On-chain Insights by IT Tech - Week 33 Bitcoin Analysis & Highlights #140

ETH momentum builds, staking exits in focus.

Hello,

The 140th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 5,000 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

🆓 Free content (for all free subscribers):

Follow & Connect

Partnership with Bitomat.com

Top 10 Crypto & Macroeconomic News

Current market situation

New Telegram community for Active Traders

Weekly Insider Token Unlocks

🔐 Premium Insights (exclusive for paid subscribers):

Bitcoin Market Overview: Spot & Futures Market Signals

Ownership Shift in ETH

ETH Staking Pulse: exit queue swells, APR soft

US Spot Bid Check: Coinbase Premium (BTC & ETH)

Bitcoin ETF Flow – Weekly Snapshot

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. 📲 Follow & Connect.

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels:

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics:

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

2. Partnership Spotlight – Bitomat.com.

This edition comes to you in collaboration with Bitomat.com, Europe’s premier crypto-ATM network. With over 300 locations across the continent, Bitomat enables you to convert digital assets into cash quickly, safely, and on your terms.

Why now?

MiCA regulations are set to tighten privacy rules across the EU. Lock in hassle-free, anonymous withdrawals while you still can.

3. Top-10 News Recap (Aug 11–17, 2025)

Bitcoin tops Google by market cap

BTC printed a new ATH above $124K, briefly valuing Bitcoin above Google, as strong institutional demand lifted the total crypto cap to $4.12T and daily volume to $201B.Ether closes in on 2021 peak

ETH hit ~$4,350, within 3 percent of its prior ATH, helped by improving policy tone and stablecoin legislation momentum.401(k) access to crypto

A new executive order opened the door for 401(k) exposure to digital assets, boosting crypto-linked equities including MSTR, COIN, HOOD while BTC hovered near $120K.USDC issuer update

Circle (USDC) reported $578.6M Q1 revenue and a Q2 net loss, and outlined a secondary sale of 10M shares at $130, signaling confidence in stablecoin growth.Robinhood expands in crypto

Robinhood (HOOD) completed a $200M Bitstamp acquisition and posted $160M in Q2 crypto revenue (+98% YoY), while launching Robinhood Chain for tokenized assets.Crypto equities rally with BTC

MicroStrategy (MSTR), Coinbase (COIN) and Robinhood (HOOD) advanced alongside BTC near $120K. MSTR’s large BTC treasury remained a key driver of equity beta.MercadoLibre rolls out stablecoin

MELI introduced Meli Dollar and previously bought 400 BTC (~$40.9M in May 2025). Shares rose into August on digital-asset adoption tailwinds.EV safety headline dents sentiment

A reported Ford EV malfunction sparked legal chatter and raised broader questions around EV and autonomous reliability, weighing on related equity sentiment.Macro jitters hit risk

Inflation worries and policy tensions pushed BTC under $119K at one point and coincided with heavy XRP liquidations (~$1B), while tech and semis lagged and spot BTC ETFs saw outflows.GENIUS Act support for stablecoins

Stablecoin guardrails from last month’s GENIUS Act continued to underpin ETH strength and activity across Circle, PayPal and other payments players, as the SEC’s Project Crypto aimed to modernize oversight.

💬 Comment:

Policy signals and real-world adoption stayed constructive, but macro nerves and ETF outflows tempered the move. With BTC consolidating near highs and ETH leadership building, flows into spot funds and stablecoins remain the key near-term catalysts.

4. Current market situation.

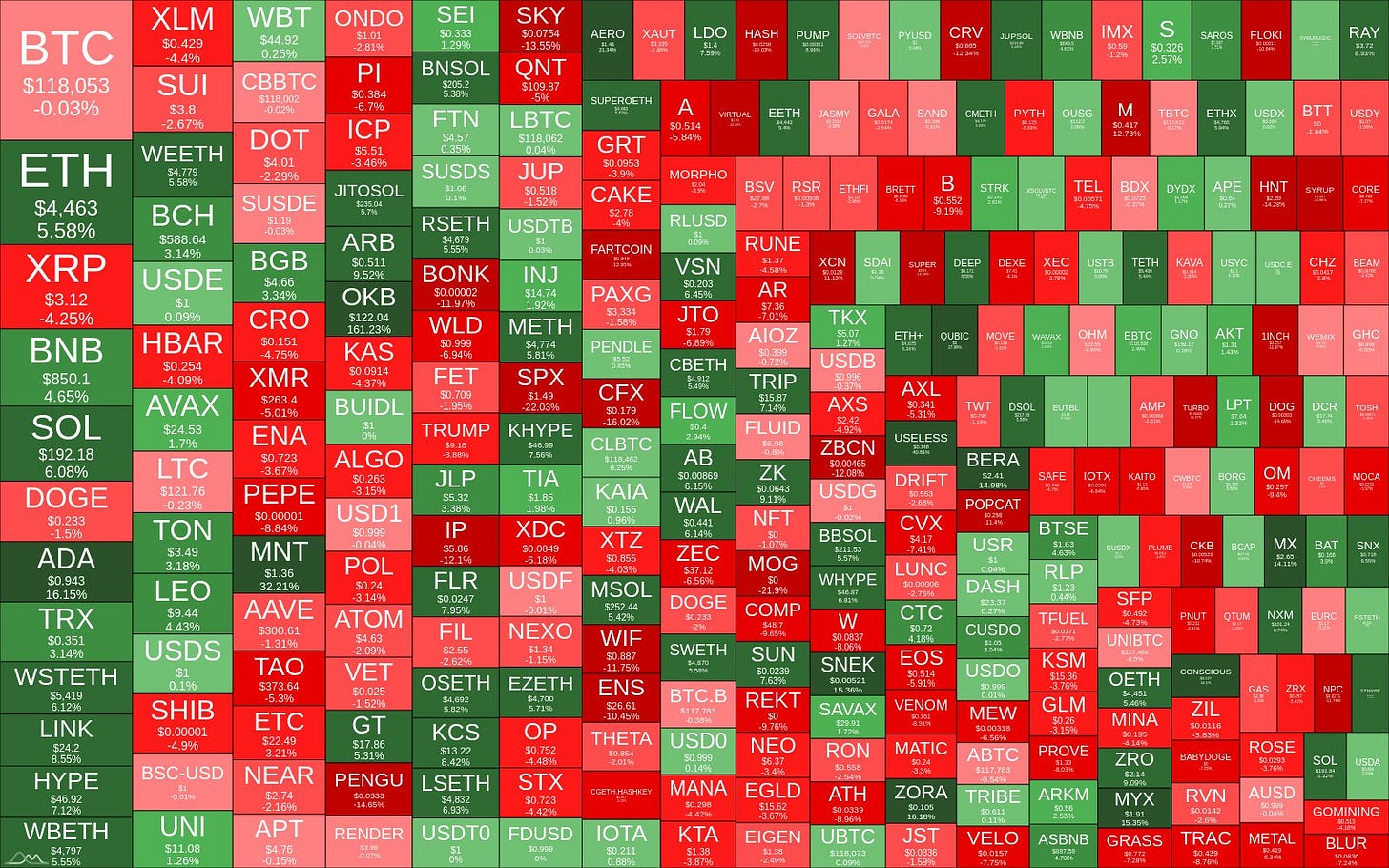

📊 Market Heatmap Weekly Summary:

Large caps: ETH +5.6 %, SOL +6.1 %, BNB +6.5 % led the move while BTC ≈ -0.03 % stayed flat. XRP −4.3 % lagged.

Layer-1 rotation: NEAR, SEI, AVAX, APT mostly green mid to high single digits.

DeFi bid: AAVE, UNI, LDO, RUNE up roughly 5–12 %, signalling risk back into protocols, not only L1s.

Memecoins mixed: DOGE +~2–3 %, SHIB +~1–2 %, PEPE printed a double-digit pop, smaller names showed two-way chop.

Notable underperformers: XMR and a pocket of gaming tokens in red low single digits.

💬 Comment:

With BTC ranging, flows rotated into ETH and selective L1s/DeFi, improving market breadth and trimming BTC dominance. Follow-through depends on ETF flows and macro headlines.

5. New Telegram Community for Active Traders.

New! IT Tech Trading Setups group is now live.

Every weekday, I share 1–2 Bitcoin trading setups in this group, based on liquidation levels, market structure, and short-term momentum. No clickbait, just clean, transparent entries with SL and TP. Most setups aim for +10–20% moves.

You can now join the group in two ways:

BingX (with KYC):

Register: bingx.com/partner/ITTECHPL

Complete KYC, deposit ≥ 100 USDT, and place 1 trade > $100

DM the bot: @IT_Tech_Trading_Setup_Bot → instant invite ✅

BloFin (no KYC, UK and US can also trade):

Register: partner.blofin.com/d/ITTech

Deposit ≥ 100 USDT and place 1 trade ≥ $100

Fill the 60-sec form: Google Form – access within 24h

🎁 Why join now?

⚡️ Fresh BTC setups drop every weekday – miss the entry, miss the move

⚡️ Potential liquidations maps

⚡️ Major on-chain movements analysis

Pick your exchange, lock in the bonus, and trade with me. See you inside! 🔥*Disclaimer: Educational content only; not financial advice.

6. Weekly Insider Token Unlocks.

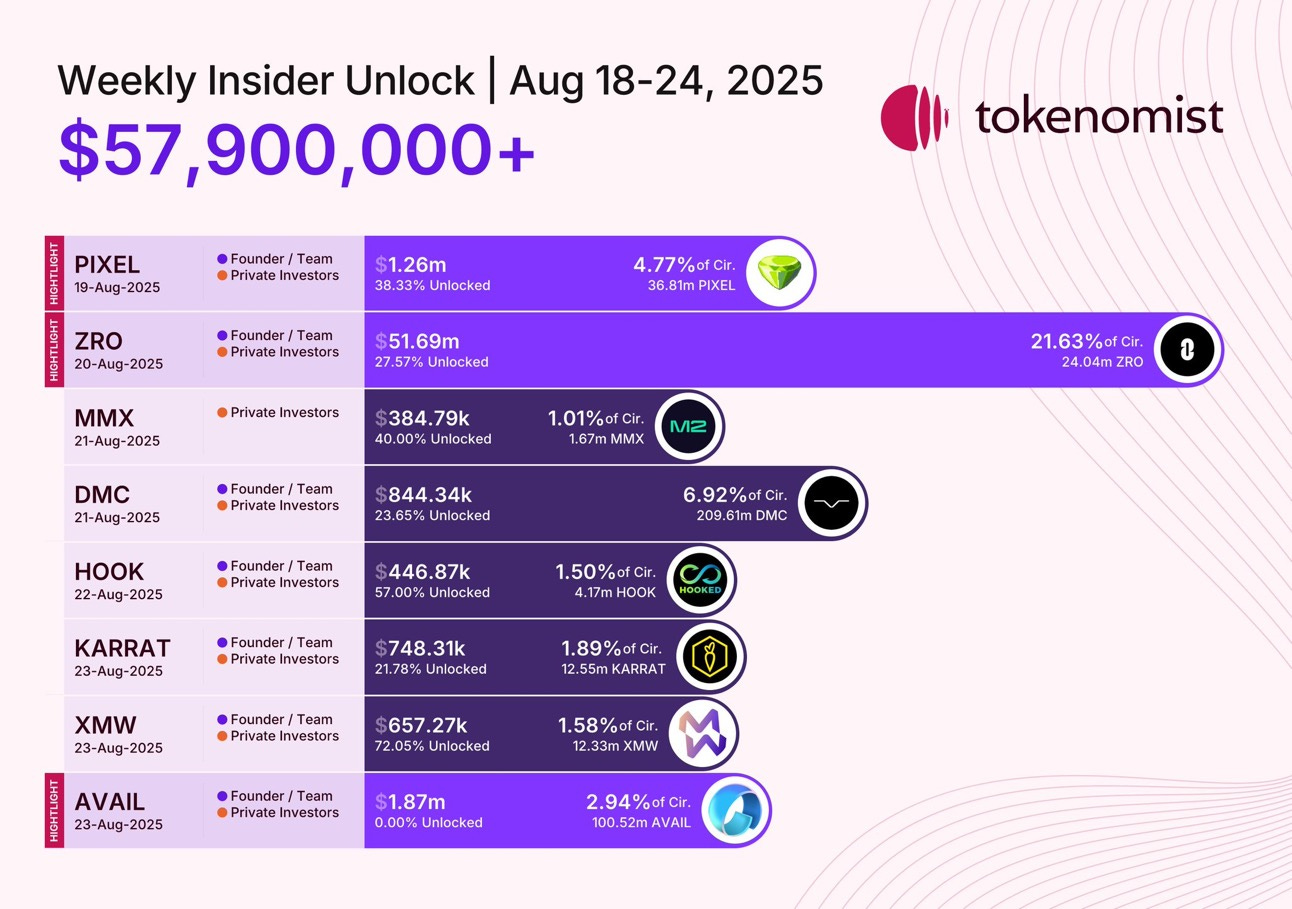

🔓 Weekly Insider Unlock | Aug 18 to 24. Total: $57.9M

🎯 HIGHLIGHT:

ZRO | Aug 20 | $51.69M | 21.63% of circ | Founder + Private

Rest of the week:

PIXEL | Aug 19 | $1.26M | 4.77% of circ | Founder + Private

DMC | Aug 21 | $0.84M | 6.92% of circ | Founder + Private

HOOK | Aug 22 | $0.45M | 1.50% of circ | Founder + Private

KARRAT | Aug 23 | $0.75M | 1.89% of circ | Founder + Private

XMW | Aug 23 | $0.66M | 1.58% of circ | Founder + Private

MMX | Aug 21 | $0.38M | 1.01% of circ | Private investors

AVAIL | Aug 23 | $1.87M | 2.94% of circ | Founder + Private

💬 Comment:

ZRO accounts for about 89 percent of the week’s value. Main event on Aug 20.

Smaller unlocks can still move price when order books are thin.

🔐 Premium Insights (exclusive for paid subscribers).

Wondering what’s inside the Premium section this week?

🔍 Here’s what Premium subscribers unlock:

🧠 Still using only the free version? You’re missing half the picture.

👉 Upgrade now to unlock all insights and get 5% off your annual plan.

Start your 7-day Premium trial.

Already subscribed? Scroll down to continue reading or listening audio version.

🎧 Podcast version: Premium subscribers now get access to a full audio podcast version of each issue. Listen on the go and stay ahead with deep on-chain insights.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.