Market Analysis Report: Dissecting the Q4 2025 Crypto Flash Crash #147

Emergency market update. Free for all.

Hello,

The emergency market update is due to the crypto market crash. I appreciate your support - over 5,000 subscribers strong! Not subscribed yet? Now's the time to join! 👇

📲 Follow & Connect:

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels:

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics:

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

Partnership Spotlight – Bitomat.com.

This edition comes to you in collaboration with Bitomat.com, Europe’s premier crypto-ATM network. With over 300 locations across the continent, Bitomat enables you to convert digital assets into cash quickly, safely, and on your terms.

Why now?

MiCA regulations are set to tighten privacy rules across the EU. Lock in hassle-free, anonymous withdrawals while you still can.

Market Analysis Report: Dissecting the Q4 2025 Crypto Flash Crash

Introduction: A System-Wide Deleveraging Event

The recent, dramatic downturn in the cryptocurrency market was far more than a simple price correction. It represented a violent, system-wide deleveraging event, characterized by a cascading series of liquidations that reset market positioning on an unprecedented scale. While triggered by macroeconomic headlines, the crash’s true severity was dictated by structural vulnerabilities within the derivatives market. This report provides a definitive analysis of the event’s underlying causes, dissects the immediate market reaction, and concludes with a forward-looking perspective on the market’s trajectory from this newly established foundation.

1.0 The Anatomy of the Flash Crash: Catalysts and Core Mechanisms

To accurately assess risk and opportunity in the wake of a market shock, it is critical to distinguish between surface-level news catalysts and the deeper, structural mechanisms that amplify their effects. The former provides the narrative, while the latter dictates the magnitude of the impact. This event was a textbook example of how a seemingly moderate external trigger can ignite a firestorm within a highly-leveraged system.

1.1 The Official Narrative: Macroeconomic Triggers

The publicly cited catalysts for the market downturn centered on macroeconomic concerns. The primary news trigger was the announcement of a proposed U.S. tariff increase on Chinese imports, specifically targeting rare earth exports, which reignited fears of a global trade war.

This news arrived in a market already sensitive to policy shifts, with an upcoming Federal Open Market Committee (FOMC) meeting where policy easing was widely anticipated. The context was further complicated by a potential U.S. government shutdown and the prospect of substantial federal layoffs, adding another layer of uncertainty that primed the market for a negative reaction.

1.2 The Deeper Cause: A Cascading Liquidation of Leverage

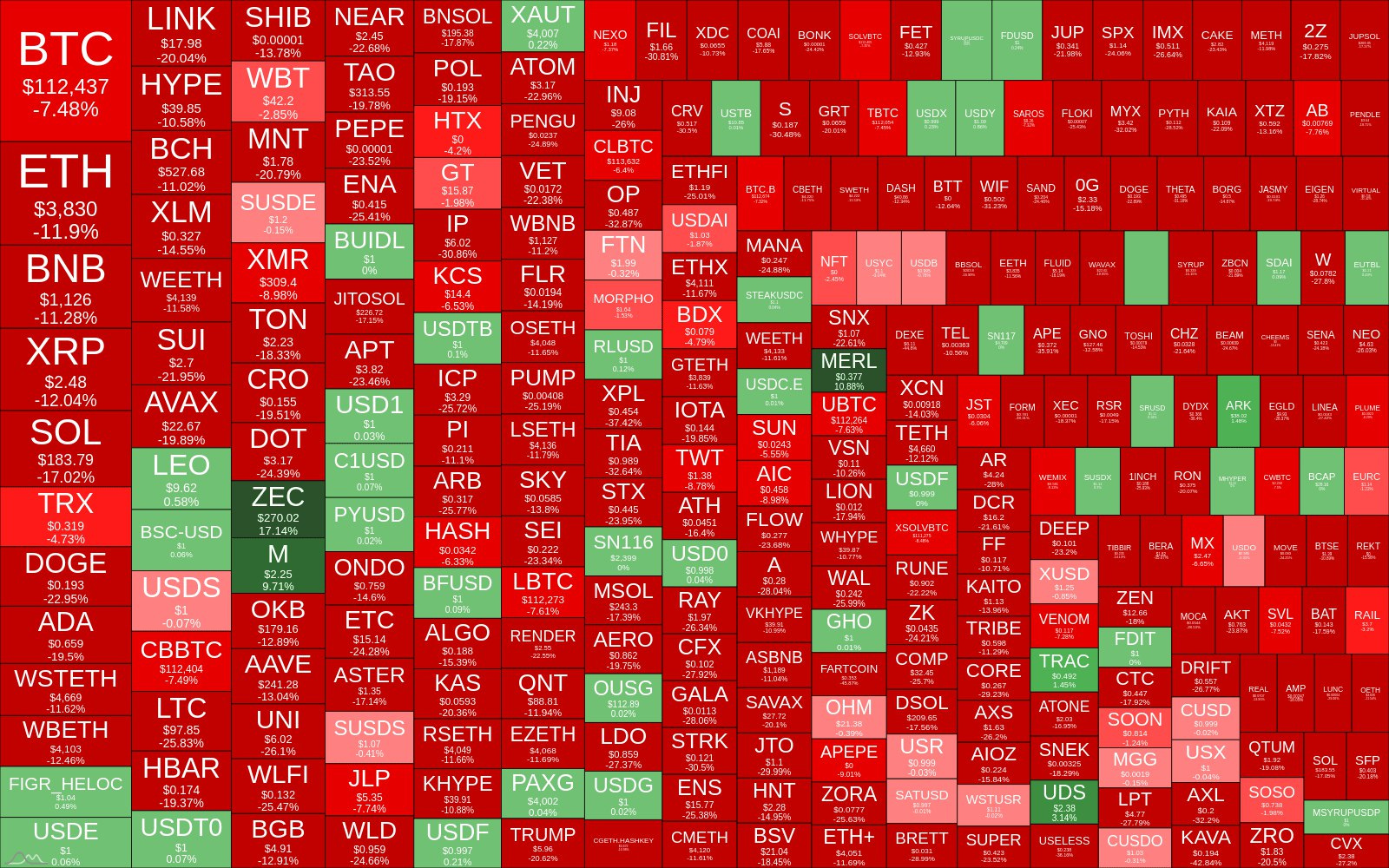

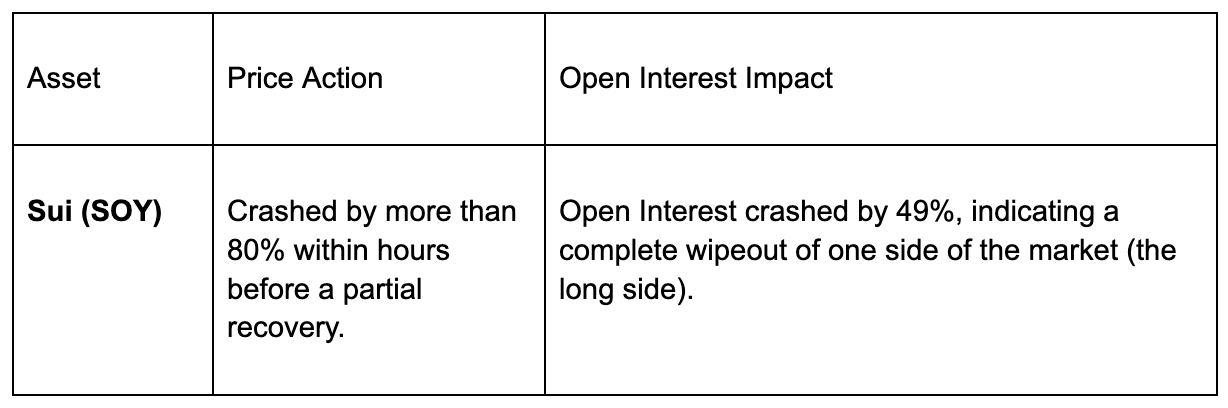

While macroeconomic news set the stage, the event’s ferocity was fundamentally driven by a full reset of leverage concentrated in the perpetual futures market, not by a retail-driven panic sell-off. The extreme price action in certain assets with high speculative interest demonstrates that this was a technical, not a fundamental, crisis.

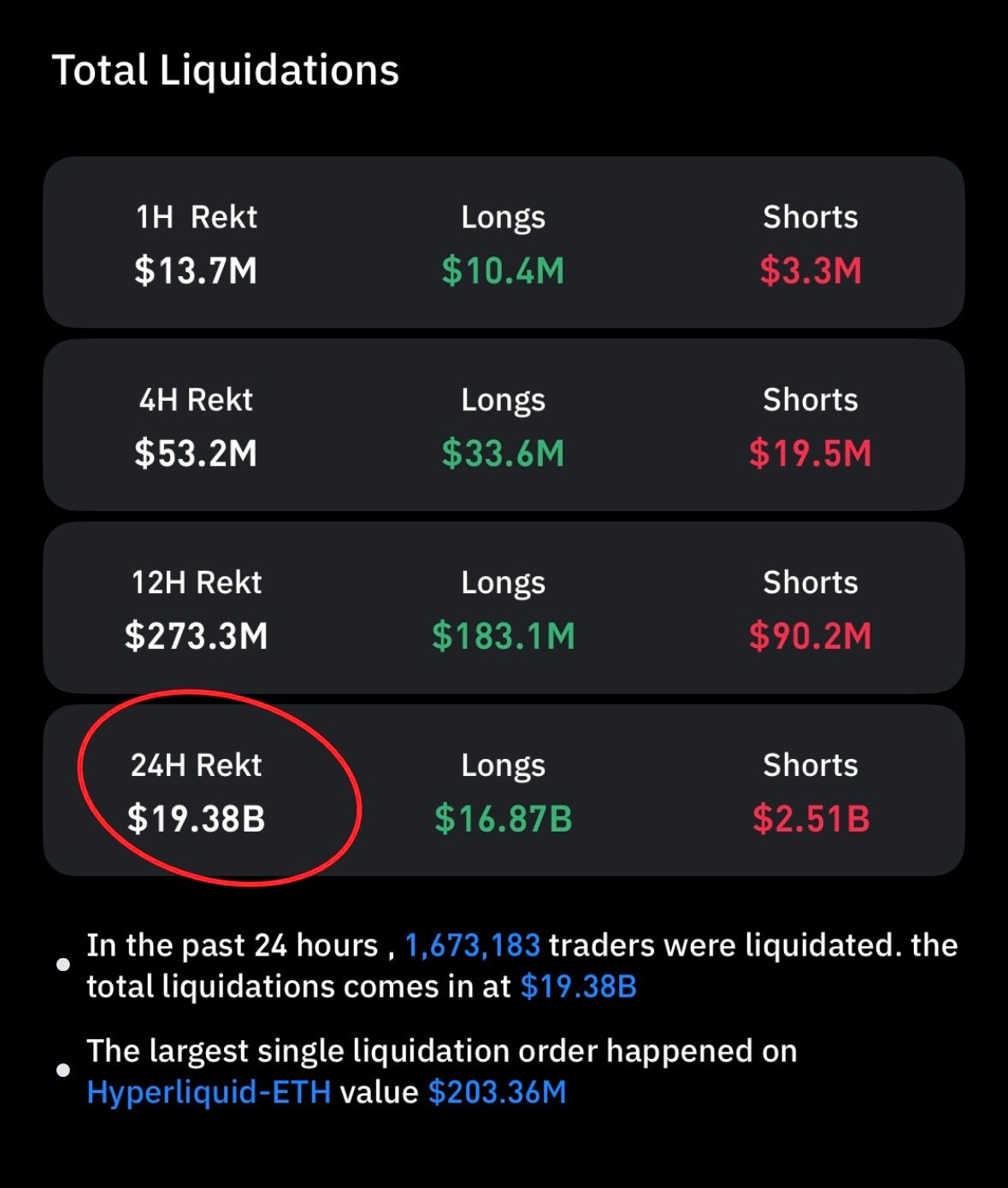

The magnitude of these drops, especially in altcoins like Sui which saw nearly half its open interest evaporate in hours, cannot be explained by the tariff news alone. This data provides unequivocal evidence of a leverage-driven cascade where forced selling triggered more forced selling in a self-reinforcing downward spiral.

1.3 The Role of Auto-Deleveraging (ADL) in the Domino Effect

A key accelerator of the crash was the Auto-Deleveraging (ADL) mechanism, an emergency system on perpetuals exchanges. ADL activates when an exchange’s insurance fund is insufficient to cover losses from liquidated positions that close beyond their bankruptcy price.

Instead of socializing losses, the system automatically closes profitable positions on the opposite side of the trade to ensure solvency. The ADL queue prioritizes closing the positions of traders with the highest profit and highest leverage. This meant that highly profitable market makers holding large short positions were at the top of the queue.

This mechanism created a cascade of negative consequences for these sophisticated participants:

Unfavorable Execution: Their profitable short positions were forcibly closed at unfavorable market prices during peak volatility, often at the very bottom of the crash.

Destruction of Hedges: Many market makers run balanced, hedged strategies (e.g., short perpetuals and long spot). When ADL closed their shorts, it instantly destroyed their hedge, leaving them with massive, unhedged long exposure that began generating enormous losses as prices fell.

Inability to Re-Hedge: The market chaos was compounded by exchange functionality issues and temporary account blocks for those affected by ADL, preventing them from opening new hedges to correct their exposure in a timely manner.

The result was a domino effect where even the most well-positioned and theoretically profitable entities incurred substantial real-world losses due to the system’s mechanics.

1.4 The Beneficiaries of Volatility

The primary beneficiaries of the cascading liquidations were the exchanges and their associated market-making vaults. As positions were forcibly liquidated, these entities were able to acquire assets at extreme discounts. This systemic trap, where the exchange’s solvency mechanism actively dismantled the risk management of its largest participants, directly funneled capital to the house.

A stark example of this is the vault of the Hyperliquid exchange, which earned over $40 million USD in just one hour by absorbing liquidated positions. Extrapolating from this, it is highly probable that exchanges with significantly higher volumes, such as Binance, realized proportionally larger profits, potentially reaching into the hundreds of millions.

This section has detailed the mechanical underpinnings of the crash. We now turn to its immediate effects on key market metrics and investor sentiment.

2.0 Immediate Aftermath and Market Reaction

A market’s immediate reaction to a major shock event is highly revealing of its underlying health, participant composition, and prevailing sentiment. By evaluating key quantitative metrics, sentiment indicators, and capital flows, we can construct a comprehensive picture of the post-crash landscape.

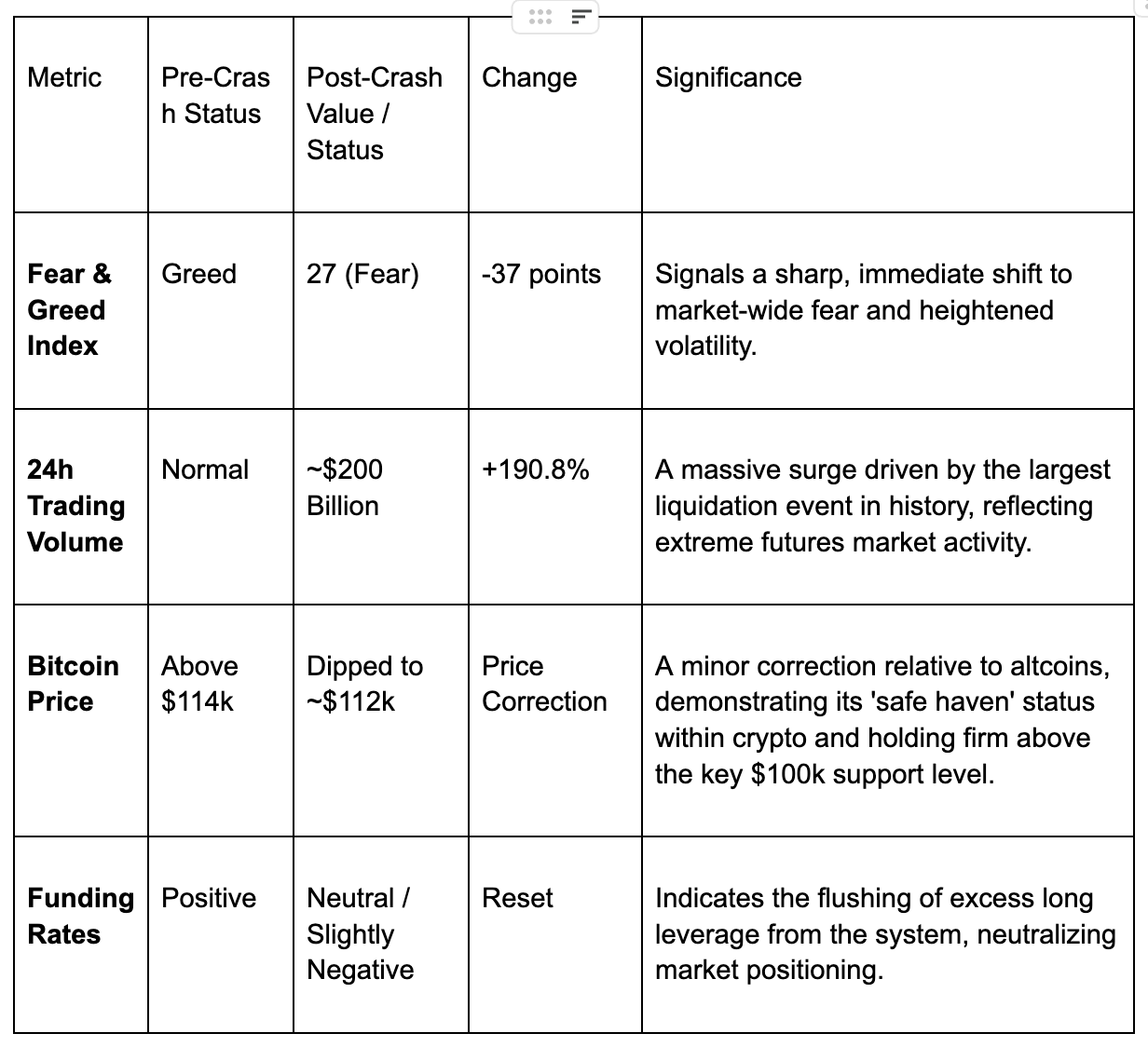

2.1 Quantitative Impact on Key Market Indicators

The crash triggered an immediate and dramatic shift across several key market indicators, reflecting a violent purge of speculative excess and a rapid transition to a state of fear.

2.2 A “Risk-Off” Event: The Flight to Quality

The event was a classic “risk-off” moment, defined by a flight of capital from higher-risk assets to relative safety. This was clearly demonstrated by the divergent performance between Bitcoin and the broader altcoin market. While altcoins experienced catastrophic drops, Bitcoin’s decline was comparatively modest, and its price remained firmly above the critical psychological and technical level of $100,000.

This dynamic suggests that institutional capital “still holds on to the main assets” and that the core thesis for holding major cryptocurrencies remains intact. The crash was a “technical reset, not an escape from the market.” Crucially, this deleveraging was confined to the derivatives markets; on-chain metrics and the fundamental theses for key assets, as evidenced by institutional dip-buying, remained undisturbed.

2.3 Institutional Response vs. Retail Sentiment

The behavior of institutional participants stood in stark contrast to the initial panic, revealing a clear divergence in strategy and conviction.

Institutional Buying: There was clear evidence of institutional accumulation during the dip. Over the past week (ending around October 8-10, 2025), total spot Bitcoin ETF inflows across all issuers (including BlackRock, Fidelity, etc.) have exceeded $5B in a 7-day streak, fueling market recovery and bullish momentum. BlackRock specifically captured a significant portion, with about $3.5B in weekly inflows as of early October, outperforming many traditional ETFs. This large-scale buying indicates that sophisticated investors viewed the downturn as a strategic entry point, not a reason to exit.

Social Sentiment: The reaction on social media platforms like X was characterized by high volume and sharp spikes in mentions of the crash. However, despite the price collapse, underlying sentiment remained resilient. Bullish sentiment held dominant at approximately 70% positive, with the prevailing narrative quickly shifting to “dip-buying” and long-term optimism, treating the event as a healthy, necessary correction.

The immediate market reaction shows a system purged of leverage but supported by institutional demand and resilient retail conviction. We will now explore the potential paths forward from this newly reset baseline.

3.0 Forward-Looking Analysis and Scenarios

Following a major market reset that purges speculative excess, several potential recovery paths emerge. The removal of leveraged positions creates a healthier foundation, but the direction of the next major move depends on capital flows, market structure, and broader macroeconomic conditions. This section outlines the primary bullish and consolidation scenarios based on historical precedent and current market dynamics, identifying key indicators to monitor.

3.1 The Bullish Case: A Manipulated Reset Before the Next Advance

This perspective frames the crash as a healthy, albeit manipulated, deleveraging event that has cleared the way for the next leg of the bull market. The key arguments supporting this thesis are:

Historical Precedent: The structure of this event mirrors previous market-clearing crashes, such as the COVID and FTX collapses. Those moments, characterized by maximum fear and forced selling, were retrospectively identified as the best buying opportunities of the last decade.

Sentiment Reset: Crucially, the market environment before the crash was defined by frustration, impatience, and pessimism—not the widespread euphoria characteristic of a true market top. The crash served to purge this lingering negative sentiment, resetting the emotional landscape for a potential recovery.

Favorable Macro Climate: The event occurred against a backdrop of powerful bullish macro factors. These include the prospect of lower interest rates (”free money coming back”), a major productivity boom driven by AI, and a record amount of capital sitting sidelined in money markets, ready to be deployed.

3.2 The Consolidation Scenario: The Necessary Path to a Sustainable Rally

The path to the broader bullish case outlined above is not immediate. Historically, a period of Bitcoin-led consolidation is the necessary precondition for a sustainable, market-wide advance.

Rising Dominance: The “final rotation” of liquidity back into Bitcoin is already underway. This is evidenced by BTC Dominance rising from a recent low of 57% to a current level of 59%.

Historical Parallels: This pattern has clear historical precedent. In both October 2017 and October 2020, Bitcoin Dominance rose sharply to 64% before a broader, market-wide rally took hold. These periods of Bitcoin leadership were precursors to explosive growth across the asset class.

Market Structure Argument: This thesis is built on the core principle that “Bitcoin leads the bull market.” Rising dominance is not a bearish sign for altcoins long-term, but rather a sign of a healthy market structure. “Liquidity must flow to the king” to establish a stable foundation before it can sustainably spill over into higher-risk assets during a late-cycle “alt season.” This rotation is the healthy, historical precursor to a market-wide rally, not a competing outcome to the bullish case.

3.3 Key Indicators for Recovery

To gauge the market’s recovery and future direction, participants should closely monitor the following key metrics:

Bitcoin Dominance Trend: Continued strength in BTC.D and a potential rise towards the historical 64% resistance level would align with past bullish cycles and support the consolidation scenario.

Ethereum’s Price Action: Ethereum’s ability to reclaim and cleanly break its previous all-time high is a critical trigger. This event is widely seen as the catalyst that unlocks a broader flow of liquidity from major assets into the altcoin ecosystem.

Funding Rates: Sustained neutral or slightly negative funding rates in the perpetuals market would confirm that speculative froth has been removed, providing a healthier and more sustainable base for a recovery.

Spot ETF Inflows: Consistent, positive net inflows into spot Bitcoin ETFs would signal persistent institutional demand, validating the “healthy correction” thesis and providing a strong tailwind for price appreciation.

4.0 Conclusion

The Q4 2025 flash crash was fundamentally a technical event, not a referendum on the crypto market’s long-term viability. It was driven by an over-leveraged perpetual futures market and amplified by the mechanical function of Auto-Deleveraging, with macroeconomic news serving merely as the spark. The fallout has been a complete reset of market positioning, wiping out speculative excess. While the short-term outlook is now neutral, defined by an ongoing flight to quality and a period of Bitcoin-led consolidation, the evidence supports a highly constructive long-term view. Ultimately, this event was not a structural break in the bull market, but rather a violent, necessary cleansing of leverage that has established a firmer foundation for the next major advance.

That wraps up this issue. Have a great end to your weekend and an even better week ahead!

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue will arrive next Sunday - check your inbox and spam folder!

Disclaimer. This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of affiliate links that may benefit the author.

Best regards

IT Tech