On-chain Insights by IT Tech - Week 27 Bitcoin Analysis & Highlights #134

Institutional Calm, Retail Silence: Supply Squeeze Meets Whale Moves.

Hello,

The 134th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,900 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

🆓 Free content (for all free subscribers):

Follow & Connect

Top 10 Crypto & Macroeconomic News

Current market situation

New Telegram community for Active Traders

Weekly Insider Token Unlocks

🔐 Premium Insights (exclusive for paid subscribers):

Bitcoin Market Overview: Spot & Futures Market Signals

Ancient Whale Awakening: 14‑Year Dormant BTC Moves

Retail Disappears as Bitcoin Holds $108K

Bitcoin’s Silent Supply Squeeze

Bitcoin ETF Flow – Weekly Snapshot

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. 📲 Follow & Connect.

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

2. Top 10 Crypto & Macroeconomic News.

📌 Key Points

Ripple applies for a U.S. banking license – XRP sentiment spikes.

Bitcoin briefly touches $110K but consolidates near $108K.

Ethereum gains momentum through tokenization and institutional flows.

$100M+ in token unlocks raise short-term volatility concerns.

Singapore fines banks $21.5M in $2.2B laundering case – regulatory pressure intensifies.

Robinhood’s tokenized ETF strategy pushes stock over $100.

Nvidia approaches $4T market cap – AI dominance continues.

Trump’s new fiscal bill passes Senate – bullish for BTC.

U.S. adds 147K jobs – markets reprice Fed cut odds.

Crypto-linked equities like Visa, PayPal, and CME gain traction.

📰 Crypto Market Highlights

Ripple Applies for U.S. Banking License

Ripple has filed for a U.S. national banking license and a Fed master account, aiming to offer traditional banking services. XRP rose 3% amid renewed ETF speculation and regulatory optimism.

Bitcoin Hits $110K, Then Retraces

BTC briefly crossed $110K on ETF inflows and the Israel–Iran ceasefire news, but pulled back near $108K following macroeconomic uncertainty and NFP job data.

Ethereum Sees Institutional Momentum

Robinhood launched tokenized stocks and ETFs on Arbitrum, while BlackRock’s ETH accumulation continues. ETH remains well below ATH but benefits from increasing tokenization use cases.

Token Unlocks Exceed $100M This Week

Projects like Ethena ($25M) and others are releasing tokens, adding to near-term market pressure. Investors should expect elevated volatility during these events.

Singapore Fines Banks $21.5M in Laundering Case

Nine financial institutions, including UBS and Citigroup, were fined for links to the Fujian gang in a $2.2B case, underscoring persistent AML compliance issues in crypto.

📈 Stock Market Highlights

6. Robinhood Stock Surges Past $100. Robinhood’s expansion into tokenized financial assets boosted its share price to a new ATH, signaling strong interest in TradFi–DeFi integration.

Crypto-Centric Stocks in Focus

CME, Visa, PayPal, and Accenture gain attention from investors seeking exposure to crypto without directly holding tokens.

Nvidia Nears $4 Trillion Market Cap

Despite the U.S. holiday closure, Nvidia’s dominance in AI and chips positions it to potentially become the first $4T company.

🌍 Macroeconomic Headlines

9. Trump’s “Big Beautiful Bill” Passes Senate. The bill includes tax relief and spending packages seen as supportive of risk assets, though it lacks crypto-specific reforms. Markets expect fiscal expansion.

U.S. Adds 147K Jobs in June. A solid NFP report reduced the probability of a Fed rate cut in the near term, causing Bitcoin to retreat from the weekly high of $110.3K.

💬 Comment:

This week featured powerful narratives: ETH and BTC continue to attract institutional capital, regulation gains momentum in the U.S., and tokenization reshapes how assets are traded. Still, volatility is likely to remain elevated, especially around unlock events and Fed commentary.

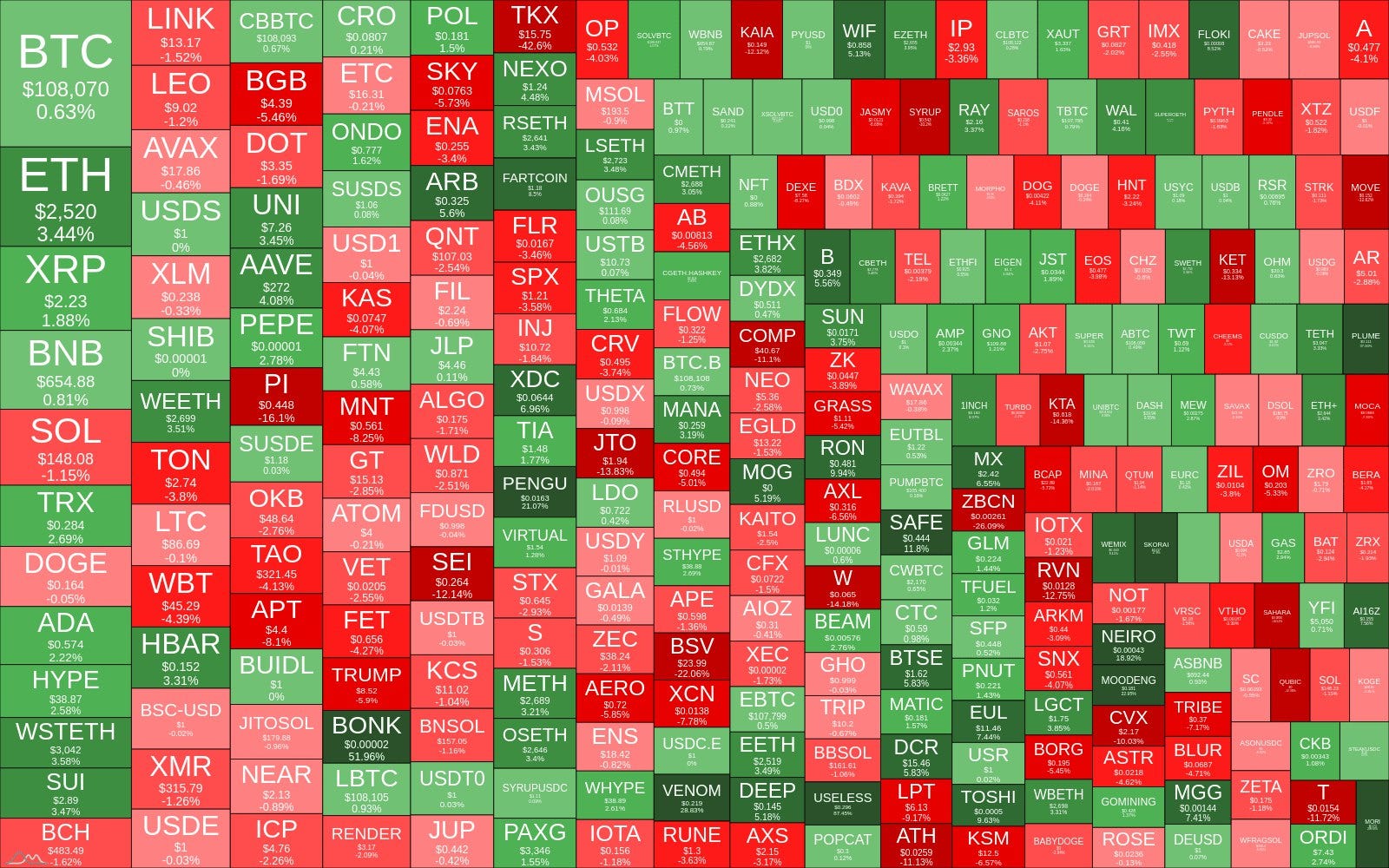

3. Current market situation.

This week’s market opened in a mixed state, with a slight tilt toward green.

BTC traded around $108,070 (+0.63%), remaining stable and technically strong.

ETH saw a healthy move to $2,520 (+3.44%), showing relative strength versus BTC.

XRP (+1.82%) and BNB (+0.81%) followed with moderate gains.

Meanwhile, SOL underperformed with a minor pullback to $148.08 (−1.15%).

The broader altcoin market is split:

🔺 Strong performers include: XDC (+9.66%), WIF (+5.36%), and PEPE (+4.08%)

🔻 Notable decliners: TKX (−42.6%), SEI (−12.14%), DOGE (−0.15%)

The heatmap indicates selective risk-taking, with capital rotating into large caps and meme tokens showing pockets of strength.

💬 Comment:

The market remains in neutral territory, with BTC dominance holding and altcoins fluctuating. Without a clear catalyst, we may see more range-bound action this week, with rotations driven by unlocks and ETF narratives.

4. New Telegram Community for Active Traders.

New! IT Tech Trading Setups group is now live.

Every weekday, I share 1–2 Bitcoin trading setups in this group, based on liquidation levels, market structure, and short-term momentum. No clickbait, just clean, transparent entries with SL and TP. Most setups aim for +10–20% moves.

You can now join the group in two ways:

🔹 BingX (with KYC):

Register: bingx.com/partner/ITTECHPL

Complete KYC, deposit ≥ 100 USDT, and place 1 trade > $100

DM the bot: @IT_Tech_Trading_Setup_Bot → instant invite ✅

🔹 BloFin (no KYC, UK and US can also trade):

Register: partner.blofin.com/d/ITTech

Deposit ≥ 100 USDT and place 1 trade ≥ $100

Fill the 60-sec form: Google Form – access within 24h

🎁 Why join now?

⚡️ First 100 BloFin users get a 20% cashback (up to $500) – valid from July 4 (10:00 UTC) to July 11 (20:00 UTC)

⚡️ Fresh BTC setups drop every weekday – miss the entry, miss the move

Pick your exchange, lock in the bonus, and trade with me. See you inside! 🔥

*Disclaimer: Educational content only; not financial advice.

5. Weekly Insider Token Unlocks (June 30 – July 6, 2025).

📊 Total Unlock Volume: $53.9M+

🔍 Key Highlights:

APT: $32.28M unlock (1.05% of supply) – Largest unlock this week. All tokens are previously locked. Watch for volatility spikes around resistance if sell pressure materializes.

IO: $7.51M unlock (5.97%) – High relative unlock. 21.71% of supply already unlocked. Medium-cap token with potential for sharp price reaction.

PEAQ: $4.52M unlock (5.96%) – Entirely new unlock. No tokens previously circulating. Thin liquidity may amplify price movements.

AGI: $3.38M unlock (4.05%) – 47.50% of supply already circulating. High dilution but possibly priced in. Monitor trading volume and momentum shifts.

OP: $2.58M unlock (0.26%) – Recurring L2 unlock with relatively low impact. 37.66% already unlocked.

🔻 Other Notables:

BB: $2.40M (6.67%) – Mid-tier token with below-average liquidity. Unlock may pressure the price short-term.

CXT: $0.85M (3.73%) – Lower nominal value but relatively large share of supply. Watch for liquidity-driven reactions.

DEVVE: $0.46M (0.95%) – Minimal unlock size. Low impact expected.

💬 Comment:

This week’s unlocks are concentrated in APT, IO, and PEAQ, which together account for over 80% of the total value. APT’s cliff unlock is particularly notable due to its size and zero prior circulation – an ideal candidate for volatility spikes. Lower-liquidity tokens like PEAQ and BB carry short-term downside risk unless supported by demand. Caution is advised midweek as most events cluster around July 11–12.

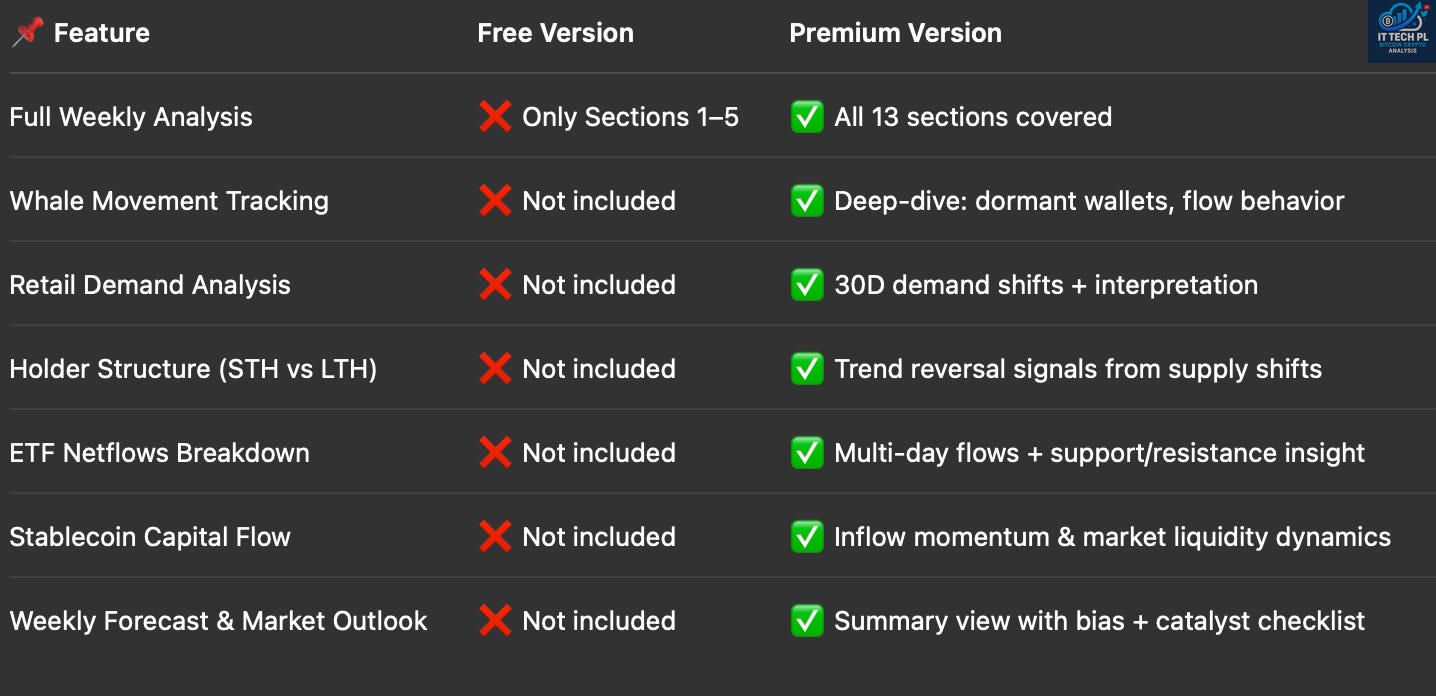

🔐 Premium Insights (exclusive for paid subscribers).

Wondering what whales are doing with 80,000 BTC? Why retail demand just plunged below –10% while price holds $108K? And how ETF inflows, LTH accumulation, and stablecoin injections tie together?

🔍 Here’s what Premium subscribers unlock:

🧠 Still using only the free version? You’re missing half the picture.

👉 Upgrade now to unlock all insights and get 5% off your annual plan.

Already subscribed? Scroll down to continue reading.

6. 🔐 Bitcoin Market Overview: Spot & Futures Market Signals.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.