#116 On-chain Insights by IT Tech - Week 7 Bitcoin Analysis & Highlights

Bybit Hacked: Over 140K Ethereum Stolen.

Hello,

The 116th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t joined yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Bybit Hack: The Biggest Crypto Theft Ever?

Current market situation

Altcoin Sectors at a Crossroads: Recovery or Further Decline?

Stablecoin Expansion: Fuel for the Next Crypto Rally?

Major Token Unlocks Next Week

Support the Newsletter: Exclusive Content & Perks

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I’ve waived my commission for lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Unfortunately, X/Twitter has blocked the embedding of tweets on Substack, so I include screenshots of the tweets along with links to them in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Bybit Hack: The Biggest Crypto Theft Ever?

Key Points

Bybit, a cryptocurrency exchange, was hacked on February 21, 2025, causing the loss of assets worth over $1.4 billion in ETH and related tokens.

The attack leveraged social engineering and UI manipulation to deceive wallet signers.

Bybit confirmed only one cold wallet was compromised, client assets are safe, and the exchange remains solvent.

Suspicion points to North Korea’s Lazarus Group as the perpetrator.

Attack Overview

On February 21, 2025, Bybit suffered a major hack, recognized as the largest in crypto history, with losses estimated at $1.4–1.5 billion. The attack began with social engineering to gain internal credentials, followed by deceiving wallet signers during a routine cold-to-hot wallet transfer through a masked UI and URL. This approved a malicious transaction, altering a smart contract’s logic to steal funds, primarily mETH and stETH, later swapped for ETH.

Bybit’s Response

CEO Ben Zhou confirmed the attack on X that day, stating only one ETH cold wallet was affected and other wallets remained secure. Bybit assured solvency and that client assets are fully backed 1:1, even if losses aren’t recovered. By February 22, 2025, all withdrawal requests were processed, and operations returned to normal.

Suspects and Notable Facts

On-chain analysis suggests an involvement of the Lazarus Group, tied to North Korea, known for past crypto heists. Remarkably, the $1.4–1.5 billion loss surpasses previous records like the Ronin Network and Poly Network hacks, making it the biggest crypto theft ever.

ETH reserves on Bybit have been successfully reclaimed, reclaiming approximately 50% of the previously held funds.

Bybit’s ETH reserves, which plunged after the hack, have now recovered to 50% of their previous levels.

My Thoughts

About 4% of Bybit’s total funds got stolen in this hack. They handled it well, and exchanges like Bitget even stepped in to lend them the missing ETH to cover the gap—rare industry solidarity.

BTC and ETH prices are holding steady, which is a relief. But let’s be real, those stolen funds are unlikely to be cashed out—they’ll be tracked nonstop on the blockchain. Meanwhile, Bybit has to buy back 140K ETH from the market, which is bullish as hell. The price is already reacting, creeping up.

People panicked and rushed to withdraw from Bybit. Me? I didn’t do a thing on day one. Yesterday, though, I tested a withdrawal—pulled some ETH I use for trading, and it hit my wallet in under a minute. Smooth as ever.

I keep 80% of my funds in a hardware wallet. The other 20% is spread across four exchanges. Diversification is key. Look after your money. 🚀

3. Current market situation.

Altcoin Sell-Off Intensifies

Bitcoin (BTC): $96,119 (-1.29%) – BTC is struggling to maintain stability after recent turbulence.

Ethereum (ETH): $2,806 (+3.69%) – ETH showing strength despite overall market uncertainty.

Solana (SOL): $171.03 (-11.69%) – Heavy losses signal risk-off sentiment in altcoins.

Dogecoin (DOGE): $0.245 (-9.37%) – Meme coin hype cooling down after recent speculative surges.

Select Bright Spots

Omni Network (OM): +13.57% – One of the biggest gainers in an otherwise red market.

TAO: +483.4% – Huge rally continues amid market-wide correction.

FAI: +31.15% – Showing resilience despite broader altcoin weakness.

Key Market Insights

Altcoins Struggling: A significant number of altcoins remain deep in the red, signaling continued sell pressure.

BTC Dominance Increasing: Bitcoin holding better than altcoins, reinforcing a Bitcoin Season narrative.

Memecoin Mania Fading? Speculative meme coins like SHIB, PEPE, and BONK are cooling off.

What’s Next?

BTC needs to reclaim $100K+ to signal renewed strength.

ETH’s breakout above $2,800 is promising—watch if it sustains this level.

If capital rotates from Bitcoin to altcoins, we could see a short-term recovery in select alts.

4. Altcoin Sectors at a Crossroads: Recovery or Further Decline?

AI Tokens: Oversold but Awaiting Catalyst

Deep correction but approaching a key inflection point

AI adoption narratives could spark fresh momentum

Memecoins: Volatility Creating Buy Zones

Heavy correction but stabilizing near key support

Speculative appetite could trigger another rally

Gaming Sector: Strong Support Holding

Stabilizing after deep retrace

Potential recovery if trend reclaims 1.0 index level

Solana Ecosystem: Early Signs of Rebound

Found support near 0.6 index level

Needs sustained breakout above 1.0 for trend reversal

Key Market Outlook:

Altcoins across all sectors are in a corrective phase. Recovery potential exists but hinges on broader macro factors and Bitcoin’s stability above key support levels.

5. Stablecoin Expansion: Fuel for the Next Crypto Rally?

Here are the key takeaways from the data:

7-day change: + $871.82 million (+0.39%), indicating a slight increase in stablecoin supply.

1-day change: - $379.38 million (-0.17%), suggesting a minor outflow over the last 24 hours.

30-day change: + $11.147 billion (+5.18%), showing significant growth in the stablecoin market over the past month.

USDT Dominance: 63.21%, reaffirming that Tether (USDT) remains the dominant stablecoin in the market.

Insights from the Chart

Steady Growth in Stablecoin Market Cap: The stablecoin market has been expanding rapidly since mid-2023, signaling an increasing demand for liquidity in crypto markets.

Potential Capital Inflow into Crypto: The rise in the stablecoin market cap often correlates with future crypto price increases, as stablecoins act as a reserve of capital ready to be deployed into BTC, ETH, and altcoins.

Short-Term Pullback: The slight daily decline suggests some capital outflows, but the weekly and monthly trends remain strongly positive.

Higher Liquidity Availability: If this trend continues, it could support higher volatility and stronger market moves, possibly pushing Bitcoin and altcoins to new highs.

Conclusion

The growing stablecoin market cap suggests increasing liquidity, which could lead to higher trading activity and capital rotation into BTC and altcoins. The trend supports the idea that the crypto market is still in an accumulation phase, with the potential for further upside if the inflows continue.

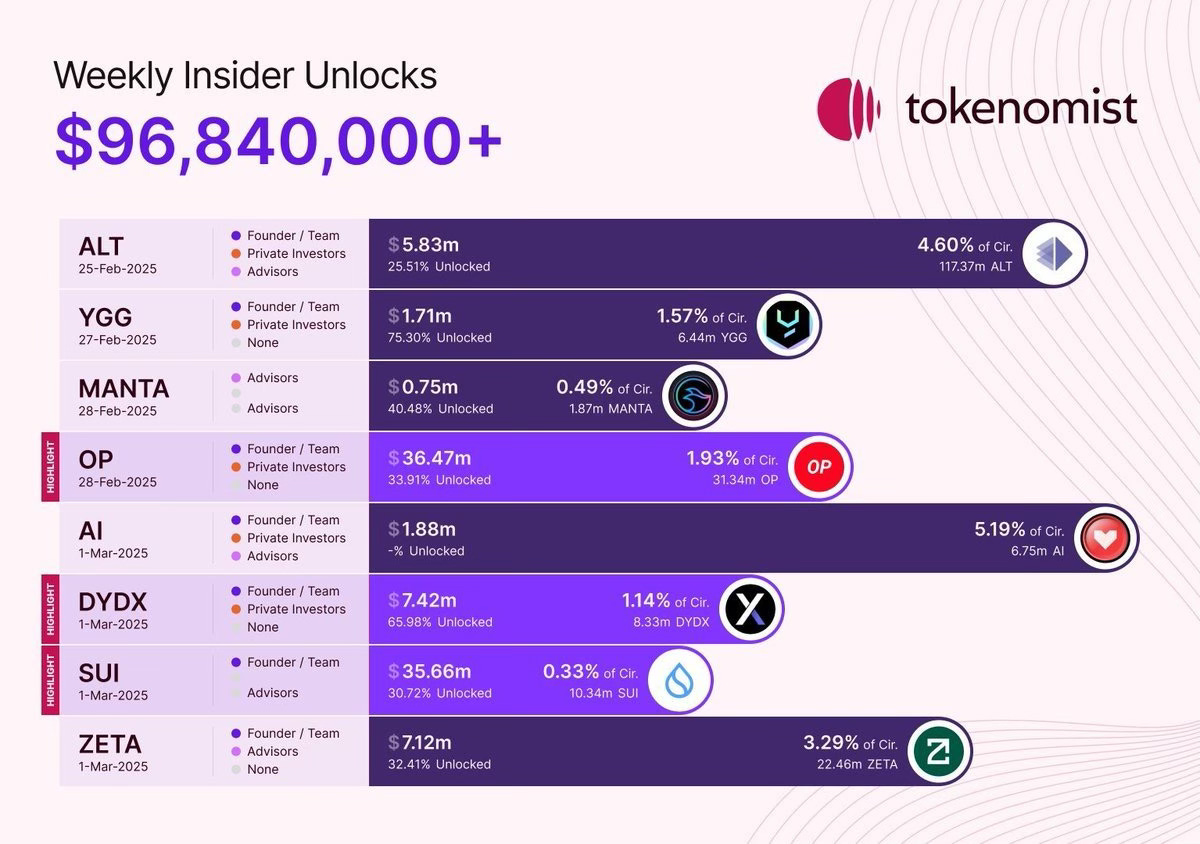

6. Major Token Unlocks Next Week.

Takeaways for Investors

Watch for potential sell-offs, especially in assets with high unlock percentages.

Be cautious around March 1st, as multiple unlocks could create a broader market impact.

Assess whether projects have strong demand to absorb the new supply, especially in cases like OP and AI.

If bullish on these assets long-term, price dips from unlocks might present accumulation opportunities.

7. Support the Newsletter: Exclusive Content & Perks.

Exclusive Content – Additional charts from premium platforms like CryptoQuant, Kingfisher, Santiment, and Intotheblock, available on request.

Telegram Subscribers' Group – Ask me any crypto-related questions directly.

Educational Content – Learn more about on-chain analysis.

Early Access – Get the newsletter immediately after it’s written, no waiting until 6 PM.

Enjoy a 5% discount coupon for an annual subscription below. Thank you to everyone supporting my work!

If you’d like to support my work with a one-time contribution, you can do so through Suppi.

8. Newsletter Issue Summary:

1. Partnership with WymienBitcoina.pl

New collaboration with WymienBitcoina.pl, allowing secure trading of 190+ cryptocurrencies. Readers can get reduced fees using the code IT TECH.

2. Bybit Hack: The Biggest Crypto Theft Ever?

$1.4B was stolen from Bybit in a sophisticated attack.

Hackers used social engineering and UI manipulation to approve fraudulent transactions.

Bybit assured solvency and full backing of client funds.

Lazarus Group is suspected to be behind the attack.

Bybit’s ETH reserves recovered 50%, but they still need to buy back 140K ETH.

3. Current Market Situation

BTC at $96,119 (-1.29%), struggling to hold key levels. A breakout above $100K could trigger a strong rally.

ETH at $2,806 (+3.69%), showing relative strength.

Solana (-11.69%) and Dogecoin (-9.37%) face heavy selling pressure.

Memecoins cooling off, and Bitcoin dominance rising.

BTC needs to reclaim $100K+ for bullish confirmation.

4. Altcoin Sectors at a Crossroads: Recovery or Further Decline?

AI Tokens: Oversold, waiting for catalysts.

Memecoins: Speculative hype fading, but support zones forming.

Gaming Tokens: Finding support, potential bounce ahead.

Solana Ecosystem: Early signs of recovery, need confirmation.

5. Stablecoin Expansion: Fuel for the Next Crypto Rally?

Stablecoin market cap grew by $11.147B in 30 days.

USDT dominance remains at 63.21%.

Higher stablecoin liquidity suggests capital inflows into crypto are growing.

Short-term outflows (-$379M in 24h), but the overall trend is positive.

6. Major Token Unlocks Next Week

$96.8M worth of tokens unlocking, with AI (5.19%), ALT (4.6%), and OP (1.93%) seeing the largest circulating supply increases.

March 1st will be key due to multiple unlocks.

High unlock percentages could lead to sell pressure and volatility.

9. Forecast for the Upcoming Week:

Bitcoin must hold $96K-$97K to avoid downside risk. Breakout 100K could fuel further growth

ETH above $3K signals potential market support.

Stablecoin growth could fuel BTC and altcoin rallies.

Watch for ETF inflows and institutional demand to sustain momentum.

Memecoins could bounce, but overall altcoin sentiment is weak.

Conclusion: Bitcoin’s ability to break $100K, Ethereum’s strength, and stablecoin expansion will dictate next week’s direction. Institutions remain a key factor in sustaining momentum.

Stay alert and monitor key indicators for better market insights. Track upcoming US events for free using the Economic Calendar.

Remember to realize profits regularly.💡

This concludes this issue. I hope you have a pleasant end to your weekend and a great week ahead.

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue arrives next Sunday at 6 p.m. - check your inbox and SPAM folder!

This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of WymienBitcoina.pl and affiliate links that may benefit the author.

Best regards

IT Tech