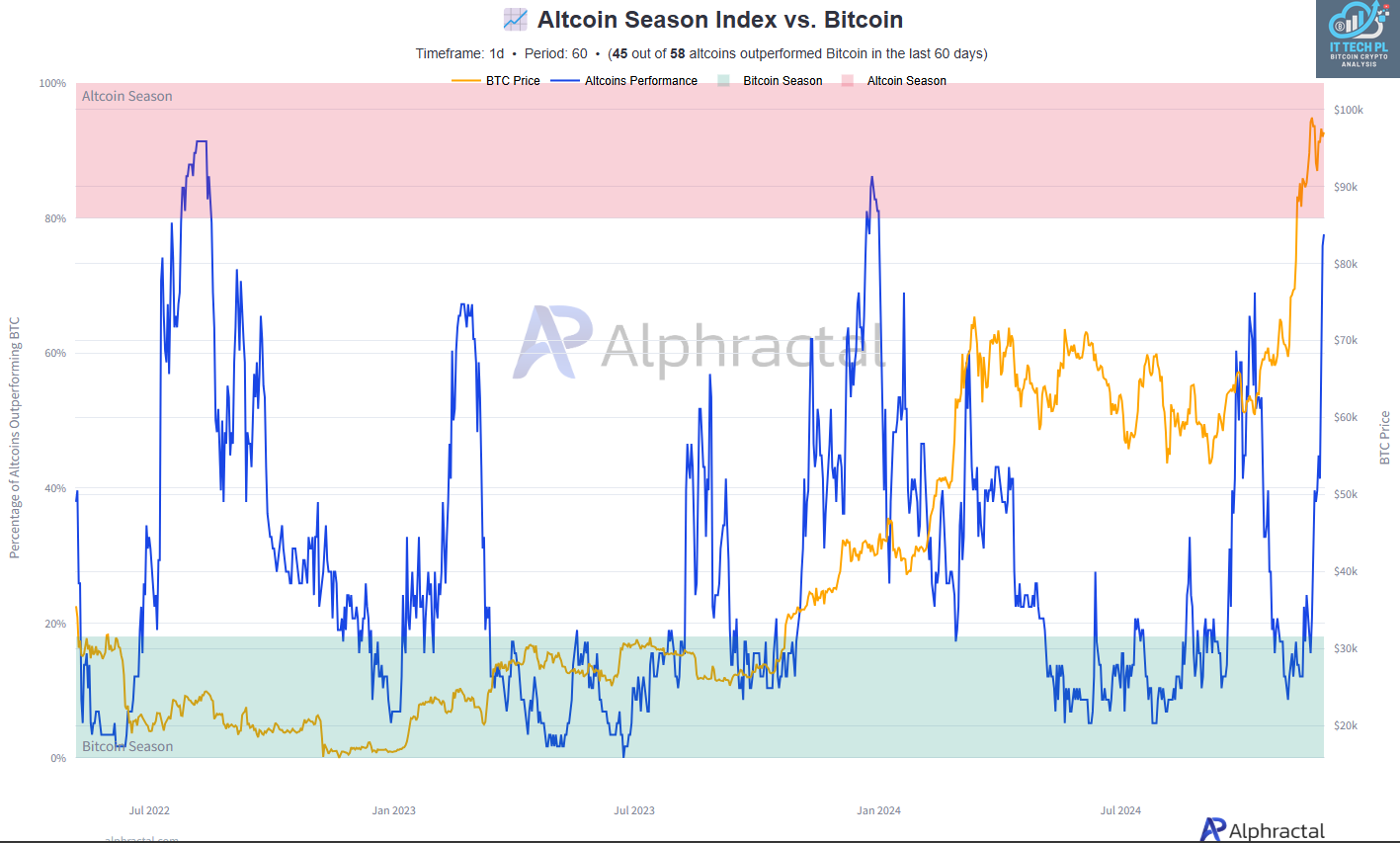

Altcoin Season Index:

The Altcoin Season Index indicates we are nearing a classic "Altcoin Season."

77.6% of altcoins are currently outperforming Bitcoin, breaching the threshold traditionally used to define altcoin dominance.

Historically, such periods coincide with profit rotations from Bitcoin into higher-risk altcoins, driving increased market speculation.

Can anyone still argue that we’re not in an alt season? 🚀

5. Profit taking by Long Term Investors.

The ongoing distribution is not unusual during a market rally but could introduce short-term volatility as coins flow into the market.

This shift indicates a potential transition phase, where profit-taking by LTHs is balanced by demand from new entrants and short-term holders.

The current behavior of STHs suggests a bullish stance, with reduced distribution and sustained accumulation. This could provide a supportive foundation for Bitcoin to test higher price levels, but monitoring for shifts back to distribution will be crucial as the rally matures.

Historical Profit-Taking Peaks: Spikes in the ratio often coincide with Bitcoin price surges, indicating heightened profit-taking during bull runs.

Recent High Ratio Levels: The current ratio has reached levels similar to past bull market peaks, signaling increased realized profits in the market.

Potential Market Sentiment Shift: High realized profit levels may suggest traders are locking in gains, potentially leading to short-term corrections or market consolidation.

Bullish Continuation or Risk of Overheating? While profit-taking is a natural part of market cycles, sustained high ratios could either signal strong confidence or foreshadow a temporary market cooling period.

A significant spike in realized losses on November 26th suggests short-term holders capitulated during a sharp market correction.

Why Short-Term Holders do not realize gains in batches on the way up and then realize losses on the way down? This has been the case in previous cycles, it is the case now and it will be the case in the future. So remember to realize profits regularly because no one can predict the future. I have reduced several positions on altcoins and realized 10% profits on several projects I own.

Remember to realise profits regularly.💡

6. Correlation between USDT and USDC market caps and Bitcoin price.

An increase in the market capitalization of stablecoins (USDT and USDC) is often correlated with a rise in Bitcoin prices, suggesting greater liquidity and demand in the market.

A decrease in stablecoin market capitalization may indicate increased cryptocurrency selling and reduced liquidity, which could lead to a drop in Bitcoin prices.USDT Daily Market Cap Change (in million USD):

2024-11-25: -126.03M USD

2024-11-26: +280.07M USD

2024-11-27: +18.75M USD

2024-11-28: +270.68M USD

2024-11-29: +470.67M USD

2024-11-30: +538.35M USD

Net USDT Market Cap Change: +1.45 billion USD

USDC Daily Market Cap Change (in million USD):

2024-11-25: -321.87M USD

2024-11-26: -8.04M USD

2024-11-27: +841.79M USD

2024-11-28: -105.37M USD

2024-11-29: +419.56M USD

2024-11-30: +91.81M USD

Net USDC Market Cap Change: +0.91 billion USD

Combined Net Market Cap Change for USDT and USDC (25.11 - 30.11): +2.36 billion USD

Conclusion:

From November 25 to 30, 2024, USDT and USDC combined saw a net inflow of +2.36 billion USD, marking a steady injection of liquidity into the cryptocurrency market. This reflects robust investor confidence and supports Bitcoin's consolidation between $96,000 and $98,000, setting the stage for potential bullish continuation in the weeks ahead.

7. Join Zoomex – The Best Non-KYC Exchange with an Exclusive Bonus!

On 31 December, new MiCa regulations will take effect across the European Union, prompting many traders to seek exchanges that do not require KYC. In response, I’ve partnered with Zoomex, a cutting-edge exchange that prioritizes privacy while offering outstanding trading conditions.

Why Choose Zoomex?

1. Privacy Without KYC

Unlike Bybit and Bitget, Zoomex allows you to trade and deposit funds without KYC requirements, keeping your identity private and compliant-free under new MiCa rules.

2. Strong Foundation

Developed by a team of former Bybit employees, Zoomex combines familiarity with enhanced privacy for a seamless trading experience.

3. Superior Trading Conditions

High Liquidity: Enjoy minimal slippage, even during high-volume trades.

Diverse Trading Pairs: A broader range compared to BingX, rivaling Bybit.

VIP Perks: Accessible VIP programs with low fees, perfect for traders of all portfolio sizes.

4. Secure and Reliable

No Downtime: Unlike Binance or Bitget, Zoomex guarantees uninterrupted service.

Unmatched Security: Zero hacks to date, ensuring your funds and trades are always protected.

🚀 Exclusive Trading Bonus for My Followers!

Sign up with my exclusive link, deposit $100, and claim a 30 USDT in trading bonus as part of this special collaboration!

How to Claim the Trading Bonuses on Zoomex:

Sign Up on Zoomex

Use this exclusive link to create your Zoomex account.

Deposit $100 or More

Make a deposit of at least $100 to qualify for the first bonus.

Claim Your First 15 USDT Trading Bonus

After depositing, the first 15 USDT trading bonus will be available in your rewards hub.

Trade in the Derivatives Section

Open a trade in the derivatives market to qualify for the second part of the bonus.

Claim Your Second 15 USDT Trading Bonus

Once your trade is completed, visit the rewards hub to claim the additional 15 USDT bonus.

Explore Additional Bonuses

Check out Zoomex's rewards hub for tasks to earn up to $45,115 in trading bonuses.

8. Paid Newsletter Subscription – Support Content Development.

I've launched a paid subscription option for my newsletter. If you appreciate my work and want to contribute to the growth of the content, I encourage you to opt for a voluntary subscription. The cost is just $5 per month. In return, you'll get:

Access to Exclusive Content – I share additional charts from premium services like CryptoQuant, Kingfisher, Santiment, and Intotheblock, available upon request for subscribers.

Access to the Supporters' Group on Telegram – Directly ask me any questions about the crypto market.

Early Access to the Newsletter – Receive it as soon as I finish writing, no need to wait until 6 PM.

Below, I've included a 5% discount coupon for an annual subscription. Thank you in advance to everyone who decides to support my work!

If you'd like to treat me to a virtual coffee or beer as a one-time gesture, you can do so through Suppi.

9. Newsletter Issue Summary:

Crypto Weekly Highlights

Key news, including Trump's crypto tax proposal, Ethereum’s strong inflows, and Ripple’s political investments. Highlights also include Morocco legalizing crypto and Coinbase listing $PEPE.

Current Market Situation

Bitcoin nears $100K but consolidates below, with strong $95K support. Sentiment remains optimistic, with room for growth before hitting past cycle highs.

Bitcoin Dominance and Altcoin Season

BTC dominance declined as altcoins saw significant inflows, marking potential altseason. Stellar and Dogecoin lead altcoin performance, outpacing Bitcoin returns.

Profit-Taking by Long-Term Holders

LTHs are realizing profits during the rally, potentially creating short-term volatility. However, STHs are accumulating, providing support for continued price growth.

Correlation Between USDT/USDC Market Caps and Bitcoin

Combined USDT and USDC market cap increased by $2.36B from 25.11 to 30.11, signaling increased liquidity and supporting Bitcoin’s consolidation.

Join Zoomex

A non-KYC exchange offering privacy, high liquidity, and zero downtime. Exclusive 30 USDT bonus available for deposits over $100 via the IT TECH link.

Paid Newsletter Subscription

Paid options start at $5/month for early access, exclusive charts, and direct interaction with IT TECH on Telegram.

Forecast for the Upcoming Week:

Bitcoin Price Movement:

Likely to test $100K again as sentiment remains bullish. However, failure to breach this psychological level could lead to further consolidation near $95K or a minor correction to $92K.

Altcoin Market:

Continued strength in altcoins, with potential outperformance in assets like Stellar and Dogecoin. Monitoring the Altcoin Season Index for sustained dominance will be crucial.

Stablecoin Liquidity:

The $2.36B inflow in USDT/USDC could provide additional support for Bitcoin and altcoins. Further increases in stablecoin market caps may reinforce bullish momentum.

Profit-Taking Dynamics:

Long-term holders may continue profit-taking, creating potential volatility. However, short-term holders’ accumulation is expected to stabilize the market.

External Factors:

Regulatory changes like MiCa and global macroeconomic conditions could influence market behavior. Non-KYC exchanges like Zoomex may attract traders seeking alternatives.

Stay alert and monitor these key indicators for better market insights.

You can track important upcoming market events in the US and the EU using the Economic Calendar, which offers free access.

Take a look at the indicators used in the dashboard. For current updates from the market, of course, drop by me on X/Twitter and the free Telegram channel.

Remember to realise profits regularly.💡

This concludes this issue. I hope you have a pleasant end to your weekend and a great week ahead. 🤝

If you found this article useful, please leave a like💙 and a comment. Should you have any questions, feel free to ask them under the post promoting the weekly newsletter – I will attempt to answer as many as possible.

Remember, the next issue of the newsletter will be released next Sunday at 6 p.m. Make sure to check your email inbox, and don't forget to look in your SPAM folder just in case!

Please note that the information in this article reflects my personal views on the cryptocurrency market and should not be taken as investment advice or recommendations. Investing in cryptocurrencies involves a high risk of losing capital. This article includes brand mentions of WymienBitcoina.pl and affiliate links to services that may provide benefits to the author.

Best regards

IT Tech

![BTC: Daily Realized Profit Loss Ratio [USD] 30DMA (CryptoQuant.com) BTC: Daily Realized Profit Loss Ratio [USD] 30DMA (CryptoQuant.com)](https://substackcdn.com/image/fetch/$s_!HJSa!,w_2400,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0aeb8098-b0f1-4eb0-8114-068fed35a225_1600x900.png)