#117 On-chain Insights by IT Tech - Week 9 Bitcoin Analysis & Highlights

Institutional Weakness & Liquidity Concerns – Is More Downside Ahead?

Hello,

The 117th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t joined yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

Bitcoin ETF Holdings & Netflow Analysis

Analysis of Public Companies with Bitcoin Holdings

Bitcoin Monthly Returns Analysis

Stablecoin Market Overview

Support the Newsletter: Exclusive Content & Perks

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Unfortunately, X/Twitter has blocked the embedding of tweets on Substack, so I include screenshots of the tweets along with links to them in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Current market situation.

Crypto Market Heatmap: Massive Sell-off Across the Board

The market is experiencing a significant downturn, with Bitcoin (BTC) at $85,821 (-10.91%) and Ethereum (ETH) at $2,245 (-20.03%) leading the decline.

Altcoins suffer even greater losses, with Solana (SOL) down 16.13%, XRP down 12.27%, and Dogecoin (DOGE) losing 15.32%.

Very few assets are in the green, indicating an overwhelmingly bearish sentiment.

Key Insights:

The sharp drop suggests liquidations and panic selling.

Bitcoin’s dominance remains strong as altcoins experience heavier losses.

A potential recovery depends on BTC stabilizing and capital flowing back into riskier assets.

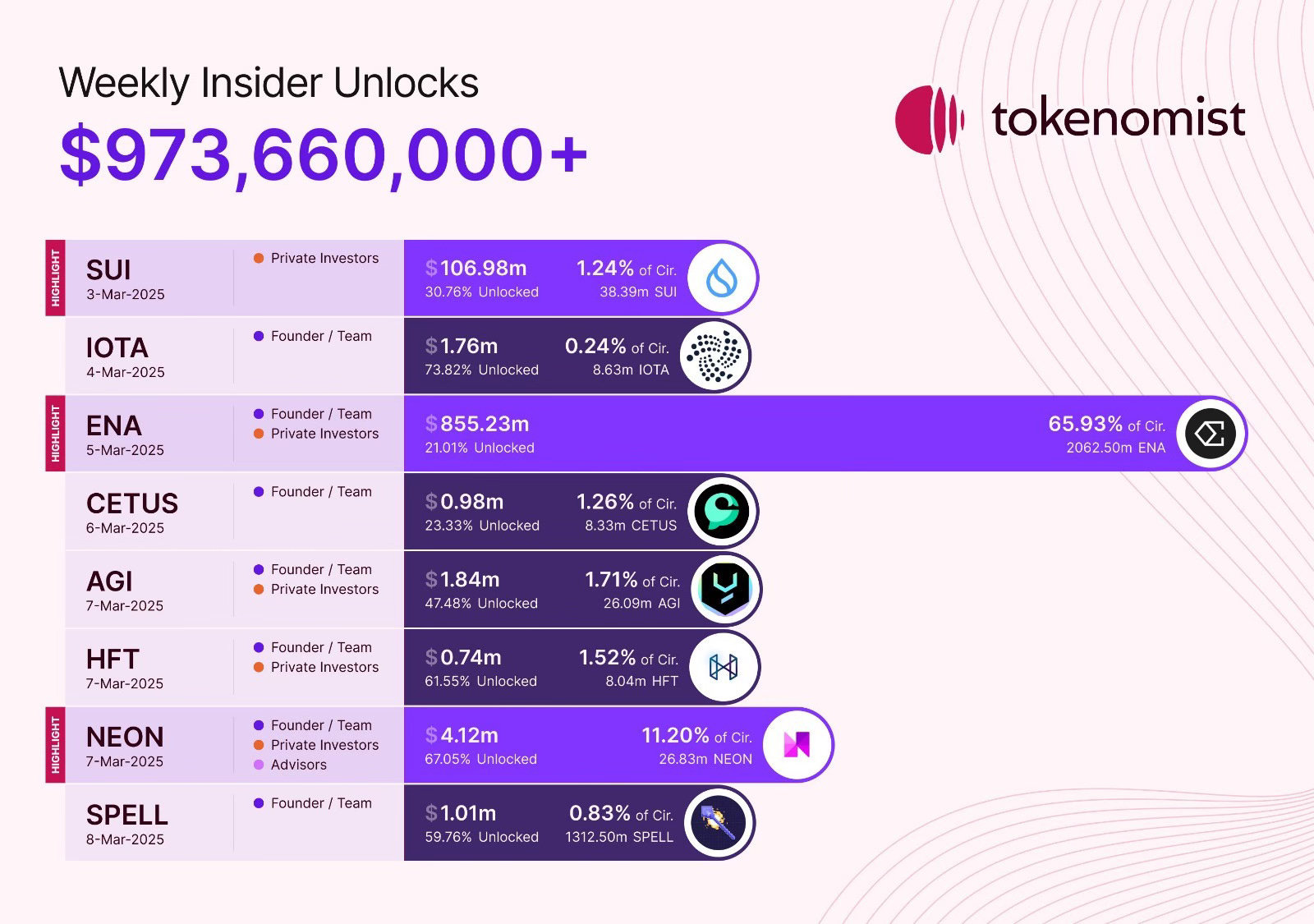

3. Weekly Insider Token Unlocks: Potential Sell Pressure.

Major Unlocks & Market Impact: $973.66M unlocks this week. Potential sell pressure across key tokens:

ENA dominates with $855.23M unlocked, representing 65.93% of supply. Heavy dilution risk and high volatility expected

SUI unlocks $106.98M, equating to 1.24% of supply. Moderate impact and liquidity absorption will be key

NEON unlocks $4.12M, with 11.20% of supply entering circulation. Highest percentage unlock, strong price movement likely

March 7 sees simultaneous unlocks for AGI, HFT, and NEON. Correlated market impact expected

Market Risks & Opportunities

High unlock percentages increase the likelihood of price drops as early investors take profits

ENA and NEON are at the highest risk due to massive supply injections

Tokens with lower percentage unlocks such as IOTA and CETUS are likely to see a minor impact

If the market absorbs these unlocks well, price stabilization or a potential recovery may follow

Traders should closely monitor ENA, NEON, and SUI for high volatility and potential market shifts

4. Bitcoin ETF Holdings & Netflow Analysis

Key Observations

Bitcoin ETF holdings peaked at 1.17 million BTC in February 2025, before declining to 1.15 million BTC, indicating a short-term reversal in institutional accumulation.

ETF net inflows remained strong throughout 2024, particularly in Q4, reflecting sustained institutional demand. However, February saw a sharp decline, with outflows coinciding with BTC’s price drop.

Recent ETF activity indicates a shift—while daily net inflows of $94.34M suggest some renewed buying, the preceding record outflows highlight growing uncertainty.

Grayscale continues to lead in outflows, contributing to selling pressure, whereas BlackRock, Fidelity, and Ark 21Shares still show inflows, albeit at reduced levels.

Key Takeaways

ETF demand has weakened, with a significant reversal in holdings. This suggests that institutional investors have been taking profits amid market uncertainty.

ETF net flows correlate directly with BTC’s price action—as selling pressure increased, BTC dropped sharply.

The return of positive inflows is a key factor to watch, but the recent sell-off indicates caution among investors.

Institutional sentiment is mixed—some providers are still accumulating, but overall demand has slowed.

Conclusion

Institutional support for Bitcoin is not as strong as before. The record outflows signal increased selling pressure, contributing to BTC’s recent declines.

Future BTC price movements will depend on whether ETF inflows recover, or if continued profit-taking leads to further downside.

Monitoring ETF flows is critical—a sustained return of net inflows could support a price rebound, while ongoing outflows may signal further corrections ahead.

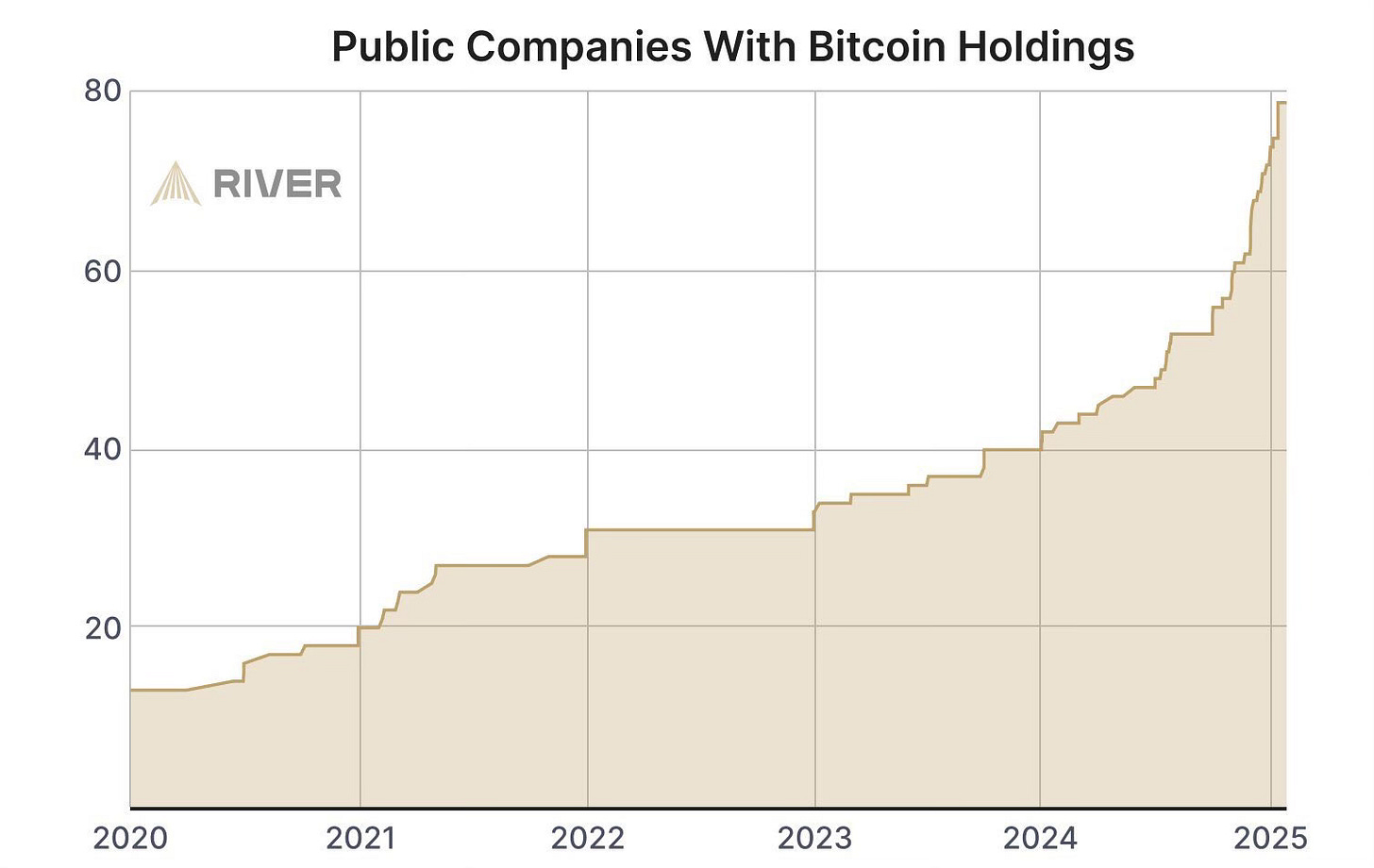

5. Analysis of Public Companies with Bitcoin Holdings Chart.

Key Observations

The number of public companies holding Bitcoin has seen a significant increase since 2020

The trend remained relatively stable between 2022 and early 2023, followed by a sharp rise starting in mid-2023

The number of companies holding Bitcoin has now exceeded 80, reflecting growing institutional adoption

Key Takeaways

Corporate interest in Bitcoin continues to accelerate, especially post-2023

The rapid increase suggests that institutional demand is reinforcing Bitcoin’s role as a treasury asse

Bitcoin now has the same number of users as the Internet did in 1997

The adoption curve mirrors early Internet growth phases, aligning with the broader macro trend of Bitcoin integration into financial markets

Conclusion

The surge in corporate Bitcoin adoption highlights increasing confidence in BTC as a long-term store of value.

If this trend persists, institutional accumulation could provide strong price support and reduce BTC supply in circulation.

6. Bitcoin Monthly Returns Analysis.

Key Takeaways

BTC recorded a 17.39% decline in February, marking its worst performance for this month in over a decade

ETH dropped -31.95%, the largest February decline in its recorded history

Historically, negative February returns have often led to weak market performance in March

Past cycles indicate that deep February corrections sometimes precede a recovery in Q2, but there is no strong seasonal pattern guaranteeing a rebound

Market Outlook

The severe downturn in February suggests investors should approach March with caution.

A strong macroeconomic catalyst or institutional inflows will be required to shift sentiment.

Short-term volatility is likely to persist. Support levels at $80K for BTC and $2,500 for ETH will be critical for stability.

If Bitcoin fails to reclaim lost ground in early March, further downside pressure could extend into Q2.

7. Stablecoin Market Overview.

The total stablecoin market cap stands at $224.37B, reflecting its critical role in crypto liquidity.

A weekly outflow of $1.787B (-0.79%) suggests reduced capital availability for crypto purchases.

One-day net change shows a $635M outflow (-0.28%), indicating the short-term risk-off sentiment.

Despite short-term declines, the 30-day increase of $7.132B (+3.28%) points to growing market confidence

USDT remains dominant at 63.59%, reinforcing Tether’s position as the primary liquidity provider

Market Implications

A sustained decline in stablecoin supply could signal liquidity tightening, potentially impacting Bitcoin and altcoin rallies.

If inflows resume, increased liquidity could provide fuel for the next leg up in the market.

Traders should monitor stablecoin movements as a leading indicator for broader crypto market trends.

8. Support the Newsletter: Exclusive Content & Perks.

Exclusive Content – Additional charts from premium platforms like CryptoQuant, Kingfisher, Santiment, and Intotheblock, available on request.

Telegram Subscribers' Group – Ask me any crypto-related questions directly.

Educational Content – Learn more about on-chain analysis.

Early Access – Get the newsletter immediately after it’s written, no waiting until 6 PM.

Get a 5% discount on an annual subscription below. Thank you to everyone supporting my work!

If you’d like to support my work with a one-time contribution, you can do so through Suppi.

9. Newsletter Issue Summary:

Current Market Situation: Massive sell-off across crypto. BTC dropped to $85.8K (-10.91%), ETH fell to $2,245 (-20.03%). Most altcoins suffered heavier losses, signaling panic selling and liquidations.

Weekly Insider Token Unlocks: Over $973M in token unlocks this week. ENA ($855M) and NEON ($4M) pose the highest risk for price dumps. Market impact expected.

Bitcoin ETF Holdings & Netflows: Bitcoin ETFs hold over 1.15M BTC, but record outflows caused a price drop. One day of positive inflows isn’t enough to confirm a trend reversal.

Public Companies with Bitcoin Holdings: Bitcoin adoption by public companies surges past 80 firms. A steady trend since 2020 indicates long-term institutional confidence.

Bitcoin Monthly Returns Analysis: BTC dropped 17.39% in February—its worst in a decade. ETH fell 31.95%, the worst on record. Historically, March tends to follow with weak performance.

Stablecoin Market Overview: Stablecoin market cap at $224B. A $1.78B outflow (-0.79%) in 7 days signals lower crypto liquidity, but a 30-day rise suggests renewed confidence.

10. Forecast for the Upcoming Week:

Bitcoin at a Critical Support Level: BTC is hovering around $85K, with $80K acting as key support. A breakdown could lead to $75K or lower.

Institutional Demand Weakens: ETF inflows plunged to record lows, coinciding with BTC’s decline. A return to positive net inflows is crucial for a market rebound.

Macroeconomic Data in Focus: Upcoming US job reports & Fed statements could trigger market volatility. A risk-on shift is needed to fuel recovery.

Stablecoin Liquidity Decline – A Warning Sign? $1.78B outflow from stablecoins signals lower crypto buying power. Watch for potential liquidity return to fuel BTC & altcoins.

March Faces Historic Weakness: Bitcoin’s -17.39% drop in February historically leads to weak March performance. A strong catalyst is needed to reverse the trend.

Market Outlook

BTC must reclaim $88K-$90K for bullish momentum.

ETF flows will be a key driver for BTC’s next move.

Stablecoin liquidity must increase to support a market rebound.

Macroeconomic events will shape investor sentiment this week.

Stay alert and track key indicators for deeper market insights. Track upcoming US events for free using the Economic Calendar.

Remember to realize profits regularly.💡

This concludes this issue. I hope you have a pleasant end to your weekend and a great week ahead.

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue will arrive next Sunday at 6 p.m. - check your inbox and spam folder!

This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of WymienBitcoina.pl and affiliate links that may benefit the author.

Best regards

IT Tech