#126 On-chain Insights by IT Tech - Week 18 Bitcoin Analysis & Highlights

When Everything Screams Bull: Is Bitcoin Ready for the Next Leg Up?

Hello,

The 126th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,700 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

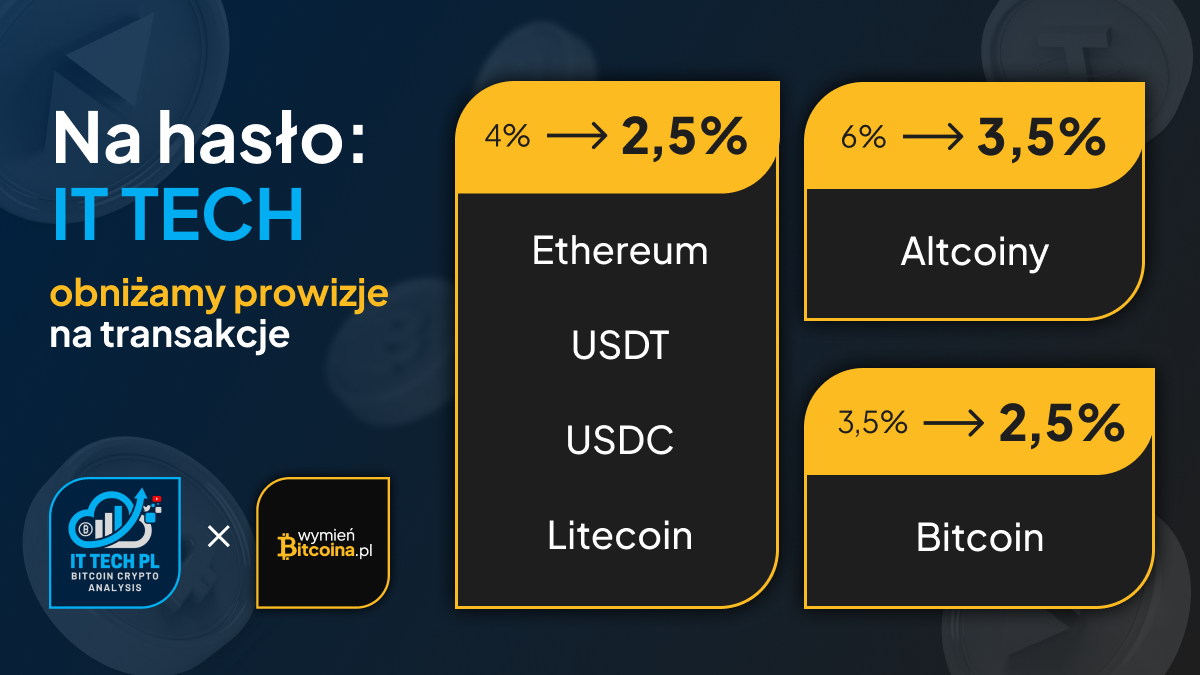

Partnership with WymienBitcoina.pl

Top 10 Crypto & Stock News (April 26 – May 4, 2025)

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

🔐 Premium Insights (exclusive for paid subscribers):

Buy-Side Pressure Builds Up: Are Bulls Regaining Control?

When Signals Align: On-Chain Metrics Turn Green Again

Bitcoin ETF Netflows: Capital Inflows Signal Strengthening Demand

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, including on-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Crypto & Stock News (April 26 – May 4, 2025.

Bitcoin Nears $100K

BTC touched $97K, its highest in 70 days, boosted by ETF inflows and Saylor’s advocacy. Analysts target $100K in May.Wall Street Rally on Jobs Beat

S&P 500 erased April losses after a strong jobs report. Unemployment held at 4.2% with 133K new jobs added.Crypto Stocks Shine in Turbulence

Coinbase, MicroStrategy, and CleanSpark outperformed traditional equities, shrugging off April’s macro volatility.Bitcoin as Digital Gold?

BTC rose 30% from April lows, decoupling from equities amid trade war fears, reviving its safe-haven narrative.Tariff Tensions Cool Down

China signaled openness to talks, boosting risk appetite and pushing equities, BTC, and bond yields higher.Stablecoin Regulation Progresses

A U.S. Senate panel advanced a stablecoin bill, reflecting growing interest in crypto financial integration.Crypto Market Cap Reclaims $3.1T

Driven by BTC and ETH, the market cap hit a new multi-week high despite weaker alt performance.Flight from U.S. Equities

Investors moved capital to bonds and international stocks, while crypto stayed strong during the shift.BTC Price Forecasts Rise Sharply

Top institutions project $167K–$225K BTC in 2025, citing strong post-halving cycles and institutional adoption.Mixed Macro: PMI Drops, Claims Rise

U.S. manufacturing PMI fell to 48.7%, jobless claims hit 241K, shaking markets ahead of Friday’s rebound.

3. Current market situation.

Weekly Market Snapshot & Top News (April 26 – May 4, 2025):

BTC climbs to $97K, pushing toward $100K, fueled by ETF inflows and institutional buying.

Crypto stocks like Coinbase and MicroStrategy outperform equities amid macro turbulence.

Stablecoin regulation advances in the U.S. Senate, signaling mainstream adoption.

Altcoins under pressure despite broader market rally: notably weak performance across L2s and DeFi.

Tariff easing & strong U.S. jobs data boost equities and market sentiment.

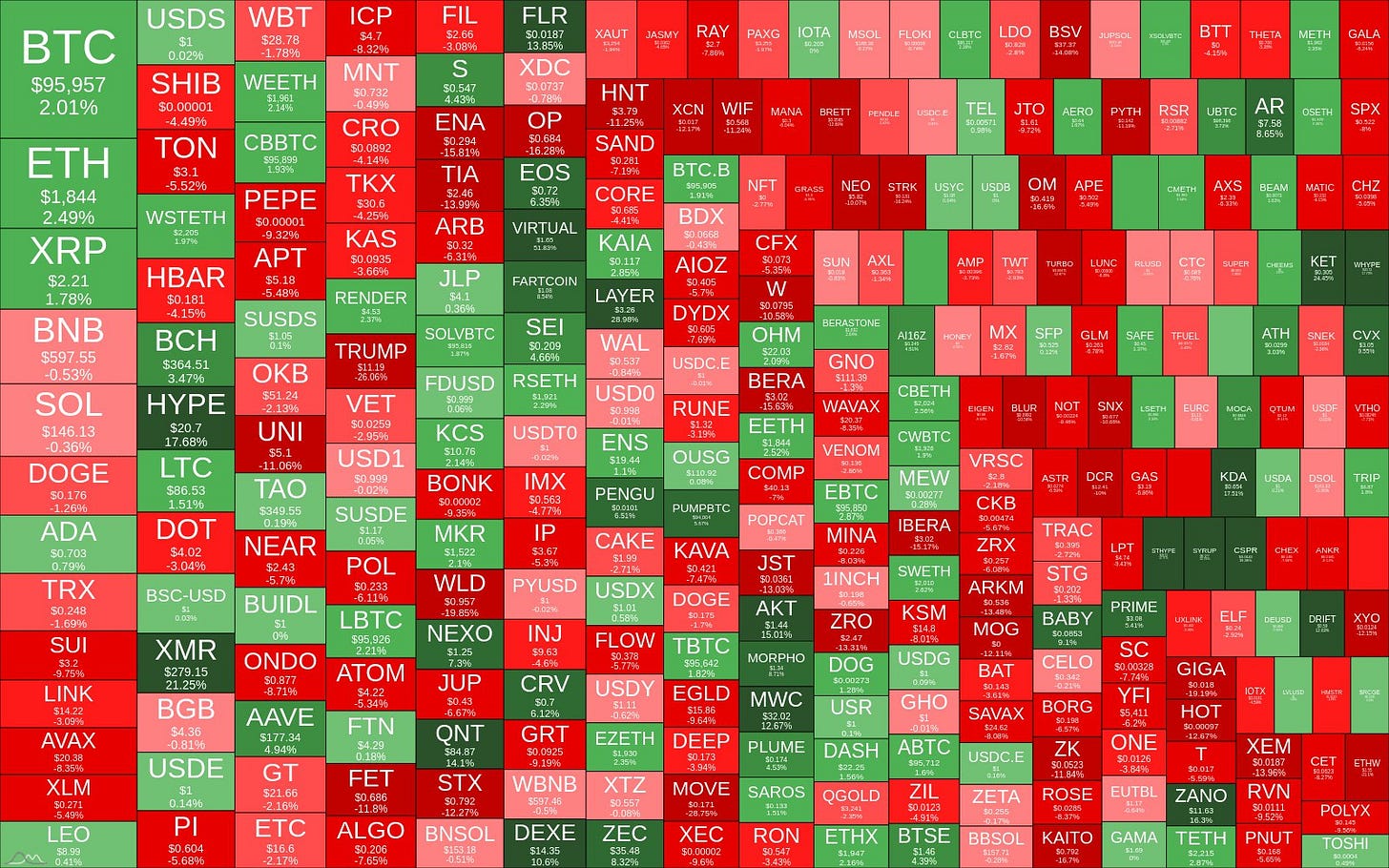

Crypto Heatmap Insights (1-Week Performance)

Bitcoin (BTC): +2.01%, approaching $96K. Still leading but pace slowing.

Ethereum (ETH): +2.49%, outperforming BTC slightly.

HYPE: standout altcoin, +17.68%

Strong gainers: FLR, LTC, TAO, FIL, XMR

Biggest losers: OP (-16.28%), ARB (-11.96%), GALA (-11.39%), XCN, BONK, and IMX.

Sector Trends:

Layer-1s (SOL, NEAR): mixed performance

DeFi (DYDX, AAVE, UNI): weak, mostly red

Memecoins: DOGE struggles this week (-1.26%), BONK -8.4%

Stablecoins: Mostly flat; USDT dominance still above 61%

Sentiment:

Despite BTC’s rally, broad altcoin weakness shows capital concentration in majors. Expect volatility if BTC slows below $100K.

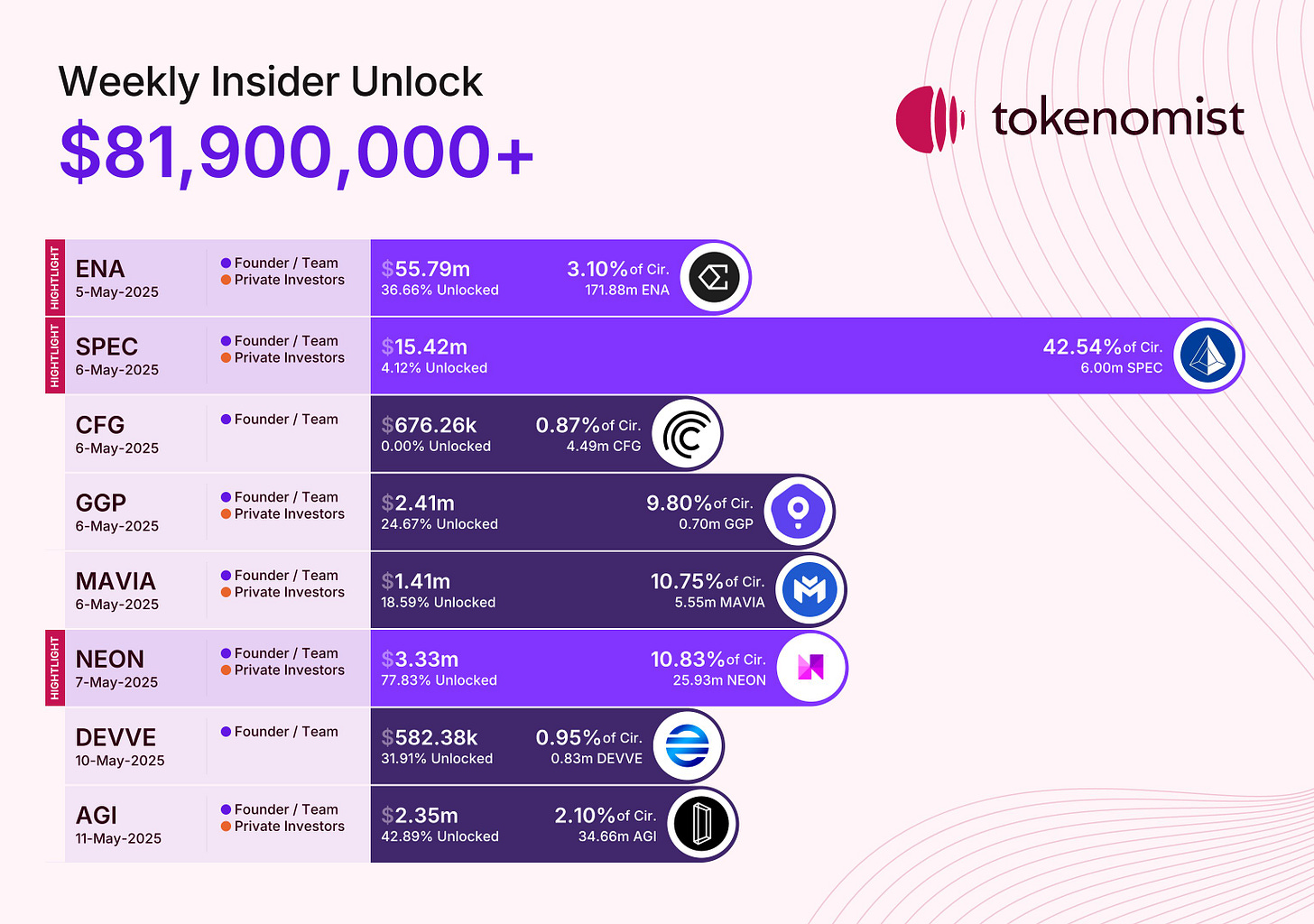

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Weekly Insider Token Unlocks (May 5–11, 2025). Total Value: $81.9M+

This week brings a lighter wave of unlocks compared to last week, but several tokens carry elevated dilution risks. Here are the key highlights:

Top Unlocks by Dollar Value:

ENA: $55.79M (3.10% of circulating supply) – largest unlock this week, moderate in % terms but still significant in size.

SPEC: $15.42M (42.54%) – massive dilution risk due to a high % of supply being unlocked.

NEON: $3.33M (10.83%) – notable due to the already high unlocked portion (77.83%).

Unlocks with High Dilution Potential:

SPEC: With 42.54% of circulating supply unlocking, this is the most critical one to watch.

MAVIA & GGP: Both have unlocks >9%, introducing possible short-term sell pressure.

Other Observations:

Most of the unlocks are for Founders/Teams & Private Investors, suggesting early investment liquidity may hit markets.

CFG and DEVVE have small unlocks by value but represent first or early stages of supply expansion.

Risk Radar:

High Risk: SPEC, NEON, MAVIA

Moderate: ENA, GGP, AGI

Low: CFG, DEVVE

🔐 Premium Insights.

Available only to paid subscribers:

✔️ Deep dive into on-chain metrics

✔️ Institutional flows & ETF analysis

✔️ Market structure breakdowns beyond the headlines

Upgrade now to get the full picture – and enjoy a 5% discount on your annual plan.

Already subscribed? Scroll down to continue reading.

5. 🔐 Buy-Side Pressure Builds Up: Are Bulls Regaining Control?

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.