#115 On-chain Insights by IT Tech - Week 6 Bitcoin Analysis & Highlights

Will the Real Altseason Finally Begin?

Hello,

The 115th issue of On-chain Insights by IT Tech is out! I appreciate your support - over 4,500 subscribers strong! Haven’t joined yet? Now's the time to join! 👇

Table of contents:

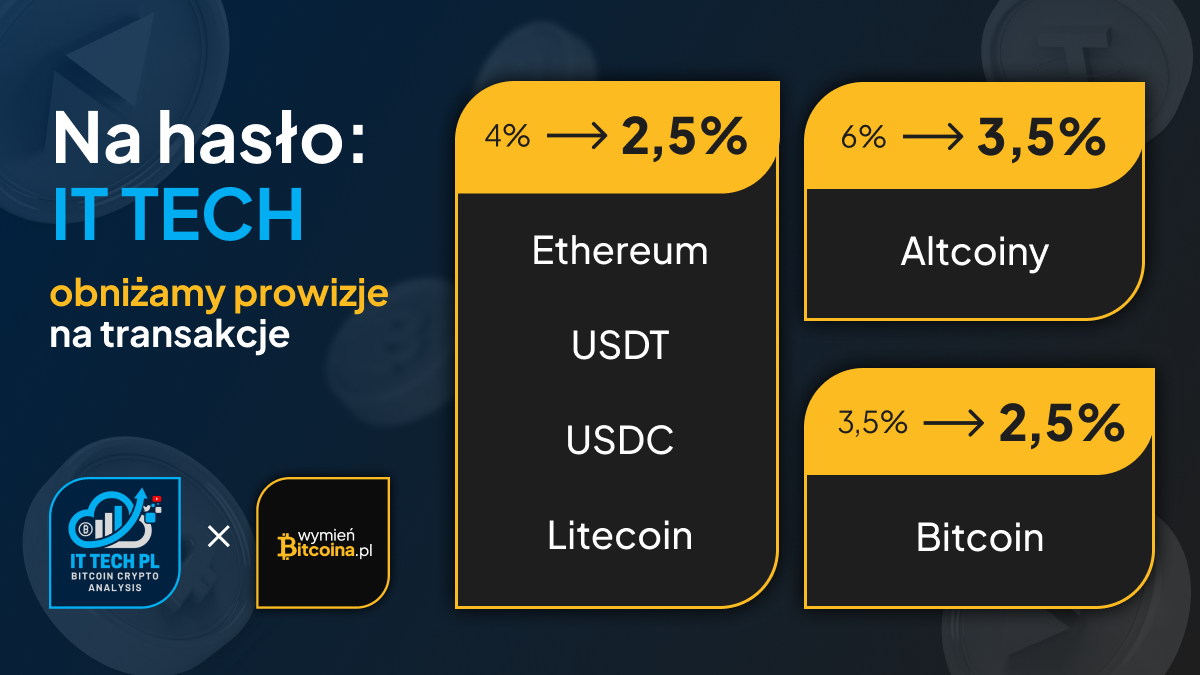

Partnership with WymienBitcoina.pl

Current market situation

Altcoin Season Index – What Does It Tell Us?

Bitcoin Halving Cycles: How Does 2024 Compare?

Can Bitcoin Reach New ATH? What It Takes for a Classic Alt Season in 2025

Support the Newsletter: Exclusive Content & Perks

Newsletter issue summary

Forecast for the Upcoming Week

1. Partnership with WymienBitcoina.pl

I'm thrilled to collaborate with WymienBitcoina.pl, founded by Patryk Kempiński of Krypto Raport.

WymienBitcoina.pl offers a secure way to trade over 190 cryptocurrencies and access crypto-related products like wallets and books, supported by expert staff.

To make it even better, I’ve waived my commission for lower fees - use the code IT TECH for additional savings!

Follow me on X/Twitter 👉 click and subscribe to my YouTube channel 👉 click.

Find all my social media and important links in my pinned post on X/Twitter, including my Linktree. Join the discussion group linked on my profile (requests must be approved). Stay updated with alerts, liquidation levels, and more.

Get faster updates and more content on my free Telegram channels:

IT Tech Crypto - Analysis, Liquidations maps, alerts, and more.

IT Tech Crypto - comments - commentary channel for everyone, On-chain alerts, bots, reports, and more.

Unfortunately, X/Twitter has blocked the embedding of tweets on Substack, so I include screenshots of the tweets along with links to them in the description.Weekly On-Chain Dashboard - New Indicators.

Here you'll find all the essential charts for market analysis in one place. It's free for everyone. Enjoy it! 👇

2. Current market situation.

🟢 Market Overview – Crypto Market in a Mixed Recovery Phase.

The latest market heatmap shows a mixed recovery across the crypto space. Bitcoin (BTC) stabilizes around $97K, while Ethereum (ETH) leads the bounce above $2,700. Some altcoins are showing signs of strength, while others remain under pressure.

📉 Bitcoin & Major Cryptos Performance

Bitcoin (BTC): $97,271 (+0.39%) – BTC consolidates, holding key support but struggling to push higher.

Ethereum (ETH): $2,703 (+1.73%) – ETH is leading the recovery, showing stronger buying interest.

XRP: $2.75 (+1.66%) – Posting mild gains but still lagging behind ETH.

Binance Coin (BNB): $667.44 (+4.75%) – One of the better-performing major assets.

Solana (SOL): $193.39 (-4.22%) – Still under pressure, showing risk-off sentiment in altcoins.

🟢 Selective Strength in Altcoins. Strong Gainers:

LTC: $132.16 (+24.49%) – Leading the market with a major breakout.

XMR: $123 (+3.26%) – Privacy coins showing resilience.

UNI, KAVA, ALGO, RAY – Posting moderate gains.

🔴 Underperformers:

HBAR (-5.79%), CRO (-4.26%), SOL (-4.22%) – Still facing downward pressure.

Meme coins: SHIB and PEPE remain volatile, with mixed performance.

🔎 Key Market Insights:

BTC Holding Key Support: Bitcoin has stabilized near $97K, avoiding a breakdown below $96K, which could trigger further downside.

ETH Leading the Bounce: Ethereum’s strength suggests renewed buying interest in major cryptos.

Altcoins Mixed: Some are bouncing while others remain weak, signaling uncertainty in risk appetite.

📊 What’s Next?

Bitcoin needs to reclaim $98K-$100K for bullish confirmation.

Ethereum’s strength is promising—if ETH holds above $2,700, altcoins could follow.

3. Altcoin Season Index – What Does It Tell Us?

The Altcoin Season Index measures the percentage of altcoins outperforming Bitcoin over the last 60 days. A reading above 75% signals Altcoin Season, meaning most alts are gaining value relative to BTC. A reading below 25% indicates Bitcoin Season, where BTC is leading the market and altcoins are underperforming.🔍 Current Market Insight: Bitcoin Season in Full Force

The latest data shows that only 3 out of 57 altcoins have outperformed Bitcoin in the last 60 days, placing us firmly in Bitcoin Season territory. While some traders on Crypto Twitter argue that a true Alt Season never arrived, this indicator suggests that altcoins have struggled significantly against BTC over recent months.

📊 Key Takeaways:

Bitcoin Strength Persists – BTC continues to dominate, attracting more capital than altcoins.

Altcoins Still Lagging – The majority of altcoins remain weak relative to Bitcoin.

Capital Rotation Could Be Key – Historically, altcoins gain strength when Bitcoin consolidates after a strong rally.

📉 What’s Next?

If BTC continues to rise, altcoins may struggle further as traders focus on Bitcoin.

A sideways BTC market could open the door for capital rotation into altcoins.

Watch for increasing altcoin outperformance—a potential signal of a shift in trend.

📉 Altcoin Performance vs. Bitcoin – Key Takeaways

The latest data confirms that Bitcoin dominance remains strong, with only 3 out of 57 altcoins outperforming BTC over the last 60 days. This reinforces the Bitcoin Season narrative, where capital is primarily flowing into BTC rather than altcoins.

🚀 The Few Winners

LTC (+24.9%) and XRP (+18%) were the only major altcoins outperforming Bitcoin.

BNB (-2.8%) showed relative resilience, holding up better than most altcoins.

📉 The Big Losers

ORDI (-79.6%) and RUNE (-58.2%) saw the steepest declines.

Popular altcoins like ETH (-25.7%), SOL (-16.9%), and DOGE (-23.8%) struggled significantly.

Meme coins like PEPE (-48.8%) and DeFi tokens like SUSHI (-52.2%) were hit particularly hard.

4. Bitcoin Halving Cycles: How Does 2024 Compare?

This chart tracks Bitcoin’s price action following its four halving events (2012, 2016, 2020, and 2024), showing how each cycle unfolded over time.📊 Key Observations:

2024 Cycle Starts Slower – Bitcoin’s current price trajectory ($97.5K) is the lowest relative to prior halving cycles at this stage, lagging behind 2012, 2016, and 2020.

Explosive Early Growth in 2012 & 2016 – The 2012 (blue) and 2016 (orange) cycles saw rapid parabolic increases within the first 300 days.

2020 Cycle More Gradual, Yet Strong – Institutional adoption played a key role in the steady price appreciation post-halving (green).

📌 2024 Cycle – Institutional Influence or Delayed Rally?

Unlike previous cycles, 2024’s price action is less explosive but more stable, possibly due to the impact of ETF inflows and institutional demand.

If Bitcoin follows previous halving trends, the real parabolic move may still be ahead.

🔎 What to Watch?

Does BTC break past $100K soon? If history repeats, a strong post-halving breakout is still possible.

ETF-driven vs. Retail Rally – Unlike past cycles, institutional money may be a bigger driver this time.

Macroeconomic Factors – Fed policies, inflation, and global liquidity could affect price action.

5. Can Bitcoin Reach New ATH? What It Takes for a Classic Alt Season in 2025

As we move through 2025, many investors are wondering whether we will see new all-time highs (ATH) for Bitcoin (BTC) and altcoins, along with a classic Alt Season similar to previous cycles. The answer depends on several key factors: supply and demand, capital allocation, regulations, and macroeconomic conditions.

Bitcoin – Is There Still Potential for a Parabolic Move?

Bitcoin has already undergone the 2024 halving, and spot ETFs are widely available, attracting significant institutional interest. However, for BTC to reach new ATH and enter a parabolic phase, the following catalysts would need to occur:

✅ Continued institutional capital inflows – BTC ETFs have already attracted billions, but further growth could come from Bitcoin Bonds, new long-term funds, or sovereign wealth adoption.

✅ Federal Reserve rate cuts – If the Fed eases monetary policy, institutional capital may flow back into risk assets, including BTC.

✅ Increased adoption of BTC as collateral – Bitcoin is already used as collateral in some financial systems, but its role as a reserve asset could expand under favorable regulations.

✅ The “digital gold” narrative strengthens – In times of macroeconomic uncertainty, BTC could be seen as a safe haven for large investors, fueling additional price growth.

📊 Chances of New BTC ATH?

High, but the key moment will be breaking the psychological $100K barrier, which could trigger a parabolic move toward $120K.

Altcoins – What Needs to Happen for a Classic Alt Season?

Historically, classic Alt Seasons emerged when BTC reached peak levels, leading investors to rotate capital into altcoins. However, the current market structure is more complex.

🚨 Challenges for Alt Season:

❌ Institutional capital is focused on BTC and ETH – While ETH ETFs are approved, other altcoins lack similar products.

❌ Capital is highly fragmented – The rise of memecoins and thousands of new projects is preventing capital from concentrating in a few key sectors.

❌ Ethereum is underperforming – In classic Alt Seasons, ETH should lead the market, but it’s currently struggling against BTC.

🔹 What Could Trigger an Alt Season?

✅ ETF approvals for other altcoins – If SOL, DOGE, or other top altcoins get ETFs, it could attract institutional investment.

✅ ETH regaining market dominance – Ethereum needs to outperform BTC and regain leadership. Major network upgrades (scaling, staking enhancements) could drive renewed interest.

✅ New market narratives gaining traction – AI in blockchain, tokenized real-world assets (RWA), or DeFi 2.0 could spark new waves of capital inflow into altcoins.

✅ Capital rotation into high-quality altcoins – The current market is dominated by memecoins and speculative assets. A classic Alt Season requires capital to consolidate in top altcoins like SOL, LINK, AVAX, ATOM, and leading L1/L2 projects.

📊 Summary – Will We See New ATHs and a Classic Alt Season?

Bitcoin has a high chance of reaching new ATH in 2025, but it must break $100K and enter a parabolic phase. ETF inflows and Fed policy decisions will be crucial.

Alt Season is possible, but the market structure has changed – Institutions prefer BTC and ETH, while capital is spread across many sectors, slowing capital rotation into top altcoins.

🔹 Key factors to watch:

✔️ Bitcoin surpassing ATH and entering a parabolic phase.

✔️ ETF approvals for additional altcoins.

✔️ ETH regaining dominance and attracting capital.

✔️ New narratives (AI, RWA, DeFi 2.0) fueling fresh demand for altcoins.

📢 What are your predictions?

6. Support the Newsletter: Exclusive Content & Perks.

Exclusive Content – Additional charts from premium platforms like CryptoQuant, Kingfisher, Santiment, and Intotheblock, available on request.

Telegram Subscribers' Group – Ask me any crypto-related questions directly.

Educational Content – Learn more about on-chain analysis.

Early Access – Get the newsletter immediately after it’s written, no waiting until 6 PM.

Enjoy a 5% discount coupon for an annual subscription below. Thank you to everyone supporting my work!

If you'd like to treat me to a virtual coffee or beer as a one-time gesture, you can do so through Suppi.

7. Newsletter Issue Summary:

Current Market Situation

Mixed recovery in the market, with BTC stabilizing around $97K.

ETH leads the bounce at $2,703, while Solana and meme coins remain under pressure.

Altcoins show selective strength, with LTC and BNB outperforming.

BTC must reclaim $98K-$100K to confirm bullish momentum.

Altcoin Season Index – What Does It Tell Us?

The indicator shows Bitcoin Season dominance, with only 3 out of 57 altcoins outperforming BTC in the last 60 days.

Traders debate whether Alt Season even occurred, as BTC continues to attract capital.

A shift to Alt Season requires BTC to stabilize and capital rotation into altcoins.

Bitcoin Halving Cycles: How Does 2024 Compare?

BTC’s 2024 post-halving performance is the weakest so far compared to previous cycles.

Institutional influence and ETF demand may be delaying the usual parabolic breakout.

If BTC follows past halving patterns, the major rally could still be ahead.

Can Bitcoin Reach New ATH? What It Takes for a Classic Alt Season

BTC has a high probability of new ATH, but $100K must be decisively broken.

Institutional inflows and macroeconomic conditions (like Fed rate cuts) could fuel the rally.

Altcoins need ETH strength, ETF approvals, and capital rotation to trigger a classic Alt Season.

Memecoins and fragmented liquidity are slowing down the expected cycle.

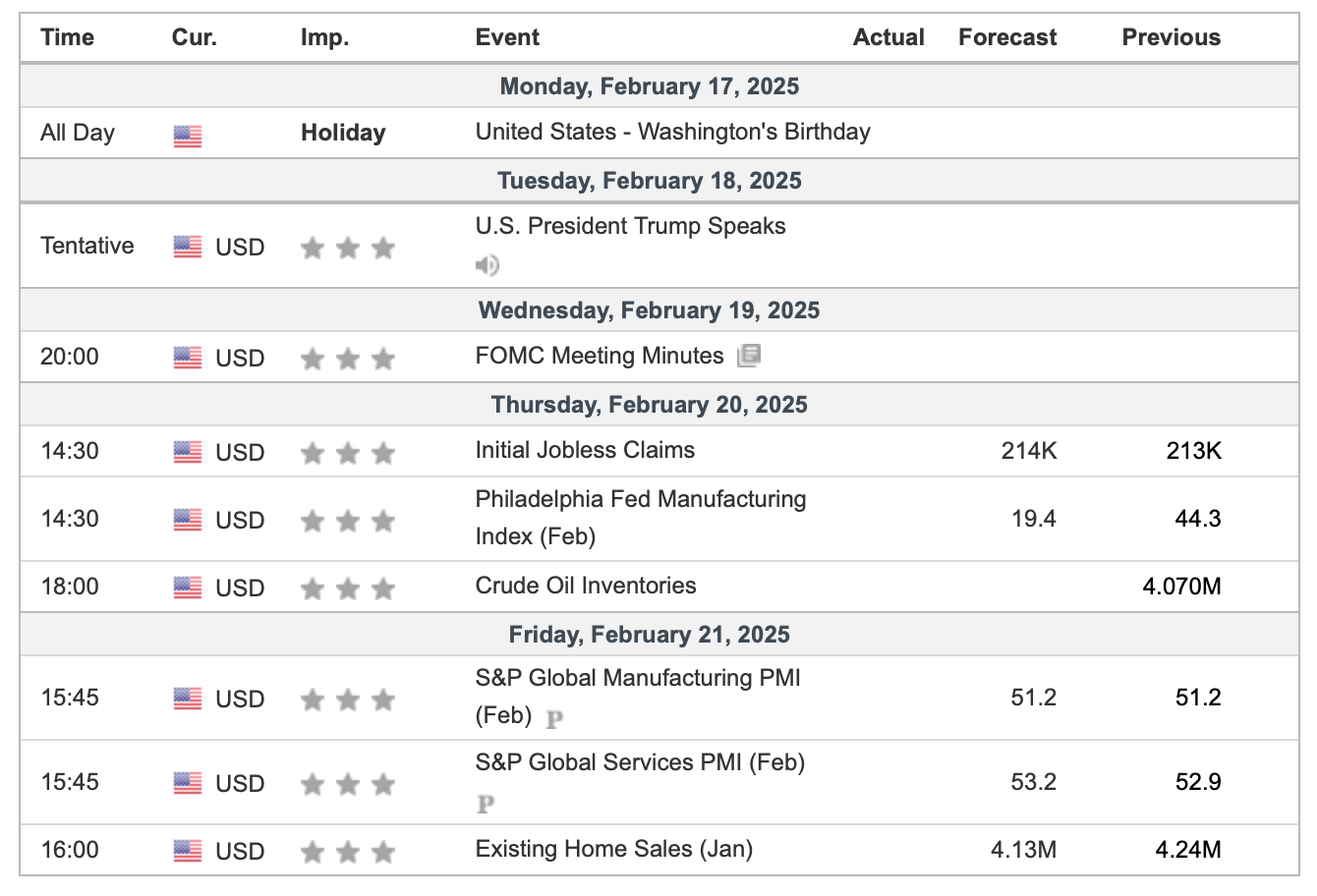

8. Forecast for the Upcoming Week:

Bitcoin’s Key Levels: BTC must hold $96K-$97K to avoid downside risk. A breakout above $100K could trigger a strong move.

Ethereum’s Strength: ETH is leading the market; if it continues above $3000, we could see renewed altcoin momentum.

Stablecoin Flows: Watching USDT/USDC market cap movements will indicate whether sidelined liquidity is entering the market.

ETF & Institutional Demand: If ETF inflows pick up, BTC could break into new ATH territory.

Memecoin & Speculative Mania: Retail speculation in memecoins could be a signal of a risk-on environment—watch for trends shifting to higher-quality altcoins.

Stay alert and monitor key indicators for better market insights. Track upcoming US events for free using the Economic Calendar.

Remember to realize profits regularly.💡

This concludes this issue. I hope you have a pleasant end to your weekend and a great week ahead.

If you found this article helpful, leave a like 💙 comment and share it on your social media. 🤝

The next issue arrives next Sunday at 6 p.m. - check your inbox and SPAM folder!

This article reflects my personal views and is not investment advice. Cryptocurrency investments carry high risk. It includes mentions of WymienBitcoina.pl and affiliate links that may benefit the author.

Best regards

IT Tech