#121 On-chain Insights by IT Tech - Week 13 Bitcoin Analysis & Highlights

Market Volatility Returns: Who’s Selling Bitcoin and What’s Next?

Hello,

The 121st issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t you joined yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Top 10 Cryptocurrency News Highlights

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

BTC: MVRV Z-Score Bull vs Bear Market

Who Is Behind Bitcoin’s Recent Sell-Off?

Bitcoin: Potential Liquidations Analysis

Bitcoin ETF Holdings & Netflow Analysis

Stablecoin Market Overview

Support the Newsletter: Exclusive Content & Perks

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Cryptocurrency News Highlights.

Here are the Top 10 Cryptocurrency News Highlights for March 24-30, 2025, based on the available information and trends as of March 30, 2025.

Bitcoin Price Stabilizes Near $88K Amid Tariff Speculation

Bitcoin traded close to $88,000 this week, with a notable jump on March 24 following reports that President Trump might opt for fewer tariffs than anticipated. Investors had been fleeing risky assets like crypto due to tariff concerns, but this news spurred a temporary recovery.GameStop Doubles Down on Bitcoin as Treasury Reserve Asset

On March 26, U.S. video game retailer GameStop announced it would include Bitcoin as a treasury reserve asset to diversify its holdings, echoing MicroStrategy’s approach. This move sparked a nearly 20% surge in its stock price overnight, fueling speculation about a broader corporate crypto adoption trend.Crypto.com SEC Investigation Closes with No Action

On March 28, Crypto.com’s CEO Kris Marszalek, announced that the U.S. Securities and Exchange Commission (SEC) officially closed its investigation into the exchange, initiated with a Wells notice in August 2024. This resolution was seen as a win for the platform amid regulatory scrutiny.Ripple Partners with Chipper Cash for African Payments

Ripple teamed up with Chipper Cash to enable fast, low-cost cross-border payments into Africa using blockchain technology. Announced around March 28, this partnership aims to serve Chipper Cash’s 5 million users across nine countries, highlighting blockchain’s growing role in global finance.BlackRock Expands BUIDL Fund to Solana

On March 25, BlackRock announced that its USD Institutional Digital Liquidity Fund (BUIDL), which has a near $2 billion market cap, would expand to the Solana blockchain. This move by a financial giant underscored Solana’s rising prominence in the crypto ecosystem.Binance Futures Lists PAXGUSDT Perpetual Contract

Binance Futures launched a PAXGUSDT perpetual contract on March 27, offering up to 75x leverage on Pax Gold (PAXG), a gold-backed cryptocurrency. With 24/7 trading and multi-asset margin options, this listing reflected growing interest in tokenized assets.Ethereum Faces Selling Pressure, Drops Below $2,000

Ethereum (ETH) declined 1.4% on March 29, falling to $1,837 amid increased selling pressure. Analysts noted a “Descending Channel” pattern, with traders disappointed as ETH failed to reclaim the $2,000 mark during the weekend.Trump Media and Crypto.com Launch ETF Collaboration

On March 24, Trump Media & Technology Group partnered with Crypto.com to launch “Made in America”-themed exchange-traded funds (ETFs) later in 2025. This collaboration boosted Trump Media’s stock and hinted at a pro-crypto stance from the administration.SEC Crypto Task Force Holds First Public Meeting

On March 24, the SEC’s crypto task force held its first public roundtable with experts, discussing how securities laws apply to digital assets. This came as the Trump administration signaled plans to revamp crypto regulations, raising debates about potential rule loosening.Ghibli-Themed Memecoins Surge After AI Trend

Memecoins inspired by Studio Ghibli surged this week, sparked by ChatGPT-4’s image generation feature. Posts on X noted OpenAI limiting speeds due to GPU strain, while the trend showcased how AI-driven content can rapidly influence crypto markets.

3. Current market situation.

Current Crypto Market Snapshot (1 week):

• Bitcoin (BTC) is down slightly by 1.1%, trading around $83,415.

• Ethereum (ETH) sees a substantial drop of 8.29%, now at $1,844.

• XRP is significantly down by 8.77%.

• Other leading altcoins also show notable declines: BNB (-2.17%), SOL (-3.95%), DOGE (-6.99%), and ADA (-7.26%).

Only a few assets, like CRO (+5.83%), XDC (+7.28%), EOS (+5.49%), and BDX (+20.61%), are showing positive performance, suggesting isolated bullish activity amid a predominantly bearish sentiment.

This broad market decline implies cautious investor behavior and reduced risk appetite. Investors should carefully monitor critical support levels to gauge potential market stabilization or further downturn risks.

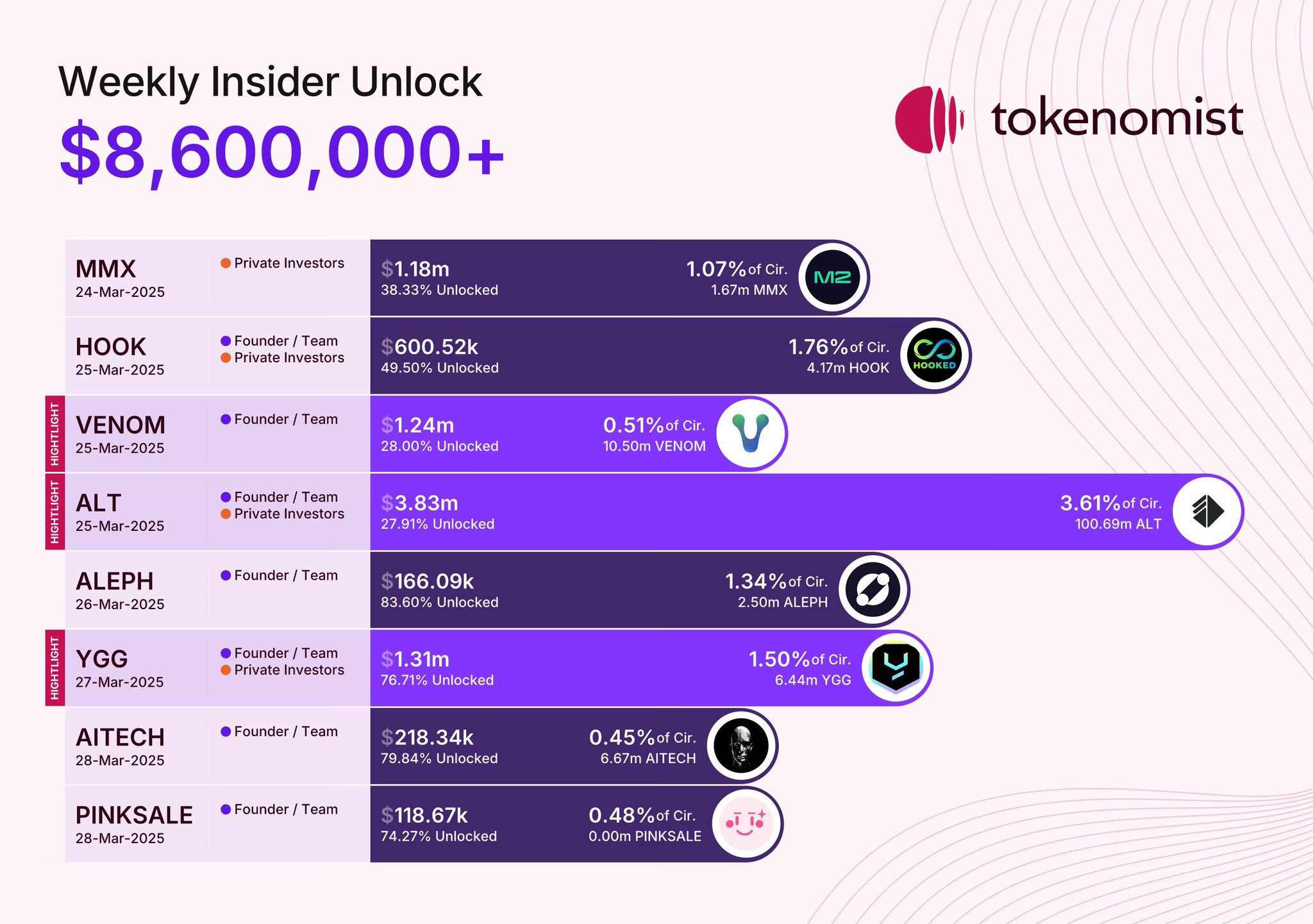

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Weekly Insider Unlocks: 31 Mar - 6 Apr ’25. Total Unlock: $ 320.9 M+

Highlights:

SUI (1.56%) - $136.12M

ENA (3.25%) - $71.58M

W (24.28%) - $70.40M

OP (1.93%) - $28.14M

DYDX (1.09%) - $6.02M

ZETA (1.79%) - $4.71M

(% indicates circulating supply unlocked)

5. BTC: MVRV Z-Score Bull vs Bear Market

MVRV Z-Score Analysis and Market Situation:

Calculation Method:

The MVRV Z-Score is calculated by subtracting Bitcoin’s realized value (average price investors paid historically) from the market value (current market cap) and dividing this by the standard deviation of the market value. It helps identify whether Bitcoin is significantly over- or undervalued compared to its historical average.

Current Market Situation:

Since March 9, 2025, the indicator has shifted to a “Bear” phase, signaling that Bitcoin has entered a corrective phase from recent highs. Historically, periods marked in red typically indicate downward pressure, consolidation, or correction rather than a sustained bull market continuation.

Interpretation & Outlook:

Current “Bear” coloring suggests Bitcoin may experience further consolidation or downward pressure in the short-term.

This phase often presents opportunities for strategic accumulation rather than signaling a long-term market top.

Compared to past cycles, current conditions resemble mid-cycle corrections rather than full bear market scenarios observed after significant peaks (like those seen post-2017 and post-2021).

Conclusion:

Bitcoin is currently experiencing a healthy correction phase. While short-term volatility and potential declines remain likely, historical patterns indicate that the market has not yet reached a major cyclical top. Investors should remain cautious but consider these corrections as potential accumulation opportunities.

6. Who Is Behind Bitcoin’s Recent Sell-Off?

The recent Bitcoin sell-off is primarily driven by short-term holders (STH)—investors holding Bitcoin for less than 155 days—realizing losses, highlighting their growing pessimism during the current price decline. On-chain data clearly shows an increased rate of STH selling at a loss (purple bars), indicating short-term investors are capitulating amid heightened market volatility.

Historically, such STH behavior often signals market stress and can mark local bottoms rather than prolonged downturns. Meanwhile, long-term holders (LTH) remain largely inactive, underscoring continued long-term confidence. This pattern suggests potential near-term volatility, but also sets the stage for stabilization once panic selling decreases.

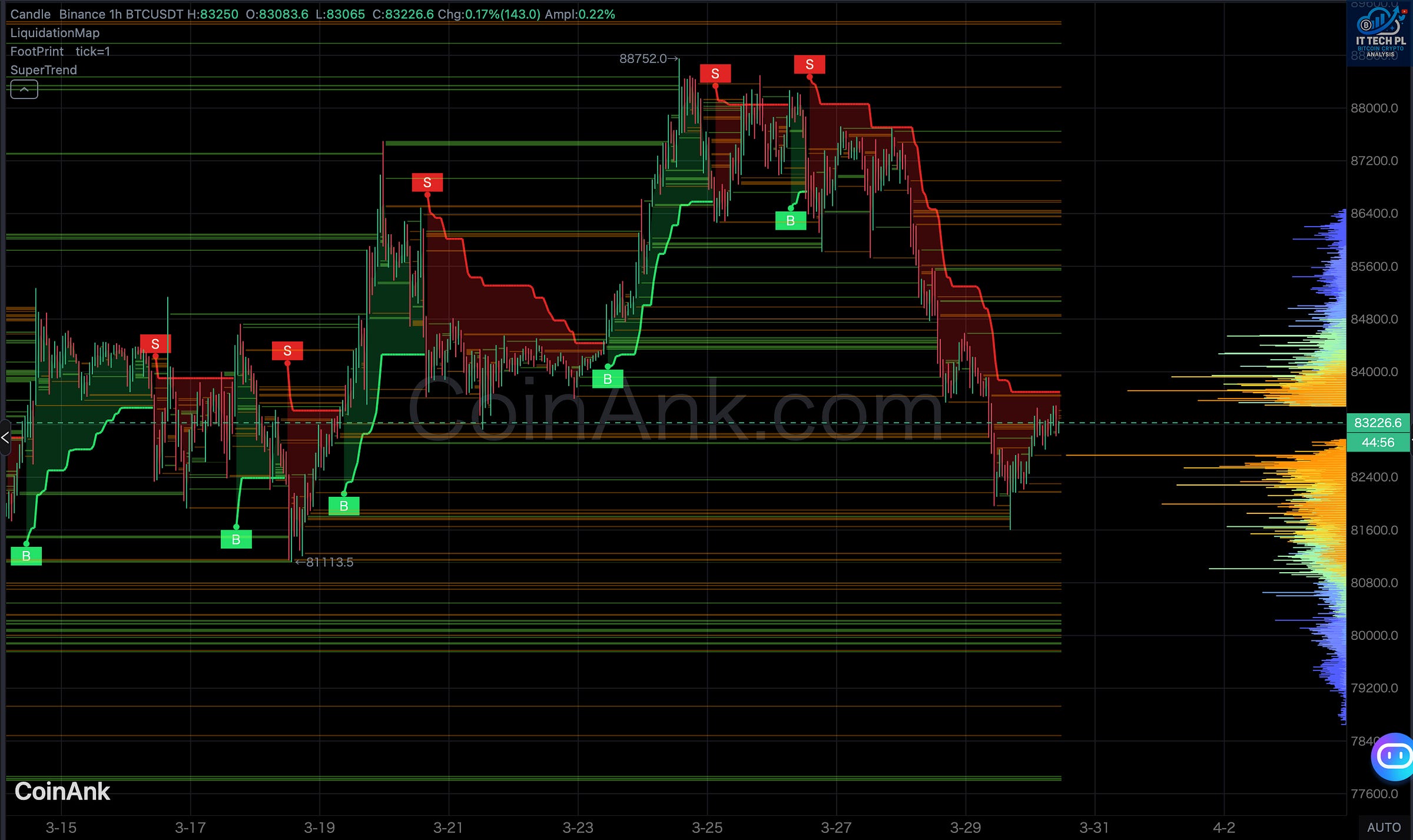

7. Bitcoin: Potential Liquidations Analysis.

Bitcoin (BTC/USDT) Liquidation & Price Analysis – Binance 1h Chart.

Current BTC Price: $83,226.6. Trend & Market Structure:

BTC pulled back from the local top at $88,752, finding support around $82,000.

SuperTrend is bearish on the 1h timeframe, with early reversal indications.

Buy/Sell markers:

Buy signals clustered at $81,100 – $82,000, creating a strong demand base.

Sell signals dominate between $86,500 – $88,000, confirming strong resistance.

Liquidation Levels:

Short Liquidations (Resistance Above Price):

$84,000 – $85,500: Immediate resistance; breaking this could trigger a short squeeze.

$86,500 – $88,000: Major resistance; critical area for bullish continuation.

Long Liquidations (Support Below Price):

$82,000 – $81,000: Current active support, confirmed by recent bounces.

$80,000 – $78,000: Key liquidity zone; loss of this area would trigger deeper declines.

Market Sentiment & Summary:

BTC is attempting a recovery following a significant pullback.

Bulls must reclaim the $84,000 resistance to regain momentum.

Breaking below $82,000 increases downside risk toward $80,000 and lower.

Key Takeaway:

Reclaiming $84,000 confirms bullish momentum short term. Loss of $82,000 suggests a deeper pullback toward $80,000 - $78,000.

🟣 Want Free 7 days of Diamond Access on CoinAnk? 💎

How to Claim Your Free Access: 👇

📱 Download the CoinAnk App

🔗 Register using my referral link or code: 84095

8. Bitcoin ETF Holdings & Netflow Analysis.

Summary of Bitcoin ETF Netflows (March 2025):

Key Observations:

Significant Negative Outflows: Early to mid-March saw substantial ETF outflows, peaking on March 7 at over $445M, correlating strongly with BTC price declines.

Recent Positive Shift: Late March experienced renewed inflows (e.g., March 19 with +$239M), reflecting returning institutional interest and supporting recent price stabilization.

Implications:

Bearish Pressure: Early-month large withdrawals indicated significant institutional caution, triggering price declines.

Potential Recovery Signs: Recent inflows hint at renewed confidence, potentially stabilizing prices in the short term.

Conclusion:

Early March showed strong institutional selling pressure, causing price declines. Recent positive inflows suggest institutions may be regaining confidence, potentially stabilizing or supporting BTC price recovery.

9. Stablecoin Market Overview.

Stablecoin Market Overview (as of Mar 30, 2025):

Total Market Cap: $233.69 billion, up $1.57 billion (+0.68%) over the last 7 days.

Monthly Change: Stablecoin market has increased by $9.55 billion (+4.26%) over the past month, indicating improving liquidity.

USDT Dominance: Currently at 61.82%, showing a minor decrease, reflecting increased diversification into other stablecoins.

Implications:

Continued stablecoin inflows suggest investors are preparing liquidity, potentially signaling upcoming market stability or moderate bullish conditions. Investors should monitor stablecoin flows closely as a leading indicator of market sentiment.

10. Support the Newsletter: Exclusive Content & Perks.

Exclusive Content – Additional charts from premium platforms like CryptoQuant, CoinAnk, Kingfisher, Sentiment, and Intotheblock, available on request.

Telegram Subscribers' Group – Ask me any crypto-related questions directly.

Educational Content – Learn more about on-chain analysis.

Early Access – Get the newsletter immediately after it’s written, no waiting until 6 PM.

Get a 5% discount on an annual subscription below. Thank you to everyone supporting my work!

If you’d like to support my work with a one-time contribution, you can do so through Suppi.

11. Newsletter Issue Summary.

1. Partnership with WymienBitcoina.pl: Secure crypto trading on WymienBitcoina.pl; use code "IT TECH" for reduced fees.

2. Top 10 Cryptocurrency News Highlights: Bitcoin stabilizes around $88K, GameStop adopts Bitcoin, Crypto.com investigation ends positively, Ripple expands to Africa, BlackRock backs Solana, Binance lists gold-backed crypto, ETH struggles under $2K, Trump Media launches ETF, SEC holds crypto discussions, AI-driven memecoin boom.

3. Current Market Situation: Broad crypto market decline; Bitcoin slightly down, ETH and major altcoins face significant selling pressure, while CRO, XDC, EOS, and BDX show isolated strength.

4. Weekly Insider Token Unlocks: $320.9M token unlock this week; watch SUI ($136M), ENA ($71M), W ($70M), OP ($28M), DYDX ($6M), ZETA ($4M) for potential volatility.

5. BTC: MVRV Z-Score Bull vs Bear Market: MVRV indicator signals "Bear" phase from March 9; indicates healthy correction, likely short-term volatility rather than long-term bear market.

6. Who Is Behind Bitcoin’s Recent Sell-Off?: Short-Term Holders (holding <155 days) primarily selling at losses, indicating panic selling. Long-Term Holders remain stable, suggesting short-term volatility but potential market stabilization ahead.

7. Bitcoin: Potential Liquidations Analysis: BTC pulled back to ~$82K; immediate resistance at $84K-85.5K; major resistance at $86.5K-88K. Critical support at $82K; potential drop to $80K-$78K if lost.

8. Bitcoin ETF Holdings & Netflow Analysis: Significant March ETF outflows correlated with BTC declines; late-March inflows suggest renewed institutional interest and potential price stability.

9. Stablecoin Market Overview: Stablecoin market cap at $233.69B (+4.26% monthly), indicating growing liquidity; minor USDT dominance drop suggests diversification.

10. Support the Newsletter: Exclusive charts, educational content, direct Telegram access, early newsletter release, and subscriber discounts are available.

12. Forecast for the Upcoming Week.

BTC volatility expected; critical price range $82K-$84K.

Monitor closely significant token unlocks (SUI, ENA, W) for potential sell pressure.

ETF netflows could signal market direction; recent inflows may support short-term recovery.

Stablecoin inflows suggest potential bullish support; observe closely for liquidity shifts.

Continued STH loss-realization may indicate short-term bottom formation.

Stay alert and track key indicators for deeper market insights. Track upcoming US events for free using the Economic Calendar.

Remember to realize profits regularly.💡

That wraps up this issue. Have a great end to your weekend and an even better week ahead!

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue will arrive next Sunday at 6 p.m. - check your inbox and spam folder!

This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of WymienBitcoina.pl and affiliate links that may benefit the author.

Best regards

IT Tech