On-chain Insights by IT Tech - Week 30 Bitcoin Analysis & Highlights #137

Mid-Cycle Profit Pulse.

Hello,

The 137th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 5,000 subscribers strong! Not subscribed yet? Now's the time to join! 👇

🎧 New! This week’s issue is also available as a private audio podcast – exclusively for Premium subscribers.

Listen while commuting, training, or walking your dog – same deep insights, now hands-free.

Table of contents:

🆓 Free content (for all free subscribers):

Follow & Connect

Partnership with Bitomat.com

Top 10 Crypto & Macroeconomic News

Current market situation

New Telegram community for Active Traders

Weekly Insider Token Unlocks

🔐 Premium Insights (exclusive for paid subscribers):

🎧 New this week: Premium subscribers now get access to a full audio podcast version of this issue.

Bitcoin Market Overview: Spot & Futures Market Signals

BTC & ETH Market Update

Bitcoin Profit Taken?

Bull-Market Peak Dashboard

Bitcoin ETF Flow – Weekly Snapshot

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. 📲 Follow & Connect.

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels:

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics:

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

2. Partnership Spotlight – Bitomat.com.

This edition comes to you in collaboration with Bitomat.com, Europe’s premier crypto-ATM network. With over 300 locations across the continent, Bitomat enables you to convert digital assets into cash quickly, safely, and on your terms.

Why now?

MiCA regulations are set to tighten privacy rules across the EU. Lock in hassle-free, anonymous withdrawals while you still can.

3. Top 10 Macro & Crypto News.

Below is a concise recap of the most relevant cryptocurrency, macro-economic, and stock-market stories from 21 – 27 July 2025, with an emphasis on institutional flows, regulation, and volatility triggers.

🧠 Key Takeaways:

Bitcoin defends the $120 K+ zone after its prior ATH, as spot-ETF demand slows but remains positive.

Ethereum ETFs add $383 M, pushing ETH firmly back above $3 K and extending a 27 % monthly gain.

XRP momentum builds on U.S. legal clarity and dual ETF launches (Nasdaq futures, Brazil spot).

Congress advances the Anti-CBDC Surveillance State Act, signalling a policy pivot toward private-sector tokens.

Solana tops $200 while alt-rotation trims Bitcoin dominance for a second week.

📰 Weekly Highlights:

Bitcoin Consolidates Near $123 K High – 21 Jul. BTC hovered in a tight $119–123 K band after its “Crypto Week” breakout. ETF inflows moderated but stayed green, while shorts avoided another wipe-out.

Ethereum ETFs Haul $383 M; ETH > $3 K – 22 Jul. BlackRock’s ETHA captured the bulk of flows, lifting ETH to a five-month high and reinforcing the $3 K level as new support.

XRP Pops on ETF Duo & SEC Retreat – 23 Jul. Nasdaq launched an XRP futures ETF, Brazil approved a spot product, and the SEC withdrew its cross-appeal—sending XRP briefly to $3.47.

Solana Breaks $200, Then Dips – 24 Jul. SOL touched $203 before a quick pullback; traders highlight developer activity and TPS upgrades as core catalysts.

Dogecoin ETF Odds Rise to 80 % – 24 Jul. Prediction markets priced an 80 % chance of approval by year-end after President Trump signed another pro-crypto bill.

Sony Buys 2.5 % of Bandai Namco for $463 M – 24 Jul. The stake deepens cooperation in anime, manga, and gaming IP, fuelling consolidation chatter in Japanese media stocks.

JPMorgan Explores Crypto-Backed Lending – 22 Jul. The bank confirmed it is piloting loans collateralised by BTC/ETH, marking another TradFi bridge into digital assets.

Crypto-Exposed Equities Edge Higher – 25 Jul. Coinbase +1.8 %, MicroStrategy +3.5 %, Marathon +0.1 % as BTC stabilized—equity beta to Bitcoin remains selective.

Anti-CBDC Surveillance State Act Passes House – 25 Jul. Alongside the GENIUS Act, the bill curbs any retail Fed-coin, reinforcing a private-token trajectory for U.S. payments.

$1B in Nvidia AI Chips Reportedly Smuggled into China – 26 Jul. Social-media reports of H100/B200 shipments via Southeast Asia highlight export-control loopholes and tech-war frictions.

💬 Comment:

Bitcoin’s pause above $120 K has allowed capital to rotate into Ethereum and large-cap alts, with ETH ETFs siphoning nearly half a billion dollars in a single day. Washington’s legislative push—GENIUS Act plus Anti-CBDC bill—continues to turn policy from headwind to tailwind, while TradFi bridges (JPMorgan lending) widen institutional on-ramps. Near-term volatility may spike around Senate debates and the looming Dogecoin ETF decision, but structural flows and rising stable-coin supply suggest dip-buying remains the path of least resistance.

4. Current market situation.

📊 Market Heat-map Summary (22 – 28 Jul)

Large-caps: ETH +3.1 %, SOL +5.6 % kept the bid alive, while XRP -6.6 % and BNB -7.3 % retraced prior gains; BTC sat almost flat at +0.2 %.

Layer-1 rotation: AVAX, NEAR, ADA each added +3–5 %; DOT and ICP slipped -6–9 %.

DeFi pocket: AAVE +7 % led; UNI unchanged; CRV and SUSHI fell -5–8 %.

Notable losers: privacy-coin XMR down ~-5 %, and memes FLOKI, MOG off -8–9 %.

💬 Comment:

With Bitcoin ranging above $118 K, traders paused the broad alt surge. Mixed red-green tiles signal profit-taking, a modest uptick in BTC dominance, and room for fresh rotation once ETF flows or macro headlines reignite risk appetite.

5. New Telegram Community for Active Traders.

New! IT Tech Trading Setups group is now live.

Every weekday, I share 1–2 Bitcoin trading setups in this group, based on liquidation levels, market structure, and short-term momentum. No clickbait, just clean, transparent entries with SL and TP. Most setups aim for +10–20% moves.

You can now join the group in two ways:

BingX (with KYC):

Register: bingx.com/partner/ITTECHPL

Complete KYC, deposit ≥ 100 USDT, and place 1 trade > $100

DM the bot: @IT_Tech_Trading_Setup_Bot → instant invite ✅

BloFin (no KYC, UK and US can also trade):

Register: partner.blofin.com/d/ITTech

Deposit ≥ 100 USDT and place 1 trade ≥ $100

Fill the 60-sec form: Google Form – access within 24h

🎁 Why join now?

⚡️ Fresh BTC setups drop every weekday – miss the entry, miss the move

⚡️ Potential liquidations maps

⚡️ Major on-chain movements analysis

Pick your exchange, lock in the bonus, and trade with me. See you inside! 🔥*Disclaimer: Educational content only; not financial advice.

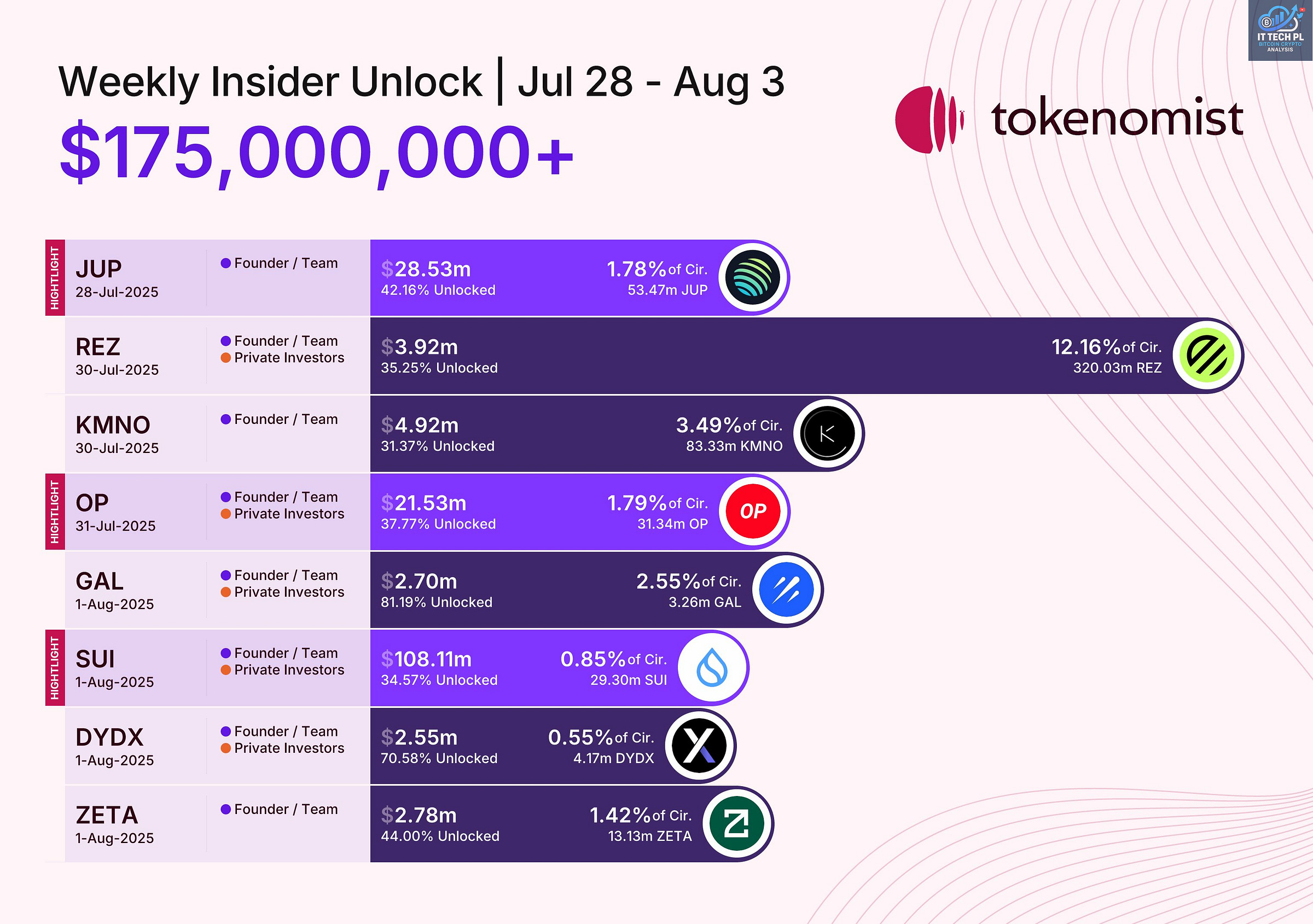

6. Weekly Insider Token Unlocks.

📊 Total Unlock Volume (28 Jul – 3 Aug): $175 M+

🔍 Key Highlights:

SUI – $108 M (0.85 % circ.) – biggest dollar clip of the week; Friday 1 Aug.

JUP – $28.5 M (1.78 %) – kicks things off Sunday, 28 Jul; moderate float hit.

OP – $21.5 M (1.79 %) – Thursday 31 Jul; recurring unlock could add volatility.

REZ – $3.9 M (12.2 %) – small nominal value but massive %-float on Tuesday 30 Jul.

KMNO – $4.9 M (3.49 %) – Tuesday 30 Jul; thin books amplify price risk.

DYDX / GAL / ZETA – each <$3 M, 0.5–2.6 % circ.; likely absorbed unless liquidity is scarce.

💬 Comment:

Dollar size skews heavily to SUI, but REZ’s 12 % float release is the sleeper risk. Expect wider spreads and funding spikes around 30 Jul – 1 Aug; post-unlock mean-reversion trades often set up 24 h later if sell pressure fades quickly.

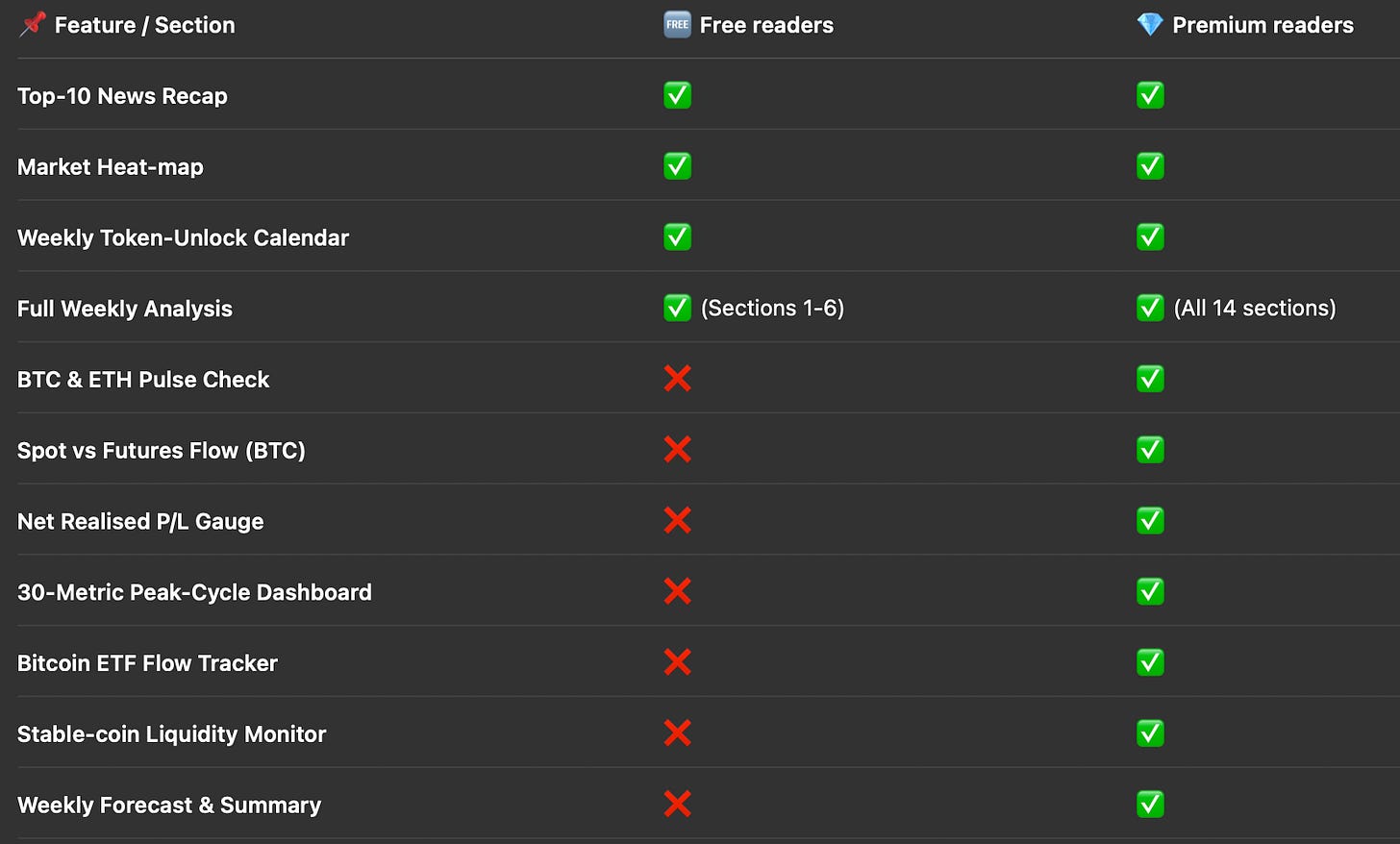

🔐 Premium Insights (exclusive for paid subscribers).

Wondering what’s inside the Premium section this week?

🔍 Here’s what Premium subscribers unlock:

🧠 Still using only the free version? You’re missing half the picture.

👉 Upgrade now to unlock all insights and get 5% off your annual plan.

Start your 7-day Premium trial.

Already subscribed? Scroll down to continue reading or listening audio version.

🎧 Podcast version: Premium subscribers now get access to a full audio podcast version of each issue. Listen on the go and stay ahead with deep on-chain insights.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.