#127 On-chain Insights by IT Tech - Week 19 Bitcoin Analysis & Highlights

Retail Returns, Altcoins Awaken, and Bitcoin Marches Toward ATH.

Hello,

The 127th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,700 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

Partnership with WymienBitcoina.pl

Top 10 Crypto & Stock News (May 5 - 11, 2025)

Current market situation

Weekly Insider Token Unlocks: Potential Sell Pressure

🔐 Premium Insights (exclusive for paid subscribers):

Altcoin Season Watch: Rotation Still in Early Phase

Bitcoin: Supply Excluding Strategy Drops Sharply Post-ETF Era

Retail Buyers Are Back – A Bullish Confirmation Signal?

Bitcoin ETF Netflows: Capital Inflows Signal Strengthening Demand

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

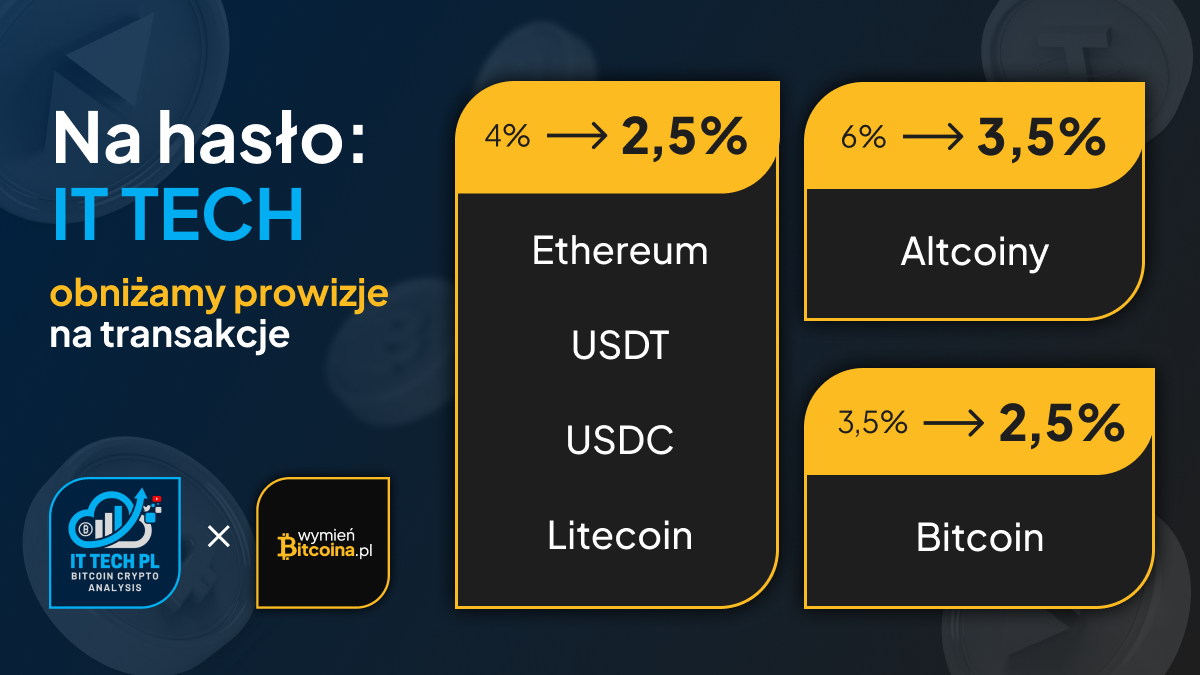

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I waived my commission to lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, including on-chain alerts, bots, reports, and more.

Due to X/Twitter blocking tweet embedding on Substack, I now include tweet screenshots alongside their links in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Top 10 Crypto & Stock News (May 5 - 11, 2025)

Crypto News

Bitcoin Surges Above $100,000: Bitcoin reclaimed the $100,000 mark for the first time since February, driven by a U.S.-U.K. trade deal and optimism over de-escalating U.S.-China tariff tensions. Prices hit $103,000 by May 10, with analysts eyeing a potential retest of the $109,000 high.

BlackRock’s Bitcoin ETF Sets Records: BlackRock’s spot Bitcoin ETF (IBIT) recorded its 19th consecutive day of inflows, pulling in $356M on May 9 alone and over $1B since mid-April, signaling strong institutional demand.

Coinbase Acquires Deribit for $2.9B: Coinbase acquired crypto options platform Deribit for $2.9B, aiming to dominate the derivatives market. However, its stock remained flat due to disappointing Q1 earnings impacted by tariffs.

Altcoin Season Signals Emerge: Bitcoin’s dominance dropped to 63.89%, with Ethereum (up 13%), Solana, and Cardano rallying. Analysts predict an altcoin season, with CoinMarketCap’s Altcoin Index rising from 23 to 36.

New Hampshire Legalizes Bitcoin Investments: New Hampshire became the first U.S. state to allow up to 5% of public funds to be invested in Bitcoin, sparking speculation about broader state-level adoption.

Ethereum’s Strong Week: Ether surged 11% on May 8–9, marking its best week since 2021, with a two-day gain of 29%. Despite a 30% YTD loss, altcoin momentum is building.

Stock Market News

Stock Indexes Rally on Trade Optimism: The S&P 500 (+0.6%), Nasdaq (+1.1%), and Dow rose on May 8 after President Trump announced a U.S.-U.K. trade deal, easing tariff concerns. Futures pointed higher on May 10.

Constellation Energy Soars: Constellation Energy’s stock jumped after beating Q1 revenue forecasts ($6.79B vs. $5.44B expected), driven by AI-related electricity demand, despite weaker profits.

Expedia Stock Falls: Expedia shares dropped after the company warned of weak U.S. travel demand, reflecting broader consumer discretionary sector challenges.

Palantir Plunges Post-Earnings: Palantir’s stock fell sharply on May 6 after earnings disappointed investors, contributing to a broader market dip as tariff and Fed decision uncertainties loomed.

3. Current market situation.

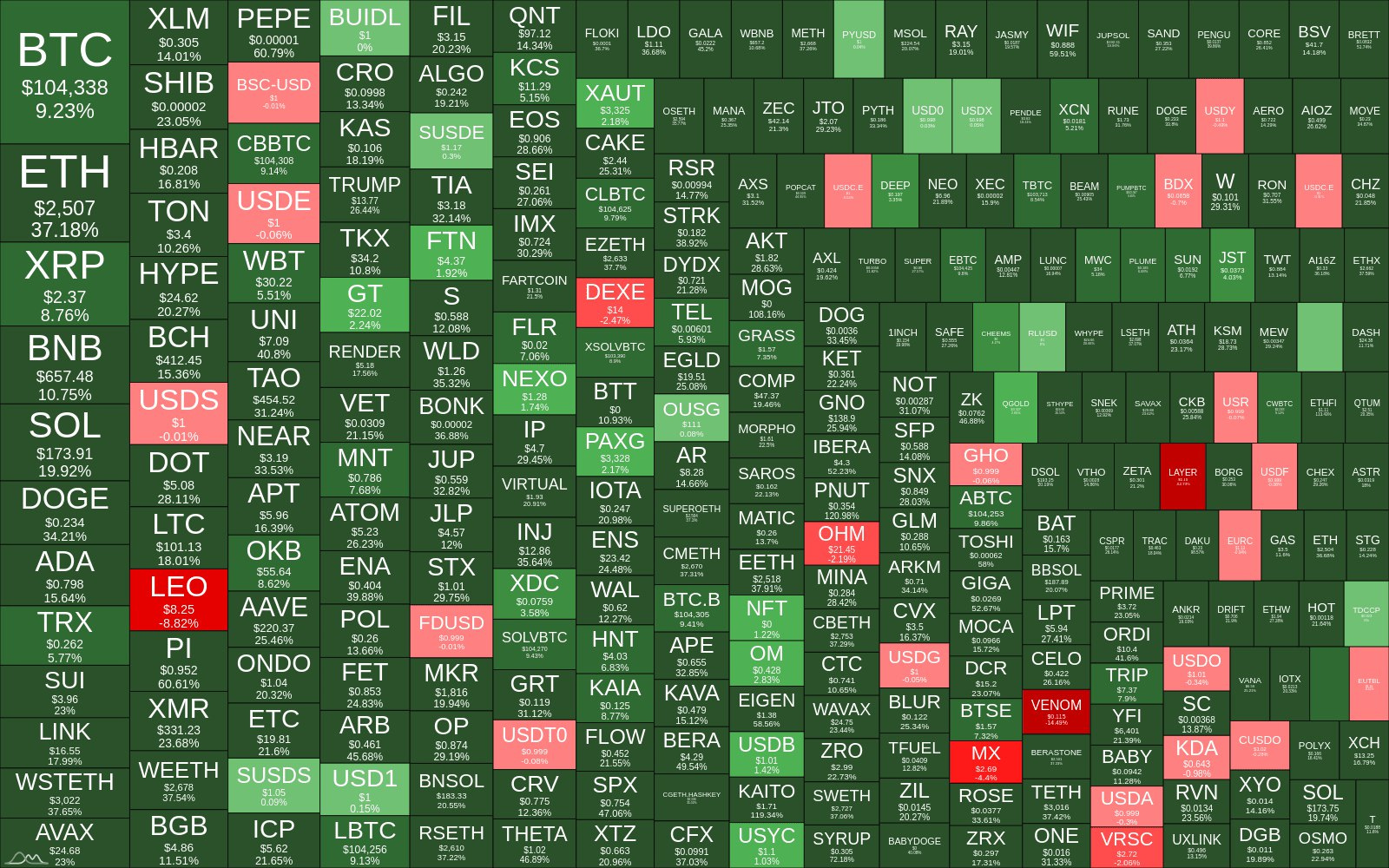

This week brought another strong wave of green across the crypto market.

Bitcoin gained +9.23%, trading around ~$104,300

Ethereum exploded +37.18% – the top performer among major assets

Solana +10.92%, BNB +12.50%, DOGE +24.16%, ADA +18.01% – strong altcoin rebound

Projects like HYPE, TON, SHIB, XMR, DOT, AVAX saw double-digit growth

🔻 Declines:

LEO (-8.82%), DEXE (-2.74%), ZETA (-7.27%), and a few stablecoins (BSC-USD, USDT.D, USDC.E) showed mild de-pegs but stayed within normal volatility

📌 Sector View:

Layer-1s: ETH, SOL, TON, and NEAR saw strong momentum

Memecoins & AI tokens: speculative flows are intensifying

Stablecoins: short-term volatility, but the liquidity trend remains upward

Conclusion:

Risk-on sentiment continues with rising altcoin participation.

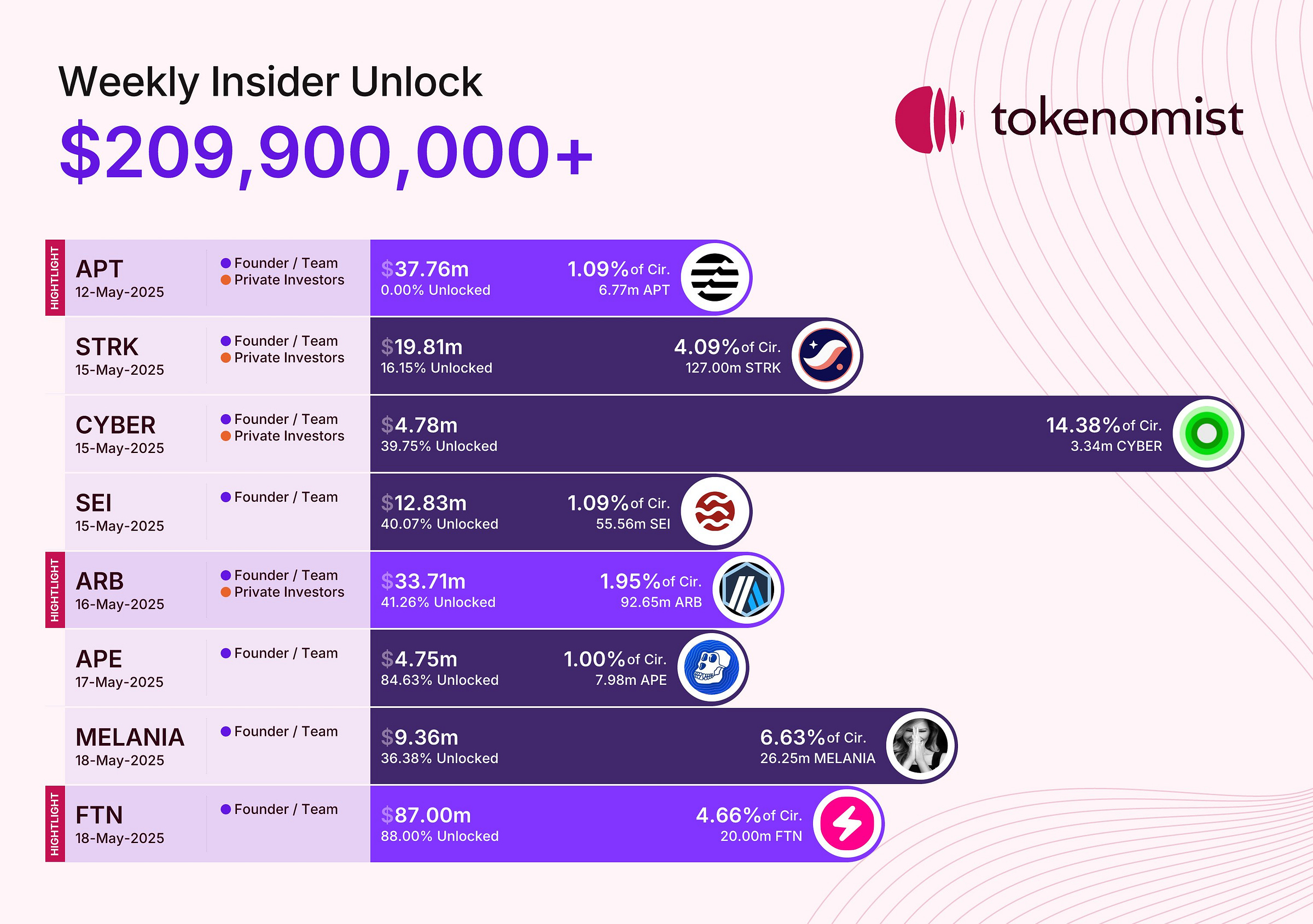

4. Weekly Insider Token Unlocks: Potential Sell Pressure.

Weekly Token Unlocks Overview – $209.9M Incoming

This week, over $209M worth of tokens will be unlocked across multiple projects, raising short-term sell pressure risks:

FTN: $87M (4.66% of supply) – High dilution risk

APT: $37.76M – Zero previously unlocked, all new supply

ARB: $33.71M – 1.95% of supply

STRK: $19.81M – 4.09% of supply

SEI, APE, CYBER: Moderate size, but high % unlocked

Watchlist: FTN, APT, STRK, ARB – most likely to impact price

Stay cautious - monitor price reactions closely post-unlock.

🔐 Premium Insights.

Available only to paid subscribers:

✔️ Deep dive into key on-chain trends

✔️ Altcoin season indicators explained

✔️ Bitcoin’s deflationary path – confirmed

✔️ ETF flows & institutional activity|

✔️ Market structure signals beyond price

Upgrade now to get the full picture – and enjoy a 5% discount on your annual plan.

Already subscribed? Scroll down to continue reading.

5. 🔐 Altcoin Season Watch: Rotation Still in Early Phase.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.