#120 On-chain Insights by IT Tech - Week 12 Bitcoin Analysis & Highlights

Bitcoin’s Pivotal Week: Will the Bulls or Bears Take Control?

Hello,

The 120th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t you joined yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Top 10 Cryptocurrency News Highlights

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

Bitcoin On-chain Supports and Resistance

Bitcoin: potential liquidations analysis

BTC: Comparison of Demand and Supply Between New and Old Investors

Bitcoin ETF Holdings & Netflow Analysis

Stablecoin Market Overview

Support the Newsletter: Exclusive Content & Perks

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Cryptocurrency News Highlights.

Top 10 Cryptocurrency News Highlights for March 17–23, 2025, based on available information and trends as of today, March 23, 2025:

Bitcoin Hash Rate Hits All-Time High

The Bitcoin network's hash rate peaked this week, signaling strong miner confidence despite fluctuating prices. This milestone reflects the growing computational power securing the network, even as Bitcoin trades around $84,000.Ethereum Staking Surges Post-Shanghai Upgrade

Following Ethereum’s Shanghai upgrade, over 15 million ETH were locked in staking within a 24-hour period. This surge highlights increasing investor trust in Ethereum’s proof-of-stake model and its long-term potential.Trump to Speak at Digital Asset Summit

On March 20, President Donald Trump became the first sitting U.S. president to address a cryptocurrency conference at the Digital Asset Summit in New York. His speech underscored crypto’s growing political relevance, sparking debates about future U.S. regulatory policies.SEC Drops Appeal Against Ripple

The U.S. Securities and Exchange Commission (SEC) abandoned its appeal against Ripple, marking a significant victory for the XRP community. This decision could pave the way for clearer regulations on cryptocurrency classifications.Stellar Partners with Mastercard for Payment Card

Stellar (XLM) announced a collaboration with Mastercard to launch a crypto payment card aimed at Latin America. The initiative targets faster, cheaper cross-border transactions, boosting XLM’s adoption in the region.Hyperliquid Whale Exposed as Ex-Criminal

An investigation revealed that a “Hyperliquid whale,” who earned $20 million trading crypto with high leverage, is William Parker, a figure with a criminal past. This raised concerns about illicit funds influencing crypto markets.Bitcoin Trading Steady at $84K Amid Market Shifts

Bitcoin hovered around $84,000 this week, with analysts noting sideways movement. Market sentiment remains mixed as investors weigh economic data and potential Trump administration policies.Sui ETF Filing Boosts Token Price

Sui (SUI) saw a 15% price jump in 24 hours after a filing for a U.S.-based Sui ETF surfaced. This move signals growing institutional interest in emerging blockchain platforms beyond Bitcoin and Ethereum.U.S. Lifts Sanctions on Tornado Cash

A court ruling prompted the U.S. to lift sanctions on Tornado Cash, a crypto-mixing service. The decision reignited debates over privacy tools in blockchain and their regulatory status.Gotbit Founder Pleads Guilty to Market Manipulation

The founder of Gotbit, a crypto trading firm, admitted guilt in a market manipulation case. This development underscored ongoing challenges with transparency and integrity in cryptocurrency trading.

3. Current market situation.

Crypto Market Snapshot (Mar 23, 2025):

Bitcoin (BTC): Stable at $84,329 (+0.12%).

Ethereum (ETH): Pretty strong rebound at $2,014 (+4.84%).

BNB, XRP, ADA: Modest gains indicate cautious optimism.

Selective Altcoins: Toncoin (TON +7.17%), Chainlink (LINK +4.68%), and Dogecoin (DOGE +2.33%) showing strength.

Underperformers: Pi (-32.47%), BCH (-4.15%), Litecoin (LTC -0.95%) leading the decline.

Market Sentiment:

The overall crypto market is stabilizing with notable recoveries in Ethereum and select altcoins, though mixed performance signals ongoing cautious sentiment.

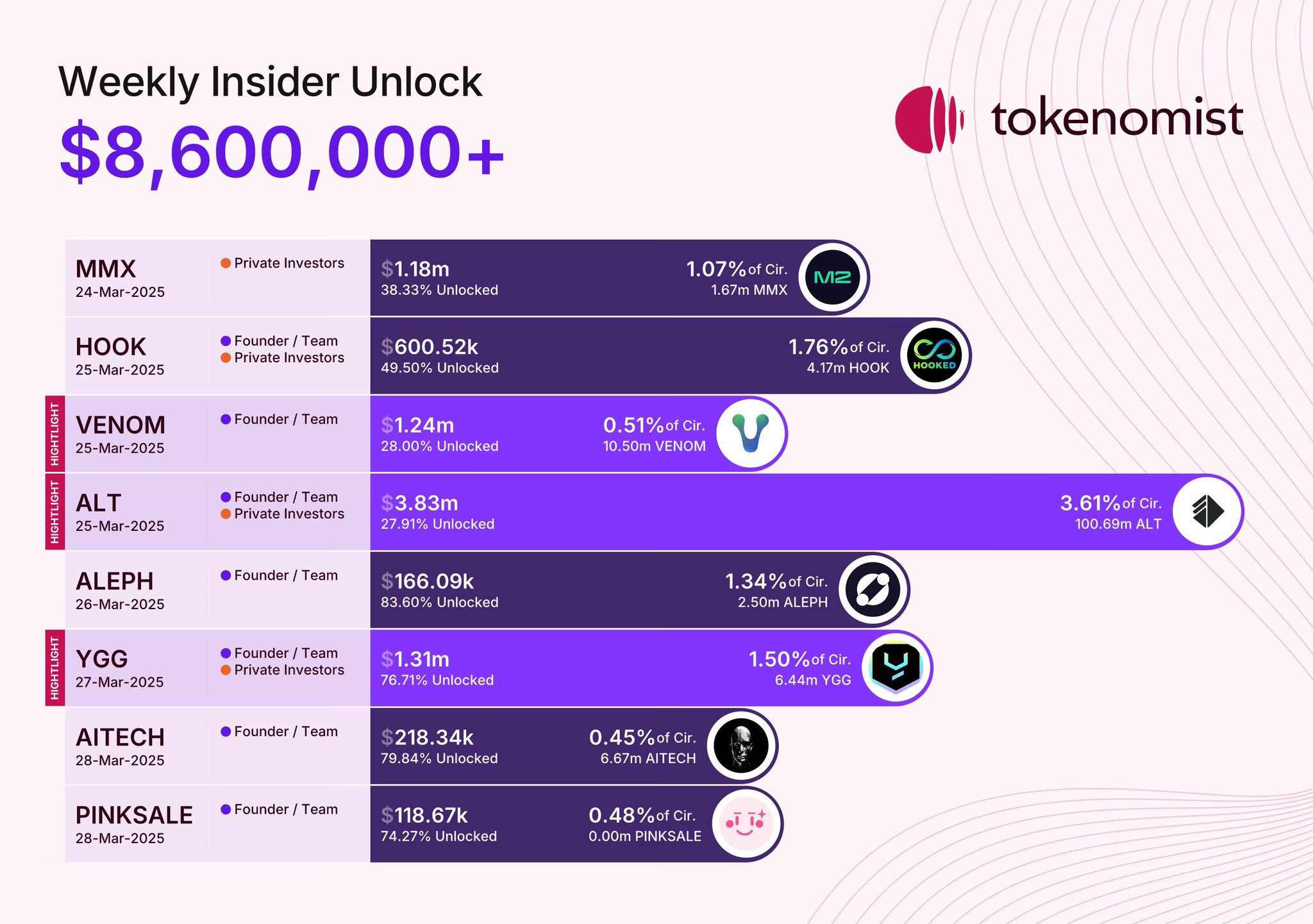

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Crypto Weekly Insider Unlocks: 24-30 Mar ’25: $8.60M+ worth of tokens unlocked this week

Top Unlocks:

$ALT (3.61%) $3.83M

$MMX (1.07%) $1.18M

$YGG (1.50%) $1.31M

$VENOM (0.51%) $1.24M

$HOOK (1.76%) $0.60M

% of circulating supply unlocked

5. Bitcoin On-chain Supports and Resistance.

Bitcoin Realized Price Analysis (Mar 23, 2025)

Observations:

BTC price: $84,290

Short-Term Holder (STH) Realized Prices:

1W–1M: $85,687 (recent buyers at a slight loss)

1M–3M: $98,230 (significant unrealized losses)

3M–6M: $89,063 (moderate losses)

Overall Realized Price: $43,637 (long-term investors remain profitable)

365-Day SMA: $75,487 (bullish support intact)

Takeaways:

Short-term bearish pressure is likely due to recent buyer losses ($85K–$90K range).

Strong long-term support from lower realized prices and SMA.

Conclusion:

Watch closely for short-term volatility around $85K–$90K, but the long-term outlook remains bullish.

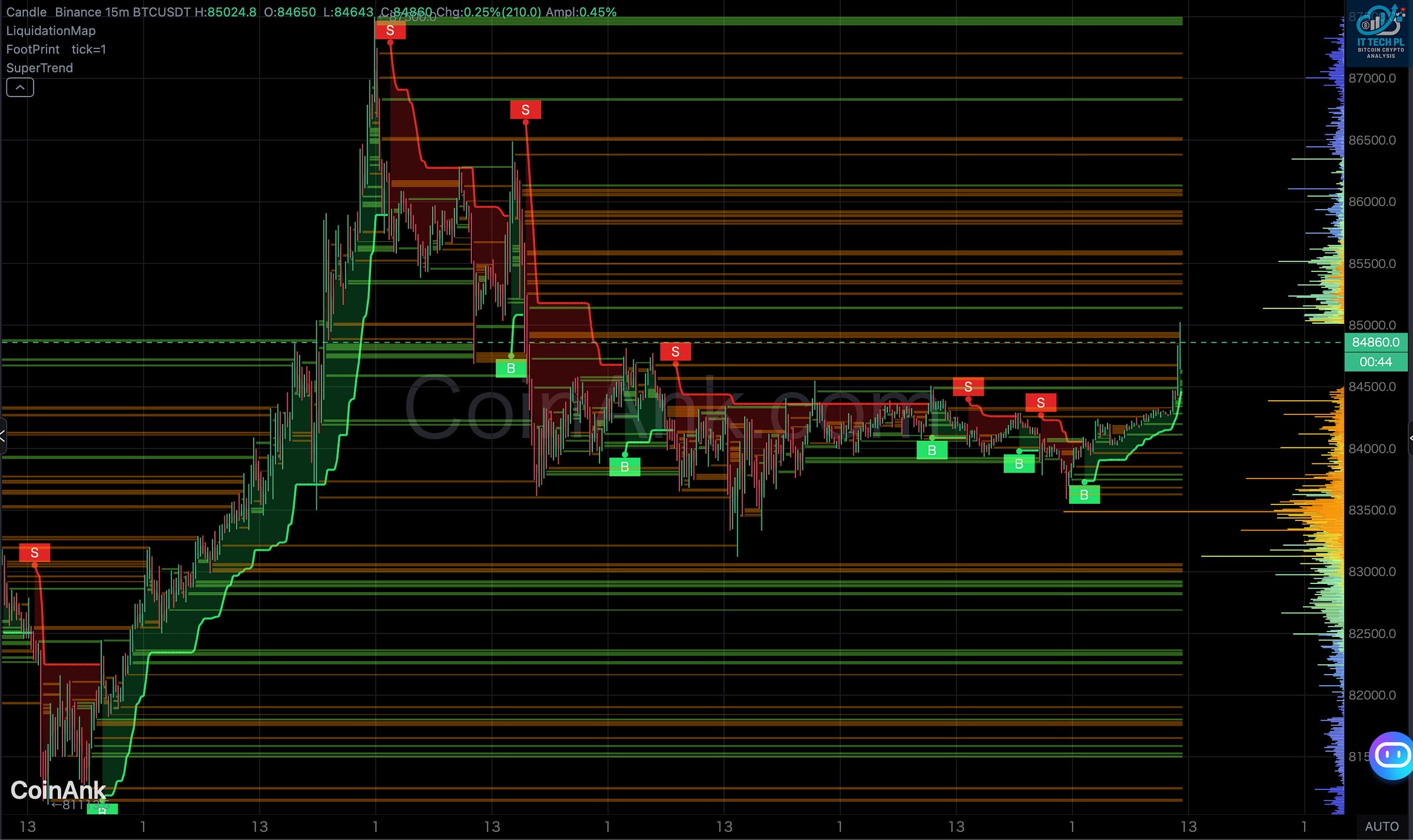

6. Bitcoin: potential liquidations analysis.

Bitcoin (BTC/USDT) Liquidation & Price Analysis – Binance 15m Chart:

Current BTC Price: $84,860.0

Trend & Market Structure:

BTC is breaking out above key resistance at $84,500. The superTrend indicator has flipped bullish, showing increased buying momentum.

Buy and Sell markers highlight reaction points:

Buy signals between $83K - $84K indicate strong demand.

Sell signals at $87,500 and recent resistance near $84.5K - $85K indicate active supply.

Liquidation Levels (Right Axis):

Short Liquidations (Resistance Above Price):

$85,000 - $86,000: Immediate heavy liquidation resistance zone.

$87,500: Key resistance and previous local top.

Long Liquidations (Support Below Price):

$84,000 - $83,500: Newly established critical support zone.

$82,500 - $81,500: Stronger support area for potential rebounds.

Market Sentiment & Summary:

BTC attempts to break above $84.5K, demonstrating bullish momentum.

A sustained move above $85K could lead to a short squeeze toward $87.5K.

Failure to maintain $84K might trigger a pullback towards $83K or lower.

Key Takeaway:

BTC is at a pivotal point. Breaking $85K could fuel a rally toward $87.5K. If rejected, expect a pullback to the $84K - $83K range.

🟣 Want Free 7 days of Diamond Access on CoinAnk? 💎

Here’s how: 👇

How To Claim Your Free Access:

📱 Download the CoinAnk App

🔗 Register using my referral link or code: 84095

Not sponsored, just sharing a great tool I’m using.

7. BTC: Comparison of Demand and Supply Between New and Old Investors.

Observations:

The current LTH supply (77.05%) is much higher than typical market tops.

Low STH supply (22.94%) signals reduced speculative activity compared to historical peaks.

Historically, tops show high STH (>30-35%), followed by declines shifting towards LTH dominance.

Present conditions mirror mid-to-late accumulation phases, not market peaks.

Market Phase Implications:

Suggests recent downturn is a healthy correction, not cycle-ending.

High LTH supply indicates strong investor confidence, potentially limiting further declines.

BTC Price Impact:

Persistent LTH dominance usually supports price stability and growth post-correction.

Continued or rising LTH levels would reinforce future price gains.

Short-term volatility is possible if macro conditions change suddenly.

Conclusion:

Current holder dynamics indicate this correction is likely a healthy market reset, supporting positive long-term price momentum.

Analysis & Comparison to Previous Cycles:

Current Situation (Mar 2025):

Recent peaks in new investor demand (orange areas) are significantly lower compared to historical market cycle tops, indicating relatively muted speculative interest.

Supply is dominated by older investors (blue areas), suggesting strong holder conviction and limited selling pressure.

Historical Context:

Previous market tops (late 2017, early 2021) featured extreme spikes in new investor demand, signaling euphoria and market overheating.

Current peaks in demand (2024–2025) are markedly smaller, highlighting a more cautious market sentiment and less speculative frenzy.

Implications for the Market:

Current dynamics resemble accumulation or mid-cycle corrections rather than market tops.

Lower speculative demand combined with stable supply from long-term holders suggests that recent corrections are more likely a healthy consolidation.

Price Impact:

Limited new investor speculation decreases the risks of severe, prolonged market downturns.

Stability from long-term holders provides strong support, reducing the likelihood of major price crashes.

Conclusion:

The current on-chain profile suggests recent price movements are likely a healthy correction within an ongoing market cycle, not the end of the bull market.

Investors should expect continued volatility, but sustained holder conviction indicates a positive long-term outlook.

8. Bitcoin ETF Holdings & Netflow Analysis.

Key Observations:

Total inflows in Week 12: +8,777 BTC, a significant reversal from recent heavy outflows.

Market Impact:

Positive inflows indicate renewed institutional confidence after several weeks of heavy selling pressure.

Significant inflows by major ETFs (BlackRock, Fidelity) may provide strong support for Bitcoin’s short-term price stability or potential upside.

Reduced selling pressure could signal improved market sentiment and potential recovery momentum in the short term.

Conclusion:

Institutional sentiment appears to be shifting positively, marking a potential stabilization or recovery phase for Bitcoin. Continued ETF inflows are critical to sustain bullish momentum in the upcoming weeks.

9. Stablecoin Market Overview.

Stablecoin Market Overview:

Market cap at $231.97B (+$2.81B, +1.22% weekly).

Monthly growth +$6.10B (+2.70%), indicating rising liquidity.

USDT dominance at 62.16%, slightly decreased.

Conclusion:

Rising stablecoin liquidity signals improving investor confidence, supporting short-term crypto price stability.

10. Support the Newsletter: Exclusive Content & Perks.

Exclusive Content – Additional charts from premium platforms like CryptoQuant, CoinAnk, Kingfisher, Santiment, and Intotheblock, available on request.

Telegram Subscribers' Group – Ask me any crypto-related questions directly.

Educational Content – Learn more about on-chain analysis.

Early Access – Get the newsletter immediately after it’s written, no waiting until 6 PM.

Get a 5% discount on an annual subscription below. Thank you to everyone supporting my work!

If you’d like to support my work with a one-time contribution, you can do so through Suppi.

11. Newsletter Issue Summary.

1. Partnership with WymienBitcoina.pl: New collaboration with WymienBitcoina.pl by Patryk Kempiński, offering over 190 cryptocurrencies with reduced fees using code ‘IT TECH’.

2. Top 10 Cryptocurrency News Highlights: Key news includes Bitcoin’s all-time high hash rate, Ethereum staking surge, Trump’s speech at the Digital Asset Summit, SEC dropping its appeal against Ripple, and Mastercard partnering with Stellar.

3. Current Market Situation: The market remains stable with Bitcoin at $84,329 and Ethereum showing a strong rebound. Select altcoins are also performing well despite some underperformers.

4. Weekly Insider Token Unlocks: Over $8.60M worth of tokens unlocked this week. The top unlocks include ALT, MMX, YGG, VENOM, and HOOK.

5. Bitcoin On-chain Supports and Resistance: BTC is trading at $84,290. Short-term losses are present, but strong long-term support remains with the 365-day SMA at $75,487.

6. Bitcoin: Potential Liquidations Analysis: BTC is breaking out above $84,500 with bullish momentum. Key resistance levels are at $85K - $87.5K, while support levels are at $84K and $83K.

7. BTC: Comparison of Demand and Supply Between New and Old Investors: Current market conditions reflect accumulation rather than a peak. Long-term holders (LTH) maintain a strong presence, indicating price stability.

8. Bitcoin ETF Holdings & Netflow Analysis: Significant positive inflows of +8,777 BTC suggest renewed institutional confidence, mainly from BlackRock and Fidelity.

9. Stablecoin Market Overview: Stablecoin market cap increased by $2.81B to $231.97B. Rising liquidity indicates growing investor confidence.

10. Support the Newsletter: Additional charts, early access, and exclusive content are available for subscribers. Readers can support the newsletter through Suppi.

11. Newsletter Issue Summary: Comprehensive insights on the market’s current state and expectations for the near future.

12. Forecast for the Upcoming Week: Stay alert for key indicators and U.S. economic events to understand potential market shifts.

12. Forecast for the Upcoming Week.

Bitcoin Price Movement: Expect price testing near $85,000 with potential breakouts towards $87,500. However, failure to break $85K may result in a retest of $83K.

2. Long-Term Holder (LTH) Dominance: The high LTH supply indicates that further price drops are likely limited. Positive accumulation phases continue to build strong support.

3. Institutional Influence: Recent inflows to Bitcoin ETFs suggest positive institutional sentiment, which may provide price stability and upward pressure.

4. Stablecoin Market Growth: The increasing stablecoin market cap indicates liquidity is returning to the market, supporting potential recovery phases.

5. Macro Influences: Keep an eye on U.S. economic data releases and political statements (e.g., Trump’s speech) for sudden shifts in market sentiment.

Stay alert and track key indicators for deeper market insights. Track upcoming US events for free using the Economic Calendar.

Remember to realize profits regularly.💡

That wraps up this issue. Have a great end to your weekend and an even better week ahead!

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue will arrive next Sunday at 6 p.m. - check your inbox and spam folder!

This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of WymienBitcoina.pl and affiliate links that may benefit the author.

Best regards

IT Tech