On-chain Insights by IT Tech - Week 24 Bitcoin Analysis & Highlights #132

BTC Holds While Retail Fades – ETFs, Unlocks, and Accumulation Signals.

Hello,

The 132nd issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,800 subscribers strong! Not subscribed yet? Now's the time to join! 👇

Table of contents:

🆓 Free content (for all free subscribers):

Follow & Connect

Top 10 Crypto & Macroeconomic News

Current market situation

Partnership with WymienBitcoina.pl

Weekly Insider Token Unlocks

🔐 Premium Insights (exclusive for paid subscribers):

Bitcoin Market Overview: Spot & Futures Market Signals

STH Still Holding Strong

Short-Term Whale Unrealized P&L: Elevated Profits, No Panic Signals

Retail Flow Cools Off – What It Means for Momentum

Bitcoin ETF Flow – Weekly Snapshot

Stablecoin Market Overview

Newsletter issue summary

Forecast for the Upcoming Week

1. 📲 Follow & Connect.

X/Twitter: Follow

X Crypto Discussion group: Join now

YouTube: Subscribe

All resources in one place: Linktree

📡 Telegram Channels

IT Tech Crypto: analysis, liquidation maps, alerts → Join here

IT Tech – comments: commentary, bots, reports → Join here

📊 Dashboard: On-chain Metrics

Weekly dashboard with all indicators in one place → Access it here

⚠️ Due to X/Twitter limits, tweet screenshots are shown instead of embeds.

2. Top 10 Crypto & Macroeconomic News (June 9–15, 2025).

Bitcoin Consolidates Above $105K

BTC continued to trade above $105,000 for most of the week. Volatility declined compared to early June, but volume remained elevated.

Market Cap Rebounds, Volatility Normalizes

After an early-week dip, the total crypto market cap rebounded 2.4% to $2.44T. Weekly volatility metrics normalized after last week’s panic.

US CPI Slightly Cools, Fed Keeps Rates Flat

June 12: CPI at 3.3% YoY (vs. 3.4% expected). FOMC decision: Fed held rates steady at 5.25%–5.50%, but the dot plot suggests fewer rate cuts in 2025.

BTC Reacts to CPI/FOMC Combo

Bitcoin spiked from $104.3K to $107.5K on CPI data but retraced slightly after the FOMC’s hawkish tone. Weekly close remained above $106K.

BlackRock, Fidelity Record Net Inflows

June 13: BlackRock’s IBIT saw +$140M in net inflows, while Fidelity’s FBTC followed with +$82M. ETF momentum picks up again.

Coinbase Volume Surges Again

BTC/USD volume on Coinbase reached $2.03B on June 13 – the highest since late May. Spot market activity spikes during macro catalysts.

SEC Comments on Ethereum ETF

The SEC stated it’s reviewing updated S-1 filings and working with issuers on final tweaks. The timeline still points to Q3 approvals.

Retail Holding Activity Grows

Glassnode data shows a 1.6% weekly increase in wallets with <1 BTC. Retail continues to accumulate post-FOMC and CPI.

Altcoin Landscape Remains Weak

Top L1s (SOL, NEAR, APT) and L2s (ARB, OP) underperformed, while meme and AI tokens saw a mixed reaction. No strong sectoral leadership.

S&P 500 Hits New ATH, Correlation with BTC Rises

SPX crossed 5,430 for the first time. BTC–SPX correlation jumped to 0.68, reflecting increasing macro sensitivity in crypto pricing.

3. Current market situation.

Weekly Heatmap Recap – June 10–16, 2025

🟥 General Overview:

This week’s heatmap leans red across all sectors, signaling a broad-based correction in altcoins while Bitcoin and Ethereum held relatively stable.

🔹 BTC: $104,988 (–0.45%) - slight decline, mostly range-bound near $105K. Still consolidating without a decisive breakout or breakdown.

🔹 ETH: $2,514 (–0.10%) - holds better than the broader market, maintaining strength above $2.5K amid ETF anticipation.

🟢 Notable Gainers:

WBT: +25.93% – Strongest among majors, momentum driven by exchange-related hype.

KAS: +8.12% – Continues strong trend from previous week; Layer 1 strength.

LINK: +8.17% – One of the few top projects in green; renewed interest in oracles.

FTN: +3.35% – DePIN sector resilience persists.

🔻 Notable Decliners:

ZK: –10.47% – Steep correction before upcoming unlock (June 17).

ARB: –8.65% – Weak L2 sentiment continues; nearing key technical supports.

APT: –6.61%, SUI: –8.07%, ONDO: –10.64% – L1 and newer ecosystem coins under pressure.

XMR: –9.01%, HBAR: –9.17% – Privacy and enterprise sectors heavily sold off.

📉 Sector Performance:

Layer 1s & 2s: Mostly red. SOL (–3.12%), NEAR (–7.92%), APT (–6.61%) are underperforming.

Meme tokens: No strength. DOGE (–1.74%), SHIB (–5.21%), and PEPE (–8.00%) are all down.

DePIN & AI: FTN stays green. RNDR, FET fail to gain traction again.

DeFi: AAVE (+3.13%) is a rare standout. LDO, UNI, CRV lagging or flat.

Stablecoins: Pegs intact. No major dislocations observed.

💬 Comment:

The market is entering a consolidation phase below resistance. BTC remains stable, but altcoin weakness dominates. Narrative-driven tokens (AI, DePIN, oracles) show resilience, but lack broad confirmation. Attention is shifting to macro events and ETF flow strength. Keep an eye on BTC reclaiming $106K+ to rebuild momentum.

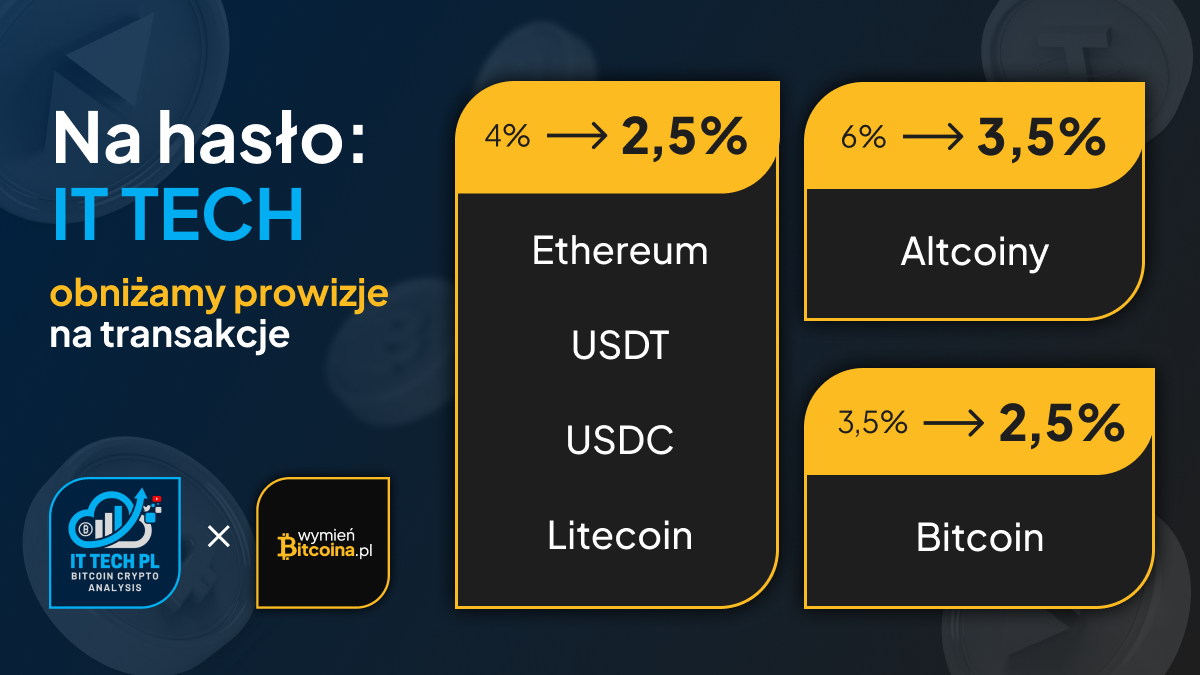

4. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl.

They offer a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

➡️ Use code: IT TECH to save on fees – my commission is waived for readers.

5. Weekly Insider Token Unlocks (June 16–22, 2025).

📊 Total Unlock Volume: $230M+

🔍 Key Highlights:

FTN: $89M unlock (4.66% of supply) → Largest nominal unlock this week. High unlock ratio (90%). Monitor June 18 for sharp volatility.

ZK: $37.9M unlock (20.91%) → Very high supply unlock. Watch June 17 closely due to a potential liquidity shock.

ZRO: $46.4M (21.63%) → Massive percentage unlock on June 20. Risk of sell pressure in low-liquidity conditions.

🔻 Other Notables:

ARB: $31.63M (1.91%) — Large value but lower relative supply ratio. Medium impact.

ID: $7.94M (11.23%) — Double-digit unlock percentage with over 50% of tokens already circulating.

MELANIA, LISTA, APE: All feature moderate unlocks ($5–6M range), with LISTA showing an elevated 14.29% unlock share.

💬 Comment:

This week’s unlocks are dominated by a few tokens with high unlock ratios (ZK, FTN, ZRO). Traders should stay cautious mid-week, especially around June 17–20. Monitor volume and order book depth before entering positions involving these tokens.

🔐 Premium Insights (exclusive for paid subscribers).

This week’s premium edition dives into the critical signals driving Bitcoin’s current structure: from realized margins and whale unrealized gains to fading retail demand and ETF flow shifts.

We break down the macro context behind BTC’s stability above $105K and whether this phase is quiet strength or calm before volatility returns.

Get a detailed view of market positioning, timing risks around token unlocks, and behavioral divergences – only in the Premium section.

🔍 Here’s what Premium subscribers unlock:

🧠 Still using only the free version? You’re missing half the picture.

👉 Upgrade now to unlock all insights and get 5% off your annual plan.

Already subscribed? Scroll down to continue reading.

6. 🔐 Bitcoin Market Overview: Spot & Futures Market Signals.

Keep reading with a 7-day free trial

Subscribe to On-Chain Insights by IT Tech💡🧠 to keep reading this post and get 7 days of free access to the full post archives.