On-chain Insights by IT Tech - Week 28 Bitcoin Analysis & Highlights #135

Institutional Dominance & Historical Signals: Bitcoin Approaches the Cycle’s Critical Window.

Hello,

The 135th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,900 subscribers strong! Not subscribed yet? Now's the time to join! 👇

🎧 New! This week’s issue is also available as a private audio podcast – exclusively for Premium subscribers.

Listen while commuting, training, or walking your dog – same deep insights, now hands-free.

Table of contents:

🆓 Free content (for all free subscribers):

Follow & Connect

Top 10 Crypto & Macroeconomic News

Current market situation

New Telegram community for Active Traders

Weekly Insider Token Unlocks

🔐 Premium Insights (exclusive for paid subscribers):

🎧 New this week: Premium subscribers now get access to a full audio podcast version of this issue.

Bitcoin Market Overview: Spot & Futures Market Signals

Shrinking Supply, Soaring Prices?

Bitcoin Halving Cycle Comparison (Day 450)

Bitcoin Mining: Made in America

Bitcoin ETF Flow – Weekly Snapshot

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. 📲 Follow & Connect.

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

2. Top 10 Macro & Crypto News

Below is a summary of the most relevant crypto, macro, and stock market stories from July 7–13, 2025, focusing on institutional activity, regulation, and volatility triggers.

🧠 Key Takeaways:

Bitcoin hits new ATH at $118.9K — over $1B in liquidations

XRP, XLM, and crypto stocks rally ahead of U.S. crypto legislation

Nvidia crosses $4T cap, but stocks pull back on Trump’s tariff threat

Bitcoin outperforms Nvidia and the S&P 500 YTD

📰 Weekly Highlights:

Bitcoin Surges to $118,900 ATH

July 11 marked a new all-time high for BTC, driven by institutional demand and speculation around the U.S. creating a strategic Bitcoin reserve. Ether followed, crossing $3,000. Over $1B in short liquidations occurred during the move.

XRP Follows with +9.7% Spike

XRP surged alongside BTC ahead of a key legislative week starting July 14 in Congress. The total crypto market cap reached $3.68T, signaling renewed investor confidence.

XLM Rallies on PayPal Partnership

Stellar was the top gainer in the top 20 cryptos after news broke that PayPal’s stablecoin would launch on Stellar, boosting sentiment and usage outlook.

Bitcoin ETF Inflows Hit $1.18B

On July 10, Bitcoin ETFs saw their largest daily inflow of 2025, reinforcing bullish positioning by institutions. COIN, MSTR, and HOOD all rallied.

Congress Set for Crypto Week

July 14 marks the start of long-awaited digital asset regulation hearings. The market is pricing in favorable outcomes, which could set the stage for sustained institutional flows.

Top Crypto Stocks to Watch: HOOD, BTCS, Galaxy

HOOD reached $85.81B market cap, with analysts highlighting it as a top blockchain-integrated stock alongside HIVE, Bitfarms, and Bitdeer.

Nvidia Hits $4 Trillion, But Markets Retrace

While Nvidia reached a historic milestone, the Dow dropped 250 points as Trump announced tariffs: 35% on Canada and more possibly coming.

Visa, BlackRock Among Crypto-Exposed Picks

Yahoo Finance spotlighted Visa, CME Group, and BlackRock as safe bets with crypto upside in 2025, citing ETF exposure and earnings growth.

Macro Risk: Trump’s Tariff Shock

The tariff escalation boosted the U.S. dollar but rattled equity markets. Bitcoin and Nvidia remained strong, suggesting capital rotation toward hard and tech assets.

Bitcoin Beats All Majors in 2025

YTD, Bitcoin has outpaced both the S&P 500 and Nvidia, supported by ETF flows, pro-crypto policy, and growing treasury adoption.

💬 Comment:

With Bitcoin now above $118K and Ethereum near $3K, institutional capital continues to dominate this cycle’s momentum. Legislative clarity in the coming days could be a make-or-break catalyst. Traditional equities remain volatile amid tariff fears — but crypto shows strength through rotation and capital inflow.

3. Current market situation.

📊 Market Heatmap Summary

The crypto market surged during the past week, with green dominating across major assets:

🔹 Bitcoin (BTC) is up +9.14%, trading at $117,895

🔹 Ethereum (ETH) shows even stronger momentum at +17.47%, reaching $2,953

🔹 Among large caps:

XRP: +23.45%

BNB: +5.33%

SOL: +9.46%

ADA: +8.96%

LINK: +16.55%

TON: +9.73%

DOT: +7.50%

🟩 The altcoin sector showed widespread gains, with standout performers like:

SPX: +24.23%

FTM: +20.57%

GALA: +21.97%

FTN: +20.27%

MNT, RENDER, FET all showing strength above +15%

🟥 Only a few red spots appeared, with minor drawdowns in:

TKX: –4.21%

PLUME: –4.10%

KET: –3.80%

Stablecoins showed slight negative deltas due to peg fluctuations (e.g., USDT, USDC derivatives).

💬 Comment:

The past week marked a strong rebound across the board. Bitcoin’s breakout above $117K and Ethereum’s acceleration above $2,900 triggered a broader altcoin rally. With most sectors flashing green, momentum remains bullish, though market euphoria levels suggest caution near resistance zones.

4. New Telegram Community for Active Traders.

New! IT Tech Trading Setups group is now live.

Every weekday, I share 1–2 Bitcoin trading setups in this group, based on liquidation levels, market structure, and short-term momentum. No clickbait, just clean, transparent entries with SL and TP. Most setups aim for +10–20% moves.

You can now join the group in two ways:

🔹 BingX (with KYC):

Register: bingx.com/partner/ITTECHPL

Complete KYC, deposit ≥ 100 USDT, and place 1 trade > $100

DM the bot: @IT_Tech_Trading_Setup_Bot → instant invite ✅

🔹 BloFin (no KYC, UK and US can also trade):

Register: partner.blofin.com/d/ITTech

Deposit ≥ 100 USDT and place 1 trade ≥ $100

Fill the 60-sec form: Google Form – access within 24h

🎁 Why join now?

⚡️ First 100 BloFin users get a 20% cashback (up to $500) – valid from July 4 (10:00 UTC) to July 11 (20:00 UTC)

⚡️ Fresh BTC setups drop every weekday – miss the entry, miss the move

Pick your exchange, lock in the bonus, and trade with me. See you inside! 🔥

*Disclaimer: Educational content only; not financial advice.

5. Weekly Insider Token Unlocks (14-20 July).

📊 Total Unlock Volume: $1.10B+

🔍 Key Highlights:

TRUMP: $903.6M unlock (45.00% of supply) – By far the week’s largest unlock. Watch for extreme volatility or potential price distortions.

FTN: $89.20M unlock (4.64%) – Major relative unlock size with already high 92% unlocked supply.

ARB: $37.96M unlock (1.87%) – Recurring unlock; may reinforce midweek volatility.

SEI & STRK: ~$18M each (1% and 3.53%) – Lower cap, but sizable as % of float.

UXLINK: $13.67M (9.17%) – High relative unlock vs. supply, low liquidity risk.

CLOUD: $11.04M (37.92%) – Mid-tier token, thin books; expect outsized impact.

ZK: $10.10M (2.41%) – Less visible project, but moderate dilution risk.

💬 Comment:

This week marks the largest unlock cycle of the quarter, headlined by TRUMP’s $903M event. While not every token will see sell pressure, price distortions are likely due to oversized allocations unlocking at once. Traders should monitor volume spikes and bid/ask spreads, especially between July 16–18.

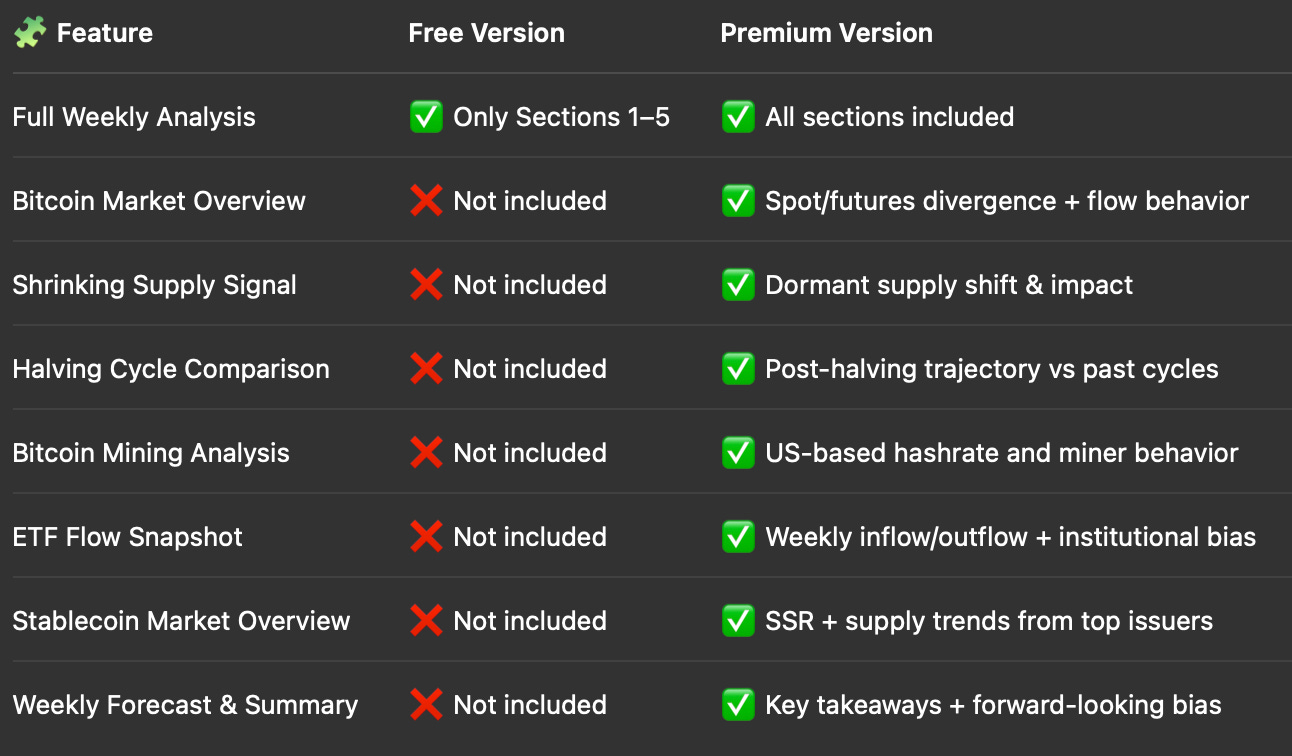

🔐 Premium Insights (exclusive for paid subscribers).

Wondering what’s inside the Premium section this week?

From ETF flows to Bitcoin miner dynamics and supply trends, the Premium version dives deep into what truly moves the market.

🔍 Here’s what Premium subscribers unlock:

🧠 Still using only the free version? You’re missing half the picture.

👉 Upgrade now to unlock all insights and get 5% off your annual plan.

Already subscribed? Scroll down to continue reading or listening audio version.

🎧 New this week: Premium subscribers now get access to a full audio podcast version of this issue. Listen on the go and stay ahead with deep on-chain insights.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.