#124 On-chain Insights by IT Tech - Week 16 Bitcoin Analysis & Highlights

Two Sides of the Chain: Accumulation vs Capitulation.

Hello,

The 124th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,700 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Top 10 Crypto & Stock News (April 14–21, 2025)

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

🔐 Premium Insights (exclusive for paid subscribers):

Behind the Scenes: What Bitcoin Smart Holders Are Doing Right Now

Bitcoin: Potential Liquidations Analysis

Bitcoin ETF Holdings & Netflow Analysis

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Crypto & Stock News (April 14–21, 2025)

Bitcoin Surges to $86K on Tariff Speculation

BTC rallied to $86K as markets reacted to U.S. trade policy shifts, triggering volatility.

Trump Launches Stablecoin: World Liberty Financial

The announcement boosted interest in politically affiliated stablecoins and sparked debates.

245% U.S. Tariffs Raise Fears of ‘Crypto Winter’

Coinbase warned of a downturn following harsh tariffs, pressuring crypto and tech markets.

Canada Launches Solana ETFs with Staking

A major step for crypto adoption, pushing institutional attention toward SOL.

Bitcoin Holds $85K Despite Global Crisis Fears

BTC showed resilience while macro warnings from top investors surfaced.

Powell Flags Tariff Risk, Markets Slide

Fed comments triggered sharp corrections in equities and spilled into crypto assets.

Chip Export Ban Hits Tech Sector

Nvidia and AMD stocks declined sharply, raising concerns for the mining hardware supply.

USDC Issuer Circle Files for IPO

Circle’s filing signals strong demand for stablecoin infrastructure amid market stress.

Bitcoin Implements Quantum-Resistant Upgrade

A key milestone for long-term BTC security and institutional confidence.

Ethereum Deploys Pectra Testnet Upgrade

Improvements in staking and scalability may revive ETH’s competitive edge.

3. Current market situation.

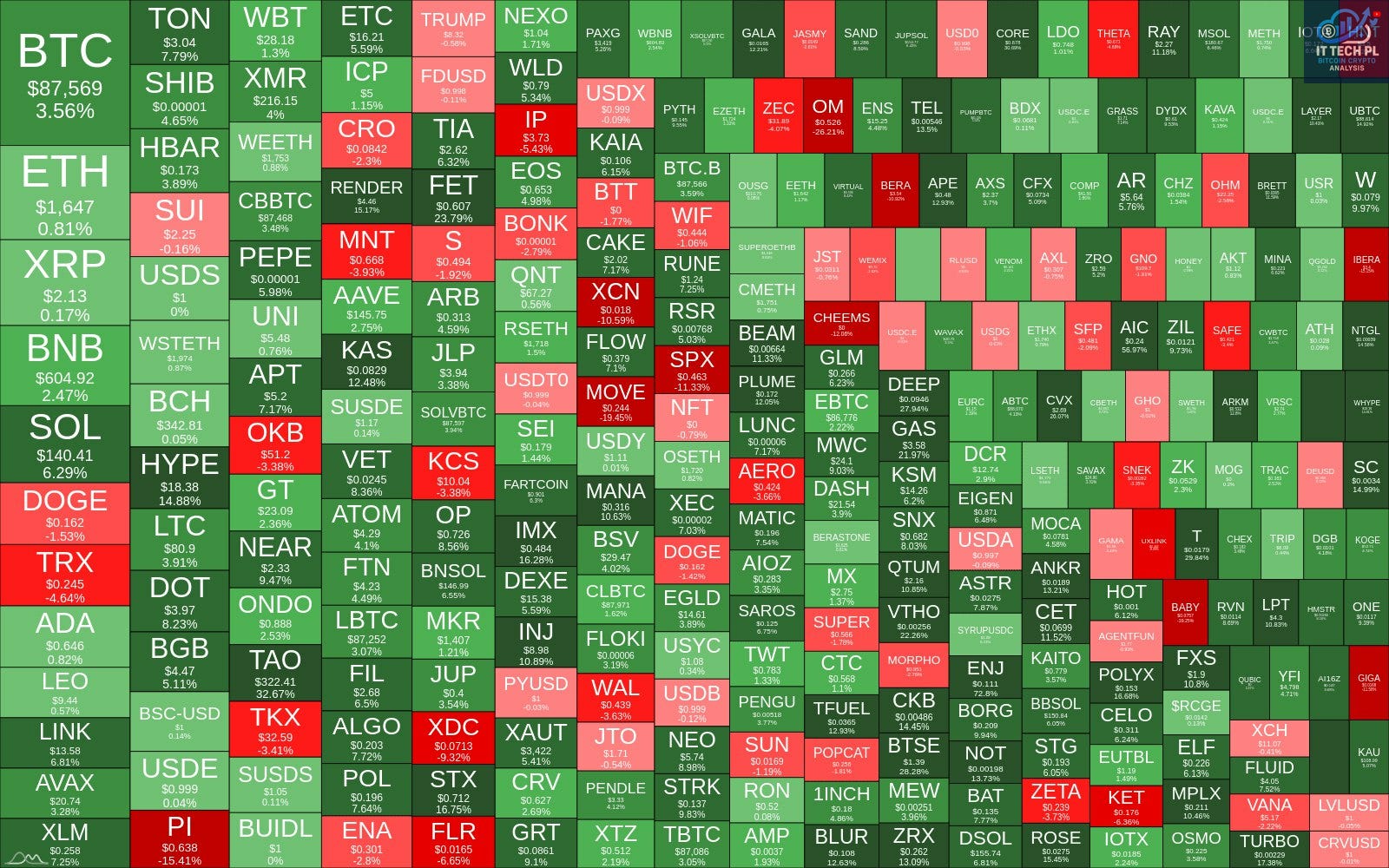

Heatmap of TOP 300 Coins – Weekly Performance Snapshot.

Overview:

This week, the crypto market is predominantly green, reflecting a broad-based recovery across major and mid-cap altcoins. Bitcoin leads with a solid +3.56% weekly gain, trading at ~$87,569. On the other hand, Ethereum underperforms with a modest +1.36% move, currently around $1,647.

🔹 Key Observations:

Leaders:

HYPE: +188.48% – the week’s top gainer, likely fueled by speculation or recent announcements.

WLD, RENDER, FET, TIA: Notable double-digit gains indicate renewed interest in AI and infrastructure plays.

SOL: +6.29%, confirming its strength in large-cap narratives.

TON: Continues strong upward momentum with +5.3%.

Laggards:

TRUMP: -5.91% despite a major unlock, indicating potential sell-off or fading meme interest.

ARB: Down slightly despite the unlock event – reflective of short-term pressure.

UKLINK, JTO, MOVR, NFT: Weak performance, showing selective weakness in lower-cap tokens.

BTC vs ETH:

The performance gap remains wide. Bitcoin is attracting capital, while ETH’s weak weekly bounce suggests continued capital outflows or investor hesitation.

Sector Trends:

Meme Coins: Mixed performance – PEPE up +5.99%, TRUMP down. Sentiment remains highly speculative.

DeFi: Mixed, with names like AAVE (+3.10%) and UNI (+2.25%) performing decently.

AI & Infra: Strongest performing cluster – led by FET (+23.97%), RENDER (+10.96%), and others.

Stablecoin Pegged Tokens: Generally stable or slightly up, indicating maintained liquidity presence.

🧭 Market Sentiment & Interpretation:

This heatmap reflects a short-term rotation into risk, but leadership is still concentrated in BTC and selective altcoins tied to strong narratives (AI, infrastructure, modular chains).

🔸 Ethereum continues to struggle on a relative basis.

🔸 Traders are rotating capital into performing clusters rather than broadly across all altcoins.

🔸 This environment favors selective exposure over broad diversification.

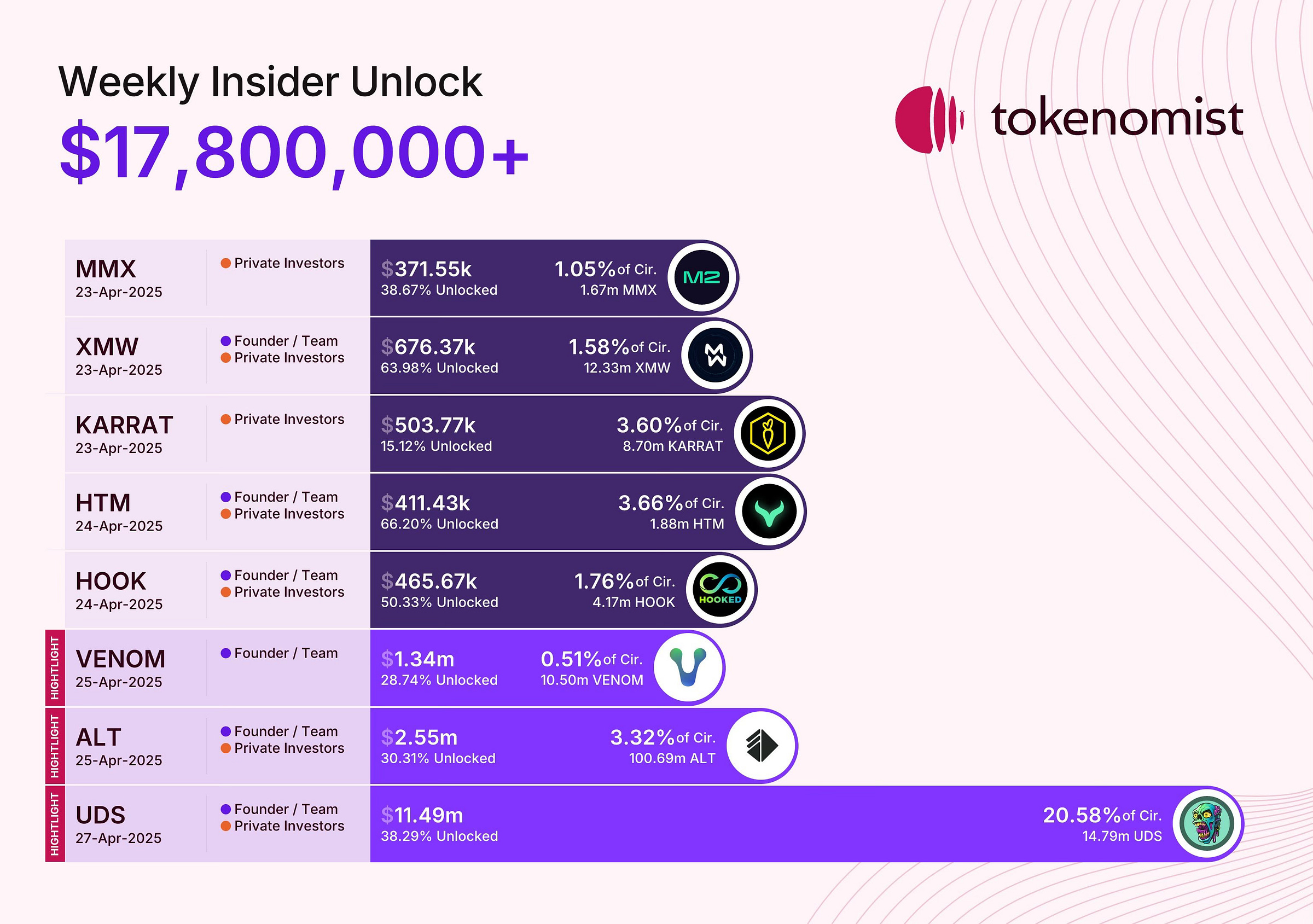

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Weekly Insider Unlocks – Over $17.8M to Hit the Market

Overview:

This week’s token unlocks a total of more than $17.8 million, with a significant portion of the circulating supply becoming liquid across multiple projects. This could introduce sell-side pressure, particularly for lower-liquidity assets.

Key Unlock Highlights:

UDS - $11.49M unlocked (20.58% of circulating supply)

High risk: Major dilution potential with a low total supply base. Likely to impact price action.

ALT - $2.55M unlocked (3.32%)

Noteworthy size relative to market cap. Could face temporary volatility.

VENOM - $1.34M unlocked (0.51%)

Less impactful proportionally, but worth tracking if liquidity remains low.

XMW - $676.37K unlocked (1.58%)

Over 63% of the total supply has already been unlocked. Selling risk is slightly reduced.

HOOK - $465.67K unlocked (1.76%)

Mid-range unlock with moderate impact, depending on market sentiment.

Summary:

Risk Zone: UDS and ALT due to high unlock percentages or total value.

Watchlist: VENOM and HOOK, less significant individually but still relevant for low-volume environments.

General Strategy: Monitor these tokens for post-unlock price dips, which may present accumulation opportunities or near-term exit signals.

🔐 Premium Insights.

Available only to paid subscribers:

✔️ Deep dive into on-chain metrics

✔️ Institutional flows & ETF analysis

✔️ Market structure breakdowns beyond the headlines

Upgrade now to get the full picture – and enjoy a 5% discount on your annual plan.

Already subscribed? Scroll down to continue reading.

5. 🔐 Behind the Scenes: What Bitcoin Smart Holders Are Doing Right Now.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.