#123 On-chain Insights by IT Tech - Week 15 Bitcoin Analysis & Highlights

Bitcoin Holds Strong as Ethereum Fades – Is the Next Big Move Coming?

Hello,

The 123rd issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,700 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Tariff Exemptions Boost Crypto Confidence

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

🔐 Premium Insights (exclusive for paid subscribers):

Ethereum’s Structural Weakness and What Comes Next

Bitcoin: Potential Liquidations Analysis

Bitcoin ETF Holdings & Netflow Analysis

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Tariff Exemptions Boost Crypto Confidence.

The announcement of steep tariffs by the Trump administration caused a strong reaction across both traditional and crypto markets. However, shortly after speculation emerged about potential tariff exemptions or adjustments, Bitcoin showed surprising resilience and a swift rebound.

On April 4–5, a significant divergence occurred: while equities and gold slumped, Bitcoin rebounded, climbing from local lows near $77.5K to over $85K. This divergence highlights Bitcoin’s growing status as a hedge asset, especially under narratives of monetary policy shifts or geopolitical uncertainty.

The rebound was also accompanied by a sharp increase in trading volume, suggesting strong demand during the bounce. On-chain and behavioral data confirm a shift in market psychology.

Santiment’s social data shows that as the news around “tariff exemptions” circulated, mentions and dominance of Bitcoin in social discussions spiked, aligning with the price recovery. This indicates that market participants quickly pivoted from fear to opportunity-seeking behavior.

Additionally, social volume for phrases like “higher” and “above” overtook “lower” and “below” around April 11–12, indicating a shift in sentiment toward bullish expectations. This behavioral inflection point matched BTC’s move above $85K.

Conclusion:

Bitcoin’s rebound in the face of macroeconomic turmoil, coupled with strong on-chain and social metrics, confirms its resilience narrative. Traders should monitor policy announcements closely, as even soft revisions (like tariff exemptions) can swiftly reverse sentiment and spark upward momentum.

Source: Santiment Insights

3. Current market situation.

Weekly Market Snapshot:

Bitcoin (BTC) remains relatively stable, posting a weekly gain of +2.01%, currently trading around $84,674.

Ethereum (ETH) experienced a sharp decline of -9.63%, dropping to $1,622, underperforming the broader market.

XRP rose by +2.18%, while BNB was slightly positive at +0.56%.

Altcoins remain under pressure: LTC (-3.52%), DOT (-6.29%), ADA (+1.66%), DOGE (+0.16%), TRX (+3.97%), and XMR (-3.36%).

Outperformers: SOL (+9.04%), showing strong momentum recovery, HBAR (+9.08%), PEPE (+16.91%), FLR (+17.48%), and TAO (+10.63%) also posted double-digit gains.

Underperformers: ATOM (-10.46%), ETH (-9.63%), and MNT (-5.70%), all reflecting broader risk-off behavior.

Despite the gains in BTC and a few isolated altcoins, the overall tone remains bearish and cautious. The defensive rotation into large-caps (BTC, SOL) suggests capital is flowing into safer assets. Lower-cap altcoins gaining traction appear to be driven more by speculative narratives or token-specific catalysts.

Investor Outlook:

With major assets like ETH under pressure and only isolated altcoins showing strength, traders should maintain a defensive strategy and monitor support levels closely. Sentiment remains fragile and sensitive to macro developments.

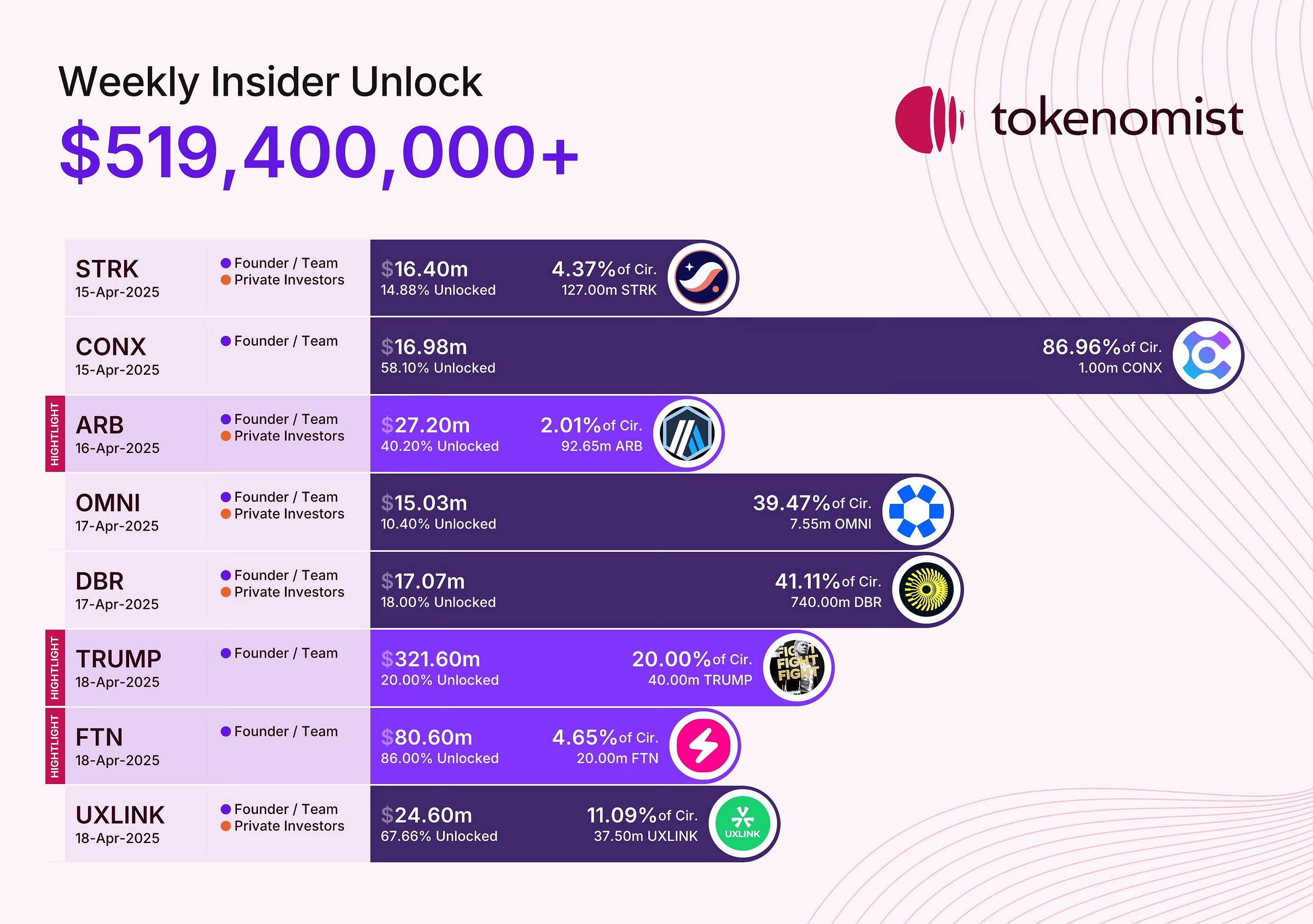

4. Weekly Insider Token Unlocks: Potential Sell Pressure

This week, over $519 million in tokens are scheduled to be unlocked, which could introduce increased sell-side pressure across several projects.

Key highlights:

TRUMP unlocks dominate the week with $321.6M (20% of supply), likely catching trader attention due to the token’s memetic nature and speculative flows.

FTN and UXLINK also stand out, with $80.6M and $24.6M, respectively, representing significant portions of their circulating supply (4.65% and 11.09%).

ARB, a major L2 token, unlocks $27.2M, although only 2.01% of the circulating supply — still notable given recent market weakness.

While not all unlocks lead to immediate sell pressure, projects with high circulating unlock percentages and low liquidity may see amplified volatility.

🔐 Premium Insights.

Available only to paid subscribers:

✔️ Deep dive into on-chain metrics

✔️ Institutional flows & ETF analysis

✔️ Market structure breakdowns beyond the headlines

Upgrade now to get the full picture – and enjoy a 5% discount on your annual plan.

Already subscribed? Scroll down to continue reading.

6. 🔐 Ethereum’s Structural Weakness and What Comes Next.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.