#122 On-chain Insights by IT Tech - Week 14 Bitcoin Analysis & Highlights

Bitcoin Faces Tariff Turbulence—See How to Navigate the Storm!

Hello,

The 122nd issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t you joined yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Top 10 Cryptocurrency News Highlights

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

Analysis: BTC On-chain Metrics Heatmap

Realized vs Market Cap: Why Bitcoin’s Bull Cycle May Be Over

Bitcoin: Potential Liquidations Analysis

Bitcoin ETF Holdings & Netflow Analysis

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Cryptocurrency News Highlights.

Top 10 Cryptocurrency News Highlights for March 31 to April 6, 2025:

Trump Family’s Bitcoin Mining Venture: On March 31, Eric Trump and Donald Trump Jr. unveiled their stake in American Bitcoin, a new Bitcoin-mining company formed through a merger. This signaled the Trump family’s deepening ties to cryptocurrency amid their broader financial maneuvers.

World Liberty Financial Raises Over $500 Million: By March 31, the Trump family assumed control of World Liberty Financial, a crypto platform that amassed over half a billion dollars, raising eyebrows due to insider-favorable governance terms as their influence in the crypto sector grew.

Bitcoin Slides Amid Trump Tariff Announcement: On April 2, Bitcoin dropped to $81,000 as President Donald Trump announced a sweeping tariff package targeting China, Vietnam, and the EU. These new tariffs—initially set at a 10% baseline for all imports, with higher rates like 54% on Chinese goods—triggered widespread market panic, contributing to a stock market crash that erased over $3 trillion from Wall Street on April 3.

U.S. Crypto Stocks Hit by Tariff Jolt: On April 3, U.S.-listed crypto stocks plummeted alongside broader equities as Trump’s tariffs fueled a sell-off. The stock market crash saw the Dow Jones fall 3.98%, the Nasdaq 5.97%, and the S&P 500 4.84%, the worst day since the 2020 pandemic, with crypto stocks caught in the crossfire of tariff-induced uncertainty.

XRP Emerges as Retail Favorite: On April 4, Coinbase spotlighted XRP’s surge in retail popularity, bolstered by new automated market maker features and regulatory clarity, offering a bright spot amid the tariff-driven chaos roiling other markets.

Bitcoin Price Rebounds: By April 4, Bitcoin clawed back some losses, rising slightly as cryptocurrencies showed resilience against the stock market meltdown sparked by Trump’s tariffs, which continued to pressure traditional equities like Nike (-14%) and Apple (-9%).

Cryptocurrencies Buck Market Meltdown: On April 4, while stocks cratered—losing $1.7 trillion in a single session due to tariff fears—Bitcoin and other cryptos rose, diverging from gold’s decline and highlighting their appeal as alternative assets during economic upheaval.

Wall Street Loss Exceeds Crypto Market Cap: On April 5, the U.S. stock market’s $3 trillion single-day loss on April 4 dwarfed the entire crypto market’s valuation, driven by Trump’s tariff escalation and recession fears, underscoring crypto’s relative stability that week.

Bitcoin Dominance Hits 61%: X posts on April 4 noted Bitcoin’s dominance climbing to 61%, a 2021 peak, as investors flocked to it amid the stock market crash precipitated by Trump’s new tariffs, which rattled global trade confidence.

STABLE Act of 2025 Passed: On April 4, X posts reported the U.S. House Financial Services Committee passing the STABLE Act of 2025 to regulate stablecoins, a move seen as a counterbalance to the economic turbulence unleashed by Trump’s tariff policies and the ensuing stock market crash.

The new tariffs, announced on April 2 and detailed further over the week, were a cornerstone of Trump’s economic strategy but sparked immediate chaos. Described as “reciprocal tariffs” to offset trade imbalances, they included steep rates—like 46% on Vietnam and 27% on India—beyond the 10% baseline, hitting sectors from tech to automotive hard. This led to a historic stock market crash on April 3-4, with companies reliant on global supply chains (e.g., Dell -19%, GAP -20%) suffering massive losses. Crypto, however, showed mixed resilience, with Bitcoin and others rebounding faster than stocks, reflecting a flight to decentralized assets amid the tariff-driven equity rout.

3. Current market situation.

Current Crypto Market Snapshot (1 week):

Bitcoin (BTC) slightly decreased by 0.35%, priced at around $83,058.

Ethereum (ETH) is down by 2.87%, trading at $1,792.

XRP faces a significant loss of 4.41%.

Major altcoins are also strongly in red: BNB (-3.06%), SOL (-4.84%), DOGE (-3.83%), ADA (-4.86%), LTC (-8.59%).

Very few cryptocurrencies resist the trend; notable exceptions include:

TRX (+8.29%)

TAO (+6.48%)

EOS (+25.97%)

Overall, market sentiment remains bearish, indicating ongoing caution and selling pressure among investors. Traders should closely monitor support levels for signs of stability or further decline risks.

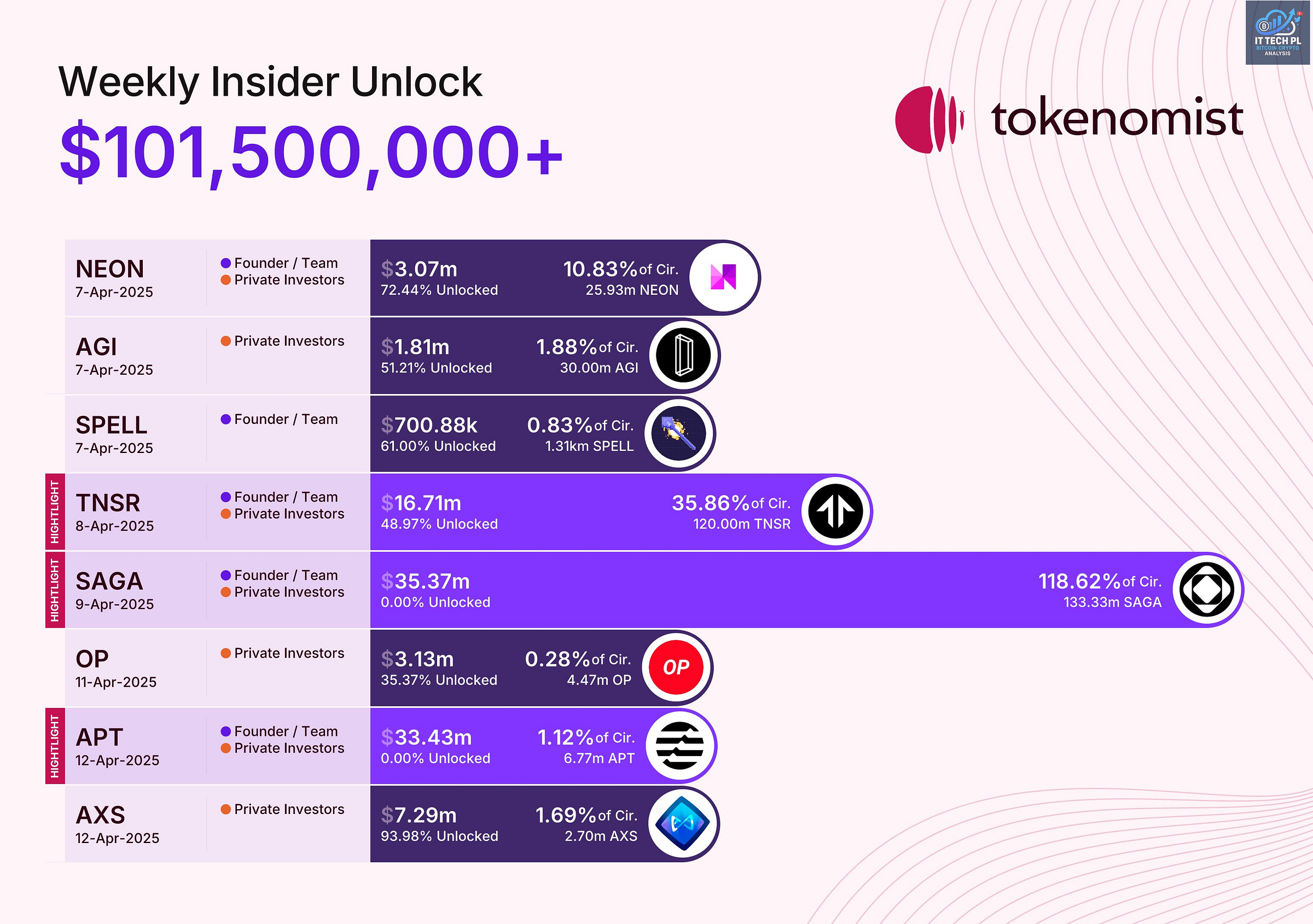

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Weekly Insider Unlocks: 7-12 Apr ’25. Total Unlock: $101.5M+

Highlights:

SAGA: $35.37M (118.62% of circulating supply)

APT: $33.43M (1.12%)

TNSR: $16.71M (35.86%)

AXS: $7.29M (1.69%)

OP: $3.13M (0.28%)

(% indicates circulating supply unlocked)

Overall, investors should closely monitor market reactions around unlock dates, especially for tokens with large unlock proportions like SAGA and TNSR, due to the high likelihood of significant short-term price fluctuations.

5. Analysis: BTC On-chain Metrics Heatmap.

Analysis: BTC On-chain Metrics Heatmap

This heatmap visualizes various key Bitcoin on-chain metrics over time, providing insight into current market conditions and historical patterns:

Current Market Situation (March 2025):

Price Drawdown from ATH (All-Time High): Currently in orange/red, showing significant drawdown from recent highs—indicating BTC is undergoing a considerable correction.

NUPL (Net Unrealized Profit/Loss): In orange/red zones, suggesting holders are experiencing reduced unrealized profits, typical during market corrections.

SOPR (Spent Output Profit Ratio): Mainly yellow/orange indicating coins moved recently have low profits or slight losses, signaling weaker market sentiment and selling pressure.

aSOPR (Adjusted SOPR): Similar orange/yellow shades reflect muted profit-taking and prevalent loss-realization among active participants.

STH SOPR (Short-Term Holders SOPR): Orange shades highlight that short-term holders (less than 155 days holding) continue realizing losses, contributing to downward pressure.

MVRV and MVRV Z-Score: Colors indicate current BTC valuation is relatively neutral to slightly undervalued compared to historical averages, supporting a corrective rather than peak cycle phase.

LTH SOPR (Long-Term Holders SOPR): Predominantly blue, indicating minimal profit-taking from long-term holders, which suggests continued confidence despite short-term bearishness.

Interpretation:

The heatmap reveals a market currently characterized by significant short-term bearish sentiment, with widespread loss realization among short-term holders.

Long-term holders remain largely inactive, a behavior typically observed during corrective phases rather than at cyclical market tops.

Outlook:

Current patterns closely match historical mid-cycle corrections, not long-term bear market setups.

Continuation of short-term volatility and further drawdowns remain possible.

A stabilization in these metrics (particularly SOPR and NUPL) would indicate a bottom formation and could signal renewed upward momentum.

Conclusion:

Bitcoin appears to be experiencing a typical corrective phase rather than a prolonged bear market. Investors should closely monitor short-term holder behavior for potential signs of exhaustion in selling pressure, which historically precedes recoveries.

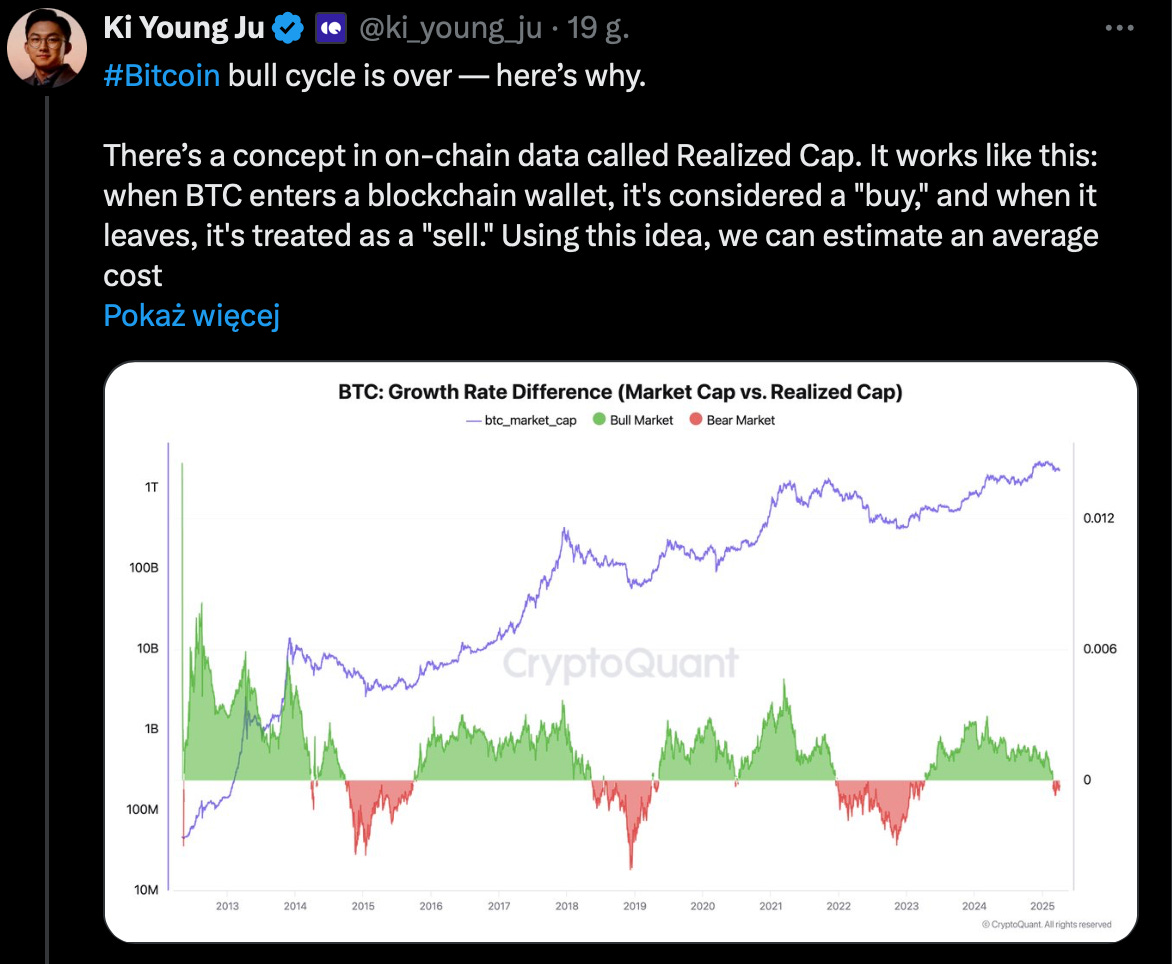

6. Realized vs Market Cap: Why Bitcoin’s Bull Cycle May Be Over.

Current Market Phase:

According to CryptoQuant’s CEO, current on-chain data suggests the Bitcoin bull cycle has ended. The key metric here is the comparison between Realized Cap (actual capital flowing into BTC) and Market Cap (BTC’s market valuation based on last traded prices).

What Does This Mean?

Access Change Notice!

From now on, full editions of On-chain Insights by IT Tech will be exclusively available to premium subscribers. Free subscribers will continue receiving approximately 50% of each article.

Upgrade today to unlock:

Exclusive Content: Premium charts and analytics from platforms like CryptoQuant, CoinAnk, Kingfisher, Sentiment, and Intotheblock.

Telegram Subscribers' Group: Directly ask any crypto-related questions.

Educational Content: Deepen your understanding of on-chain analysis.

Immediate Full Access: Read the newest newsletter issue immediately upon publication.

Enjoy a 5% discount on an annual subscription!

If you’d like to support my work with a one-time contribution, you can do so through Suppi.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.